Real Estate Market Intelligence May 2024

Real Estate Market Intelligence

May 2024

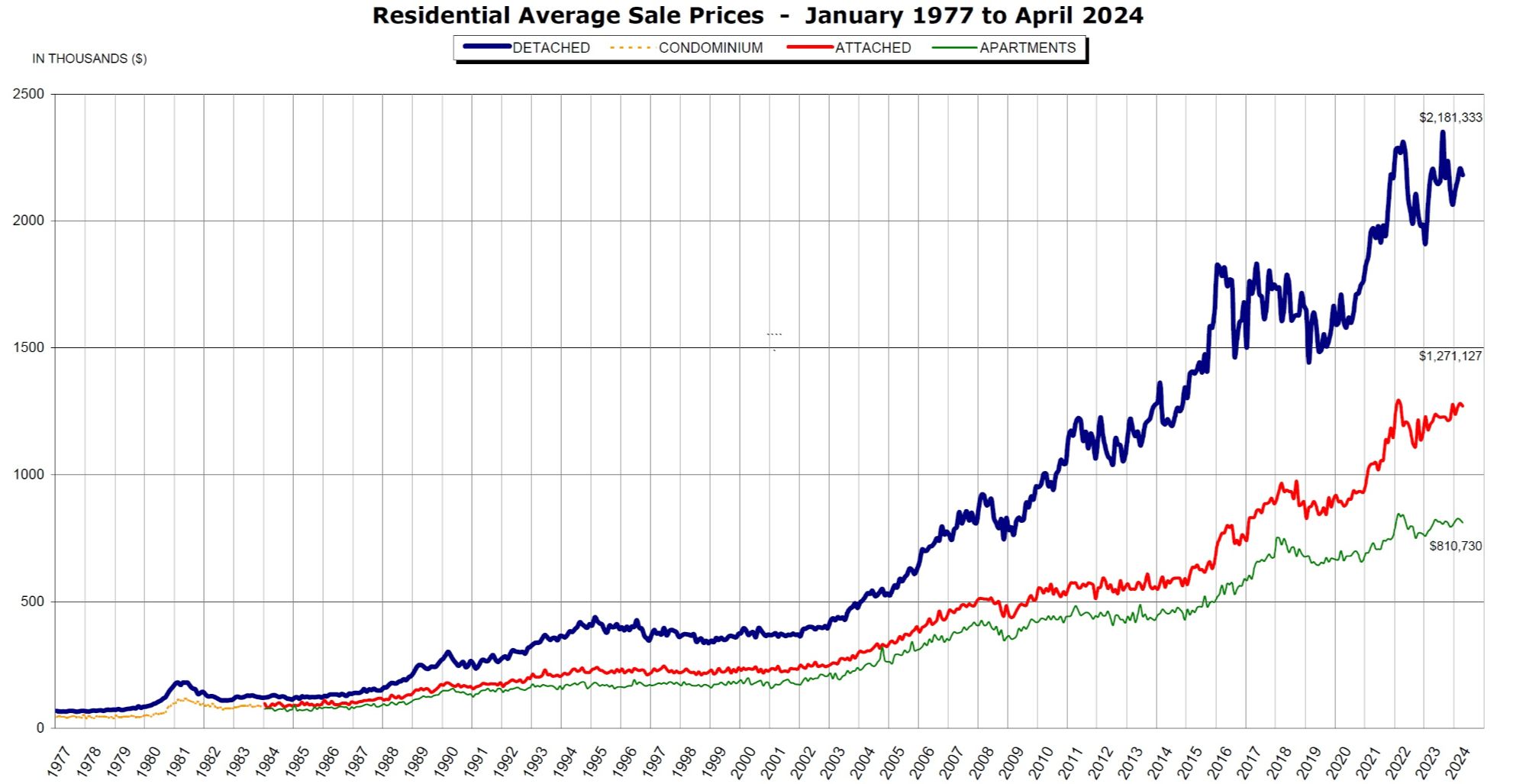

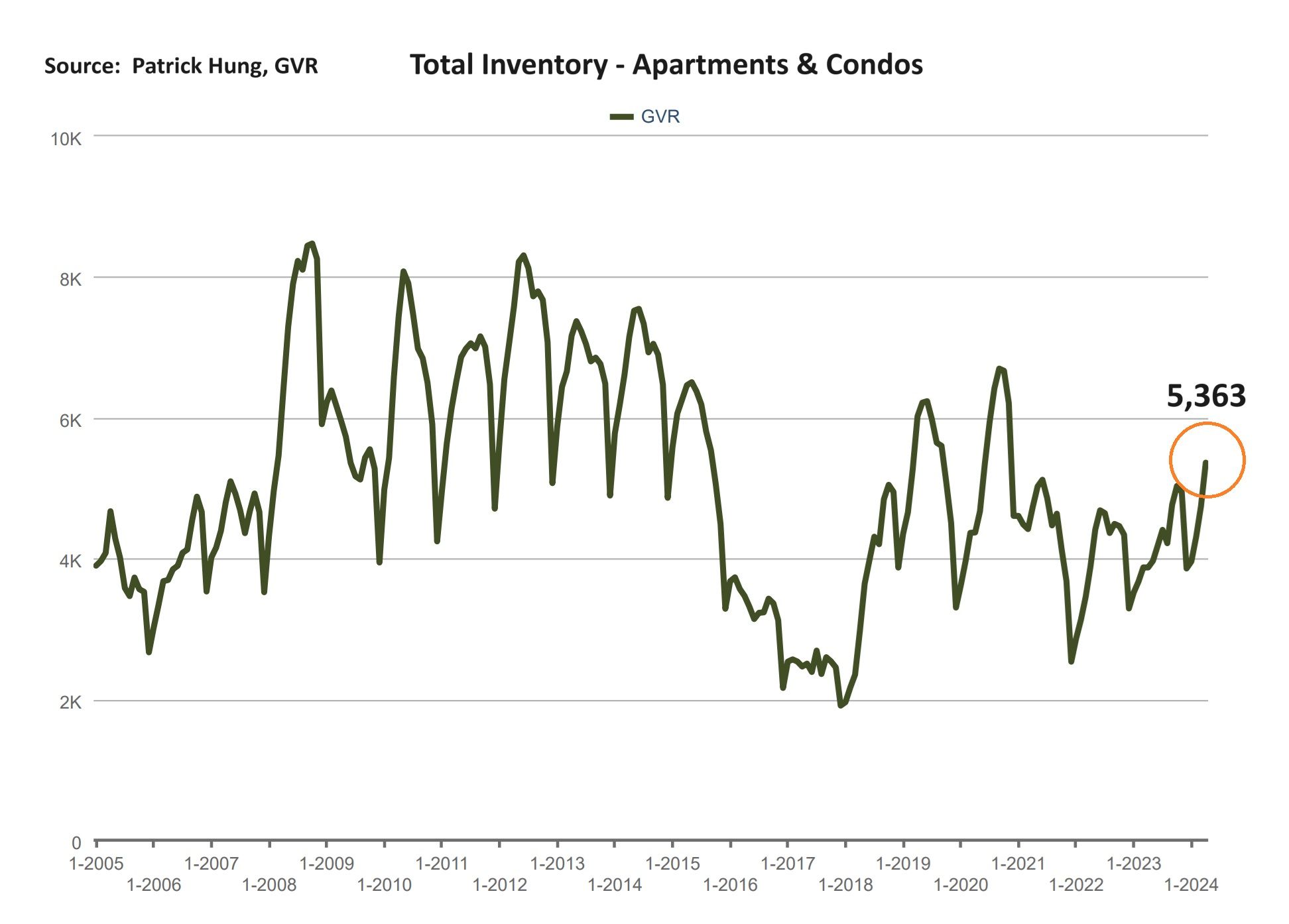

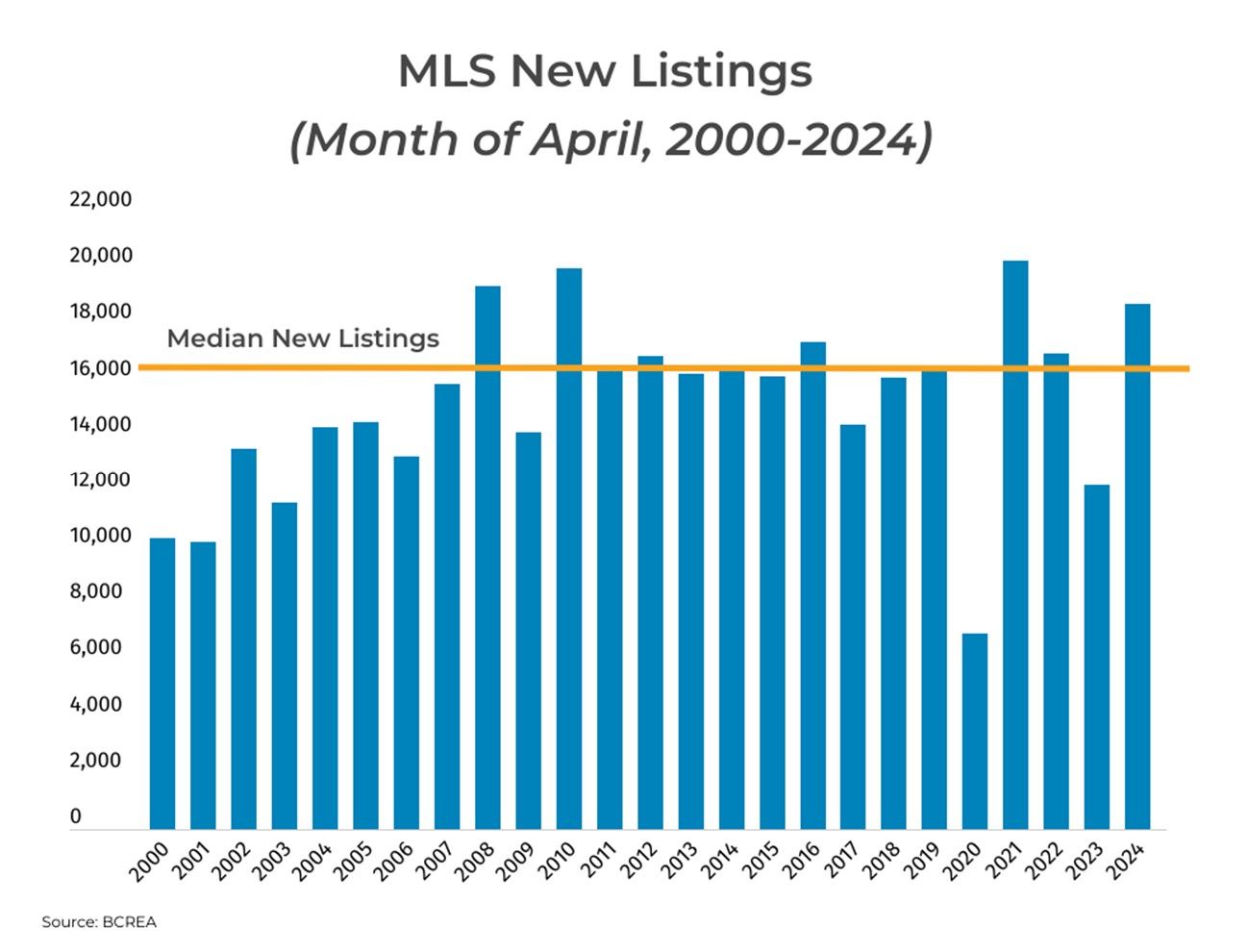

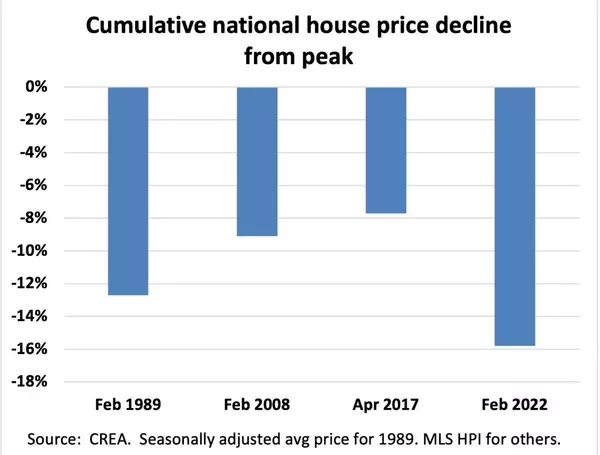

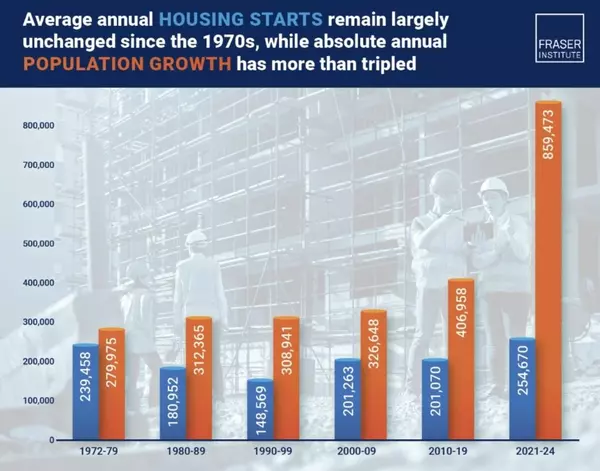

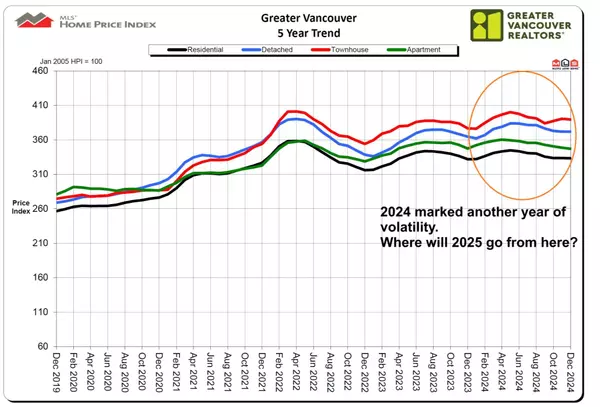

The Vancouver real estate market has had many surprises throughout the years, and in April, we got exactly that: housing inventory has risen to the highest level in four years. There were many theories in the sudden surge in new listings, and to me, such sharp rise is drive by multiple factors. Firstly, the Air BnB ban has finally applied in April. This may have caused some apartment and condo Sellers to come off the sidelines, having milked the cash flow to the last minute before placing them