Real Estate Market Intelligence 2025 Overview

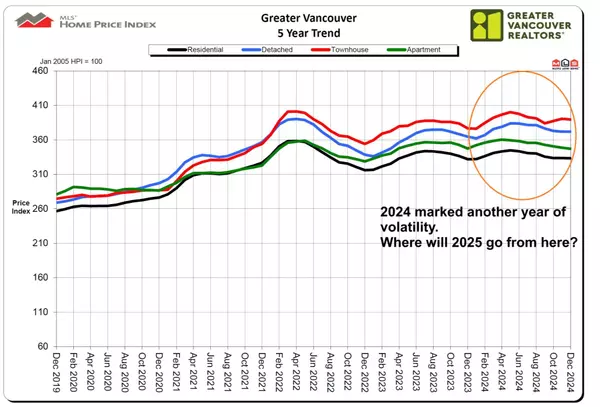

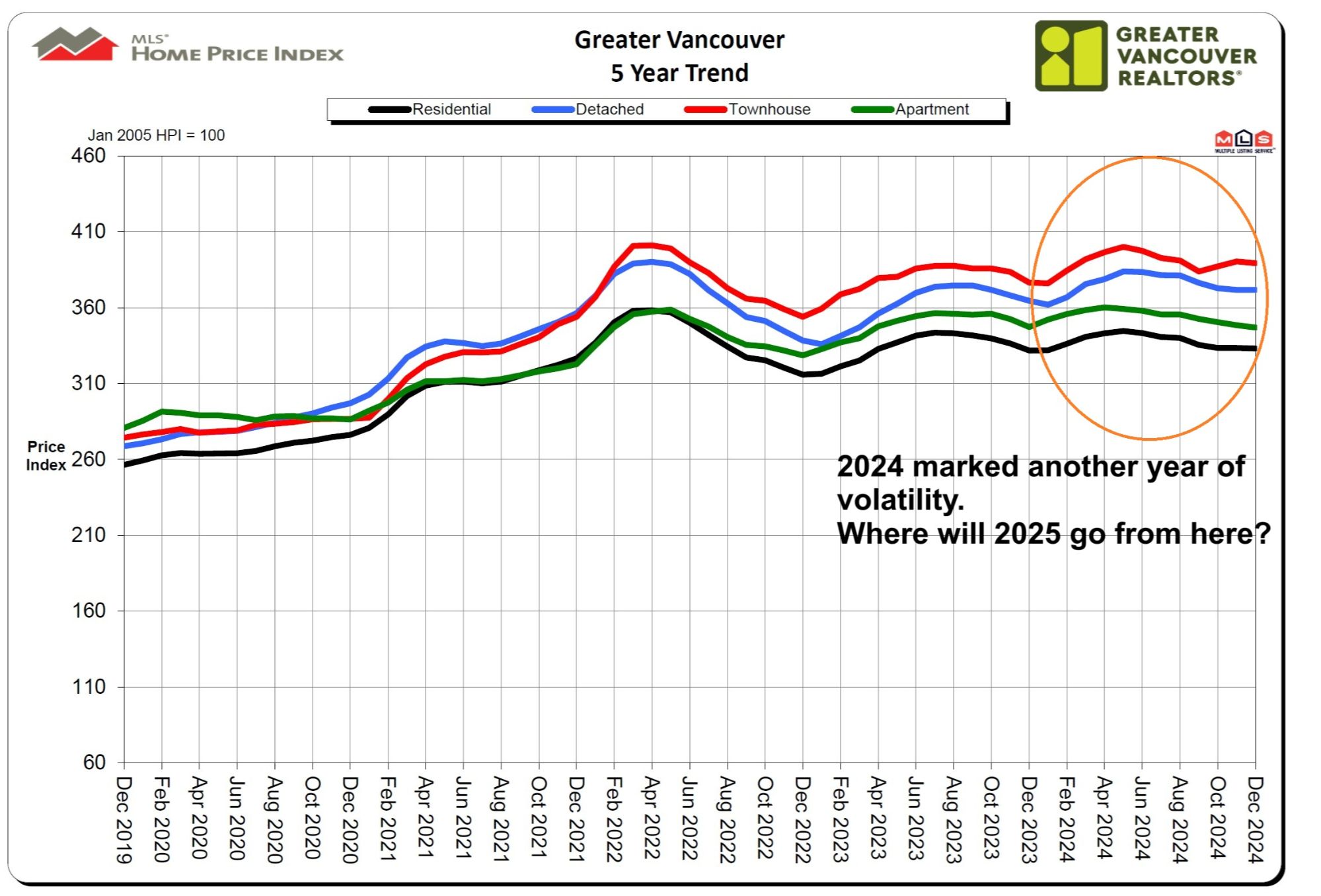

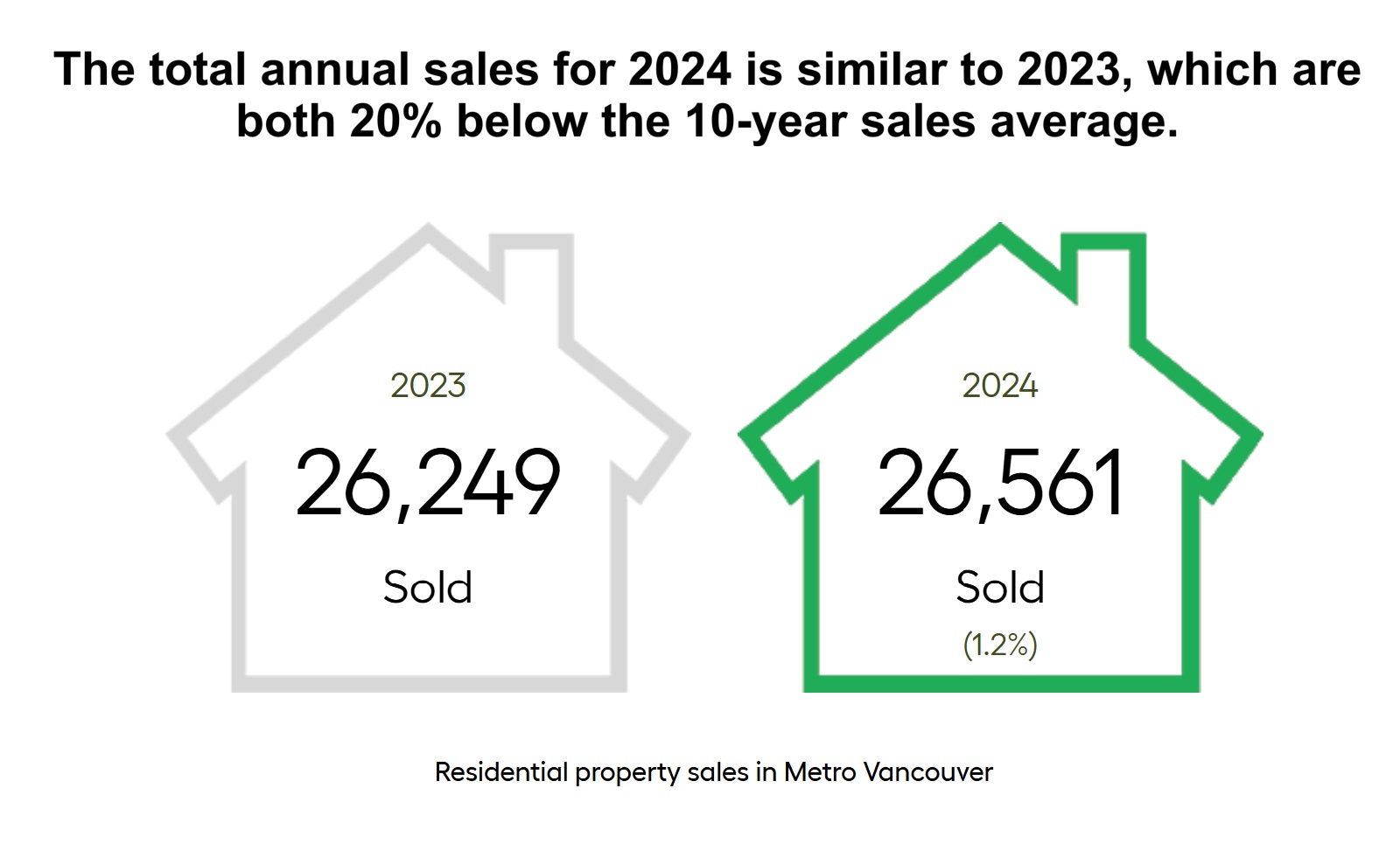

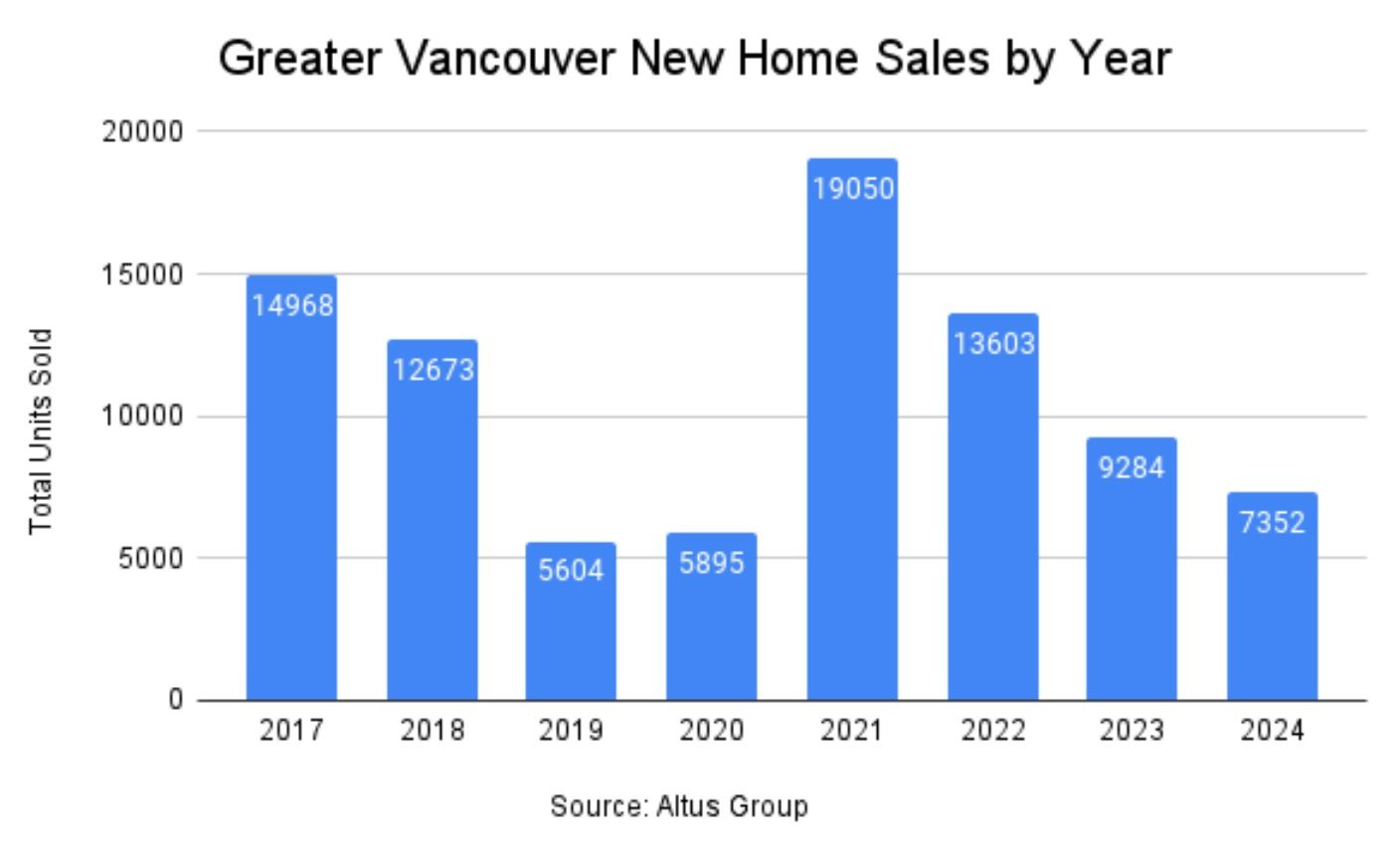