on the market. While this may be a one off instance, we are also seeing more completed apartment pre-sale projects, especially investors, liquidating due to the further negative cash flow and elevated borrowing costs. While this has caused a more-than-anticipated supply in the apartment segment, now what about townhouses and detached homes? Surprisingly, these two segments too, are seeing similar trend. My take is that for single houses, there are more high net worth investors liquidating multiple properties due to the new capital gain policy. Imagine you were a Seller and you bought 3 single houses 20 years ago as investments, each at $500k. Now they are worth $1.8m each. At this rate, the new capital gain, increasing from 50% to 66.7%, will take a significant bite into their profit. The key is, the deadline to liquidate these assets will have to be before June 25, 2024. Thus, we should be seeing an influx of such homes flooding the market and shifting back from a Seller's to a balanced market for now.

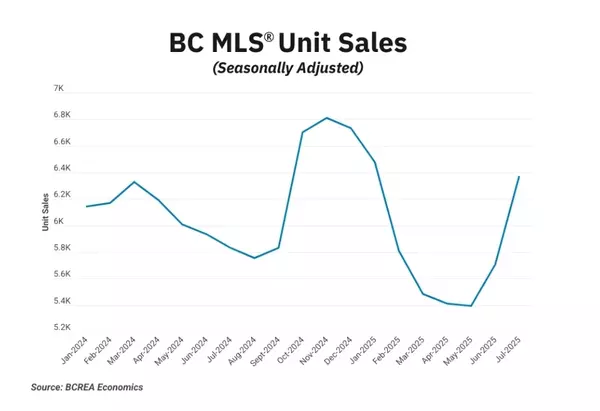

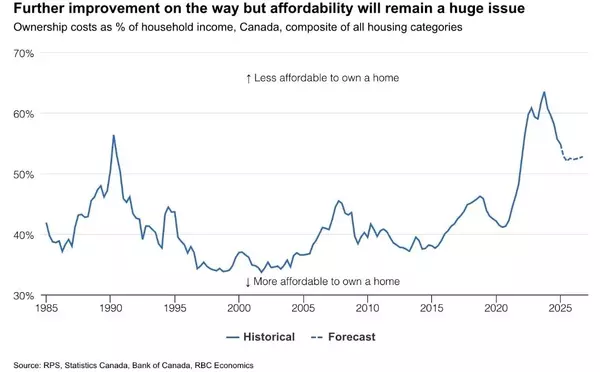

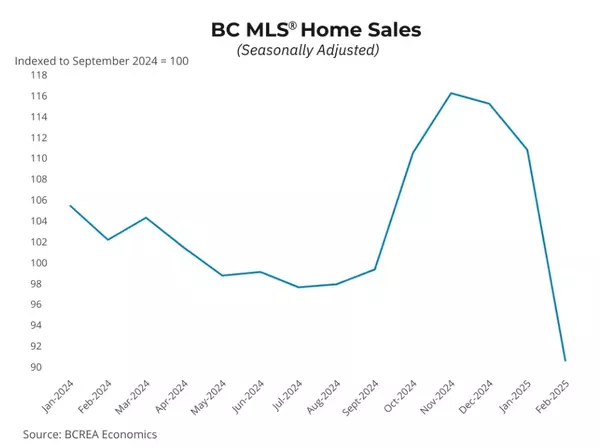

On the sales and demand side, it does feel a bit more sluggish than a typical spring, with sales registering -12.2% below the 10 year average. A report by BMO has suggested that 70% of Buyers are waiting for the rate to cut before making a move, and mortgage companies are reporting a surge in pre-approval done in April. As Buyers anticipate the date of the cut (most likely July), it does feel that more and more of them are pushing up against the gates. Personally, my bets are on the Buyers' psychology side than the actual rate cut (affecting affordability) itself. The Vancouver real estate market is known for it's resilience and is highly emotionally charged, and by definition it creates a herd mentality. When others aren't buying, I'm not buying. And when everyone else is buying, I'm getting in as soon as possible. While in April there were definitely more supply than demand and calmed the market, it is very possibly for the tides to turn quickly when the rate cuts, and that can easily tip the market back the other way to the Sellers. As of this moment, it is still too early to tell, but is worth monitoring. I believe the rates will be held in June, and the first cut will be in July. Again, whether you're a buyer, seller, or bystander, make sure to position yourself accordingly. Whether we like it or not, changes and rate cuts are coming.

Some of the unique trends I've been observing:

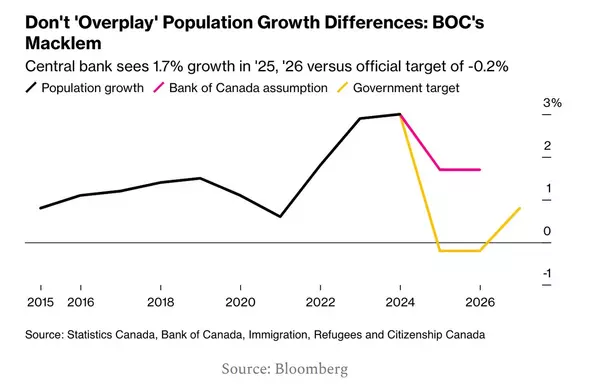

1. Canada's April unemployment rate held steady at 6.1%, while the US's unemployment rate also held steady at 3.9% within the same period. The divergent continues: Canada's economy continue to weaken while US economy remain strong. With the Canadian rate cut on the horizon, this for sure is creating a recipe for Canadian dollar disaster.

2. There were 7,092 new listings in April, and that is a whooping +42.2% increase compared to April 2023. Since the pandemic, the Vancouver real estate inventory has become a key driving factor, and even in the midst of the highest rates in 20 years, we have not seen inventory risen this fast. Until now. If Sellers continue to flood the market with more listings in May, we should be seeing all segments return to a balanced market.

3. The Trudeau government's "Robinhood" policy of raising the capital gain from 50% to 66.7% claims to be affecting only 0.13% of Canadian, but rest assured that it will be hurting just about everyone. From doctors, chiropractors, dentist, realtors, small business owners, to major corporations, they will see a chunk of their profits (as well as pension funds) vanish. Canada, especially BC, is already facing a grim shortage of family doctors and specialists, and this policy may tip them overboard and flock to the south, with a better pay and a less overloaded healthcare system. Just when Canadians thought the wait times for the doctors are unacceptably long, think again.

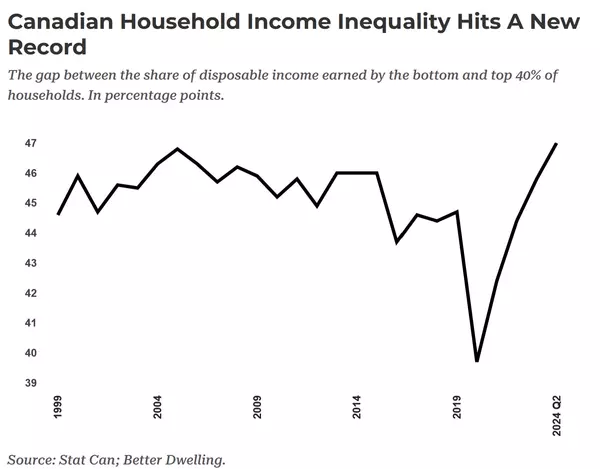

4. Over 1 in 10 Canadians are pushing their credit card limits higher. As Canada has the highest household debt of any G7 countries, families continue to battle higher living standards and elevated home prices. Business insolvency is way up too (+129.3% annually) as families are cutting way back on discretionary spending.

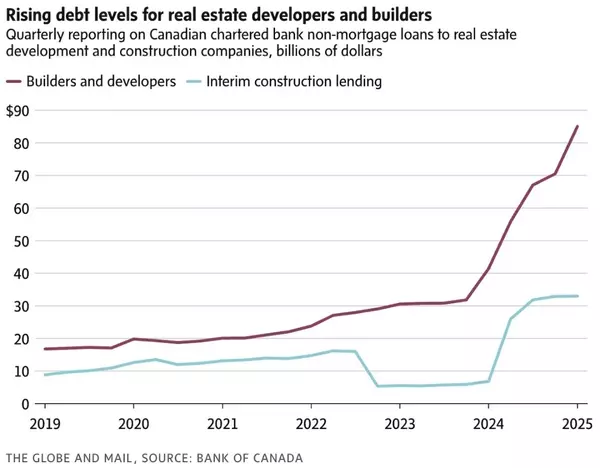

5. The construction industry continues to contract, and more and more trades and contractors are getting laid off. It's unfortunate but this will continue in the foreseeable future. Sales on pre-construction continue to slow, and developers will further step back as the risk is simply too high to take on any new projects.