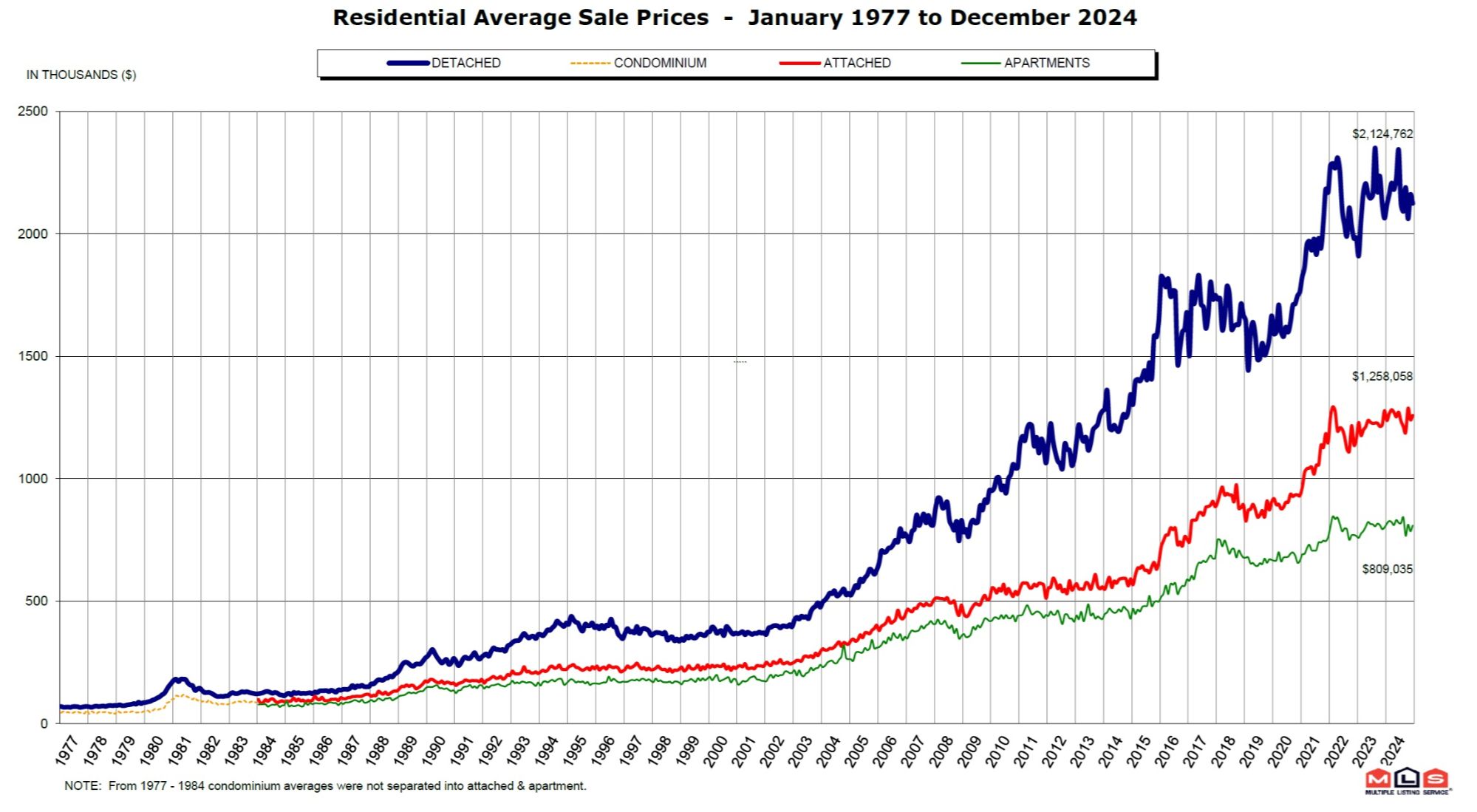

Hope your New Year is off to a wonderful start. In summary, 2024 was a year nothing short of up's and down's, with the year started off strong but fell flat since the summer. For the second half of the year, it gave up all the price gains it made, and ended up near where it started. On the bright side, the year ended on a high note with elevated sales. However, the overall total sales of the 2024 was also nearly flat (compared to 2023), and ended again at 20% below the 10-year sales average. To cap it off, 2024 was another year of roller coaster ride.