Here are the 3 highlights for April:

- Huge jump in new listings (+25.8) over the 10 year average, while total inventory has increased significantly to surpass 12,000 units, the first time since summer 2020.

- Due to the sudden surge in inventory, Buyers are faced with more selection and can afford more time to choose. This was the calming music to the traditional spring frenzy market and has brought it back to a balancing level.

- April continue another month of home prices gain of +0.8% (March price growth was +1.1%). Price continue to level off as inventory rises, and this was most evident in the apartment segment.

Here are the in-depth statistics of the April:

- Last month's sales were -16.7% below the 10 year April's sales average.

- Month by month residential home sales increased by +17.5% from March 2024.

- Month by month new home listings increased by whooping +40.5% compared to March 2024.

- Last month's price adjustment was +0.8% compared to March 2024.

- Sales-to-listing (or % of homes sold) ratio is 23.5% (compared to 23.8% in March 2024). By property type, the ratio is 17.6% for single houses, 31.0% for townhouses, and 26% for apartments/condos.

Download Vancouver Real Estate Market Report May 2024

Single House Market

For the month of April, the areas with the most price gains are in West Vancouver, Port Moody and Tsawwassen at +4.5%, +3.8% and +2.4% respectively. Conversely, the neighborhoods registered the most significant price drops are in Pitt Meadows, Sunshine Coast and Squamish with -1.3%, -1.0% and -0.2% respectively. The detached home market remains in a balanced market for the past two months, with average days on market at 32 days (compared to 35 days last month), and month-to-month average price continue to climb by +1.6% (compared to +1.8%% last month). Sales-to-listing ratio (% of homes sold) has dropped slightly to 17.6%. (compared to 18.2% last month).

Townhouse Market

Townhouse market had an average April spring in terms of both month-to-month sales (+14.3%) and price (+1.3%). Currently, the townhouse total inventory level is the highest in 3 years. This is certainly welcoming news to Buyers and young families, who have been looking to upsize to an affordable townhouse. Sellers, on the other hard, are coping with the rising inventory and more competition, and has to either adjust their price or expectations accordingly. There is somewhat of a splitting attitude between the Buyers and Sellers. As the pent-up demand is usually strong for this segment, the recent open houses has suggested that there are more traffic than offers. The townhouse Buyers may want to wait till the actual rate cut before making a move. On the flip side, the townhouse Seller may also elect to wait. If they currently don't get the price that they want, they know that the rate cut would most likely increase demand and translate in an increase in price. This anticipation game between Buyers and Sellers can tip the supply demand either way, or such opposing forces can simply cancel out each other. For townhouse Buyers, I would suggest to get into the market now before the rate cut, as historically townhouse has been known for its under-supply. Specifically townhouse market can turn on a dime, so when we have a month of abundance supply like we had in April, capitalize on it while you can, or risk more fierce bidding wars with other Buyers when the rate drops in the in upcoming months.

In April, the areas with the most townhouse price growths are all in the outskirts in Sunshine Coast, Squamish and Whistler at a +4.9% (tied 1st and 2nd) and +4.3% respectively. Conversely, the neighborhoods with the a least price growth are in Tsawwassen, Ladner and Burnaby East, at -2.4%, -1.9%, and -1.3% respectively. The townhouse market has officially shifted to a Sellers market, with average days on market remained flat at 20 days (same as last month). Month-to-month sale price continue to climb up by +1.3% (compared to +1.7% last month). Sale-to-listing (% homes sold) ratio is the best among all segments and remains nearly the same at 31% (compared to 31.3% last month).

Apartment and Condo Market

In April, the apartment market was the only segment that registered a negative price growth at -0.1% (compared to +0.9% in March), while staying in the Seller's market at 26% sales ratio (percent of homes sold). The apartment inventory level has spiked significantly to levels not seen since mid-2020 (see graph). On paper, the apartment segment says its in a Seller's market, but it certainly feels like it son the Buyers' side as inventory climbs. Since the apartments are the primary market for retail investors, the recent policies such as the end of AirBnB and the rise in capital gains, has created the perfect recipe for investors' liquidation sale. The apartment owners also consist mainly of first time home buyers and young families, and these groups are most prone to elevated interest rate stress and rising standards of living. Thus, the "Alberta is Calling" campaign may have lured them to move, and inadvertently adding more apartment inventory to the pool. And as inventory rise, so does competition, and this is definitely good news for Buyers when they have more time to choose and to bargain. However, Sellers have to be more patient as inventory pile up, and it will take likely take months before the current inventory gets digested. Apartments under $600k are still a hot commodity, especially the 2 bedrooms under that price range in Greater Vancouver. The apartment prices may have levelled off or dipped a little for now, but I wouldn't hold my breath on this one for too long, especially for the one bedrooms entry level homes. Apartment buyers, bargain while you can.