Looking ahead, I believe 2025 will be an even more volatile year. Here are the emerging trends to observe:

1. More affordability with lower rates and increased amortization (for first time buyers)

2. End Users remain the market's main driving force

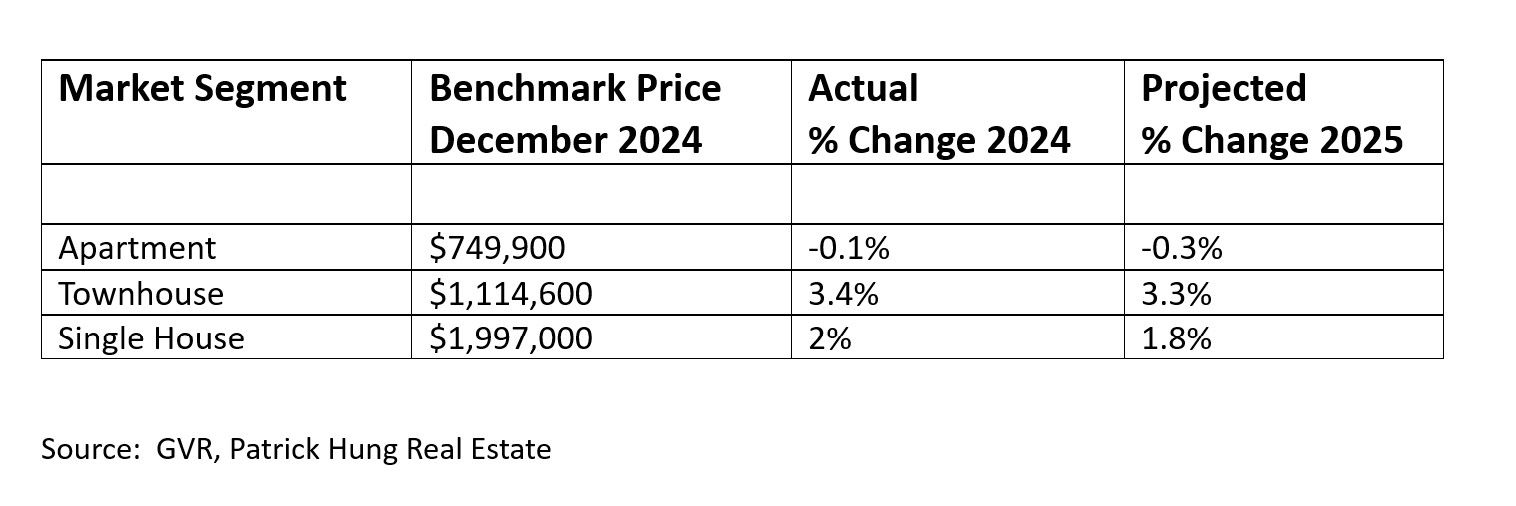

3. Single house and townhouse market will outperform condos

4. Distress sales will grow as insolvency rises

5. Retail investor remain sidelined and seek alternative options

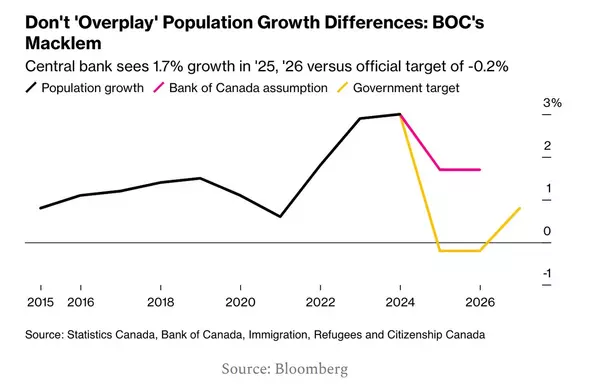