For the month of April, the best performing neighbourhoods for apartments are Tsawassen, Pitt Meadows and Ladner, posting +2.2%, +1.6% and +1.5% gains respectively. Conversely, the areas with the most significant price drops were West Vancouver, Richmond, and North Vancouver, with -2.1% & -2% and -0.9% respectively. The apartment and condo segment have remained in the Sellers market, with average days on nearly flat at 25 days (compared to 26 days last month). Month-to-month sale price has slipped into the negative territory at -0.1% (compared to +0.9% last month). Sale-to-listing (% homes sold) ratio remained remained flat at 26% (compared to 25.8% last month).

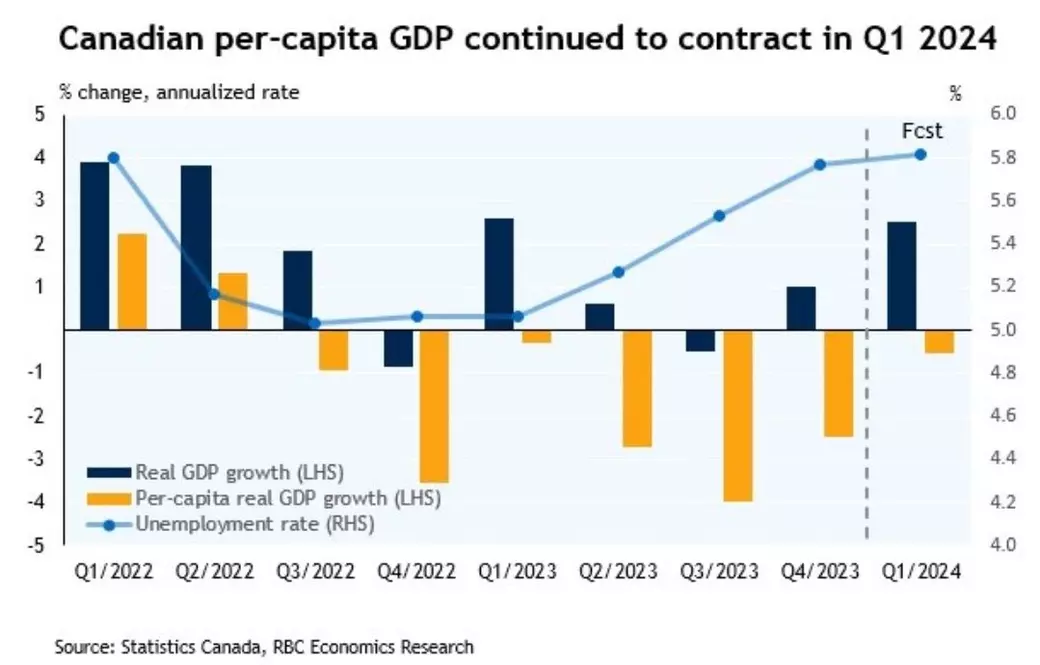

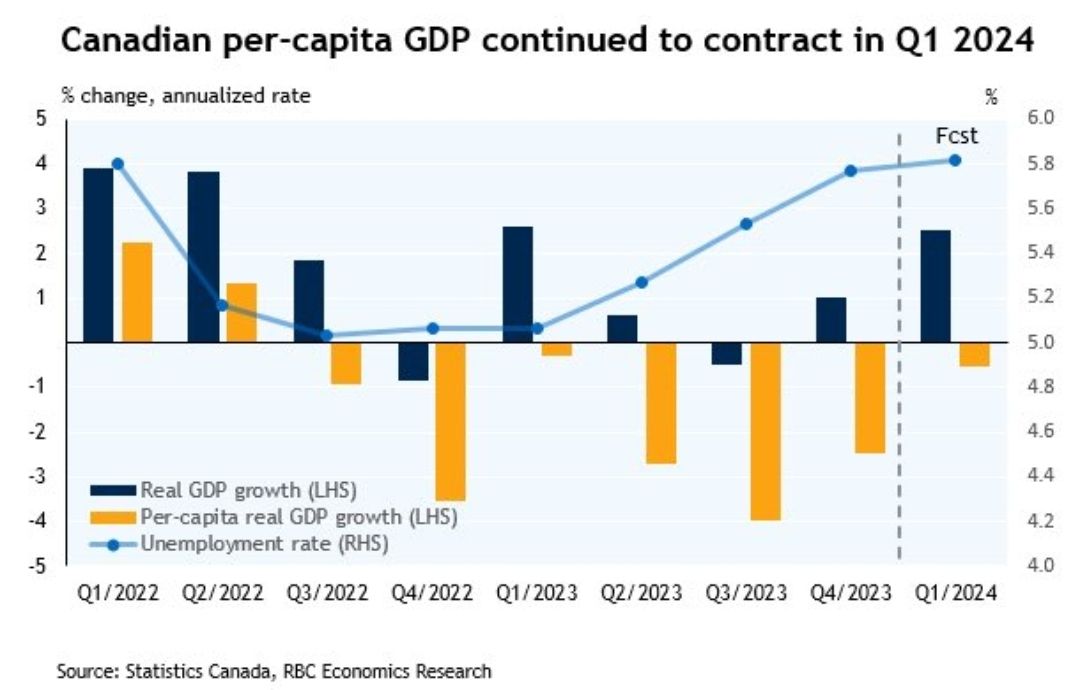

1. Real Contraction

The real Canadian per-captial GDP has contracted for the 7th straight quarter, dating back to Q3 2022. Some would argue that this is partially contributed by a greater population base, such as immigration. As population grows, Canadian living standard deteriorates as housing prices remain stubbornly high. No wonder many Canadians are upset with the federal government. (Source: Statistic Canada, RBC Economics)

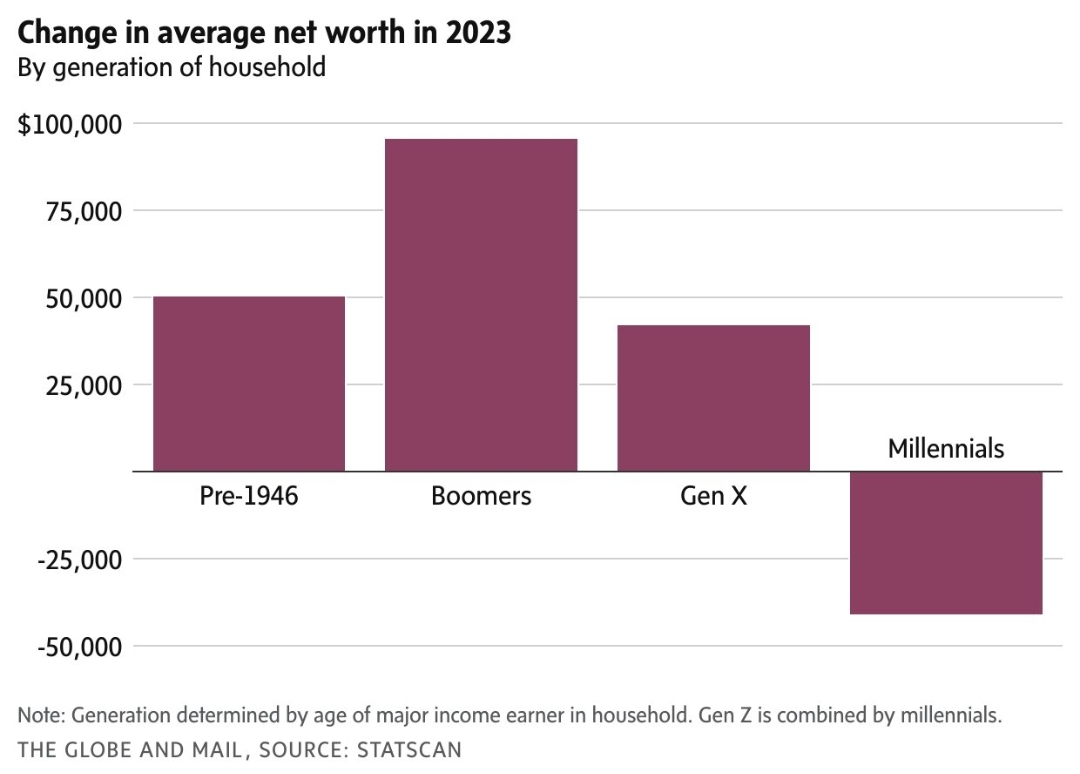

2. Lost Generation

After 20+ years of low borrowing costs, Canadians are now realizing the aftermath of the generational have's and have-not's. From Gen X (age 44-59) to Boomers (age 60+), these are the "have's" with positive net worth. The Millennial (age 28-43) got it worst and continues to dip into negative net worth. Whether we like it or not, Daddy and Mommy banks are real and well. (Source: Globe and Mail, Statscan)

3. Pivot?

April was such a unique month as inventory spiked a whooping +42.2% when compared to same month last year. Meanwhile, sales ratio (% of homes sold) has dropped to 21% (compared to 29%) within the same period. All this translates into more inventory, less sales and we're heading into a balanced market. Summer months are usually the calmer season for real estate, but this one may be different when the rate drops. Watch out. (Source: BCREA)

Recent Posts

GET MORE INFORMATION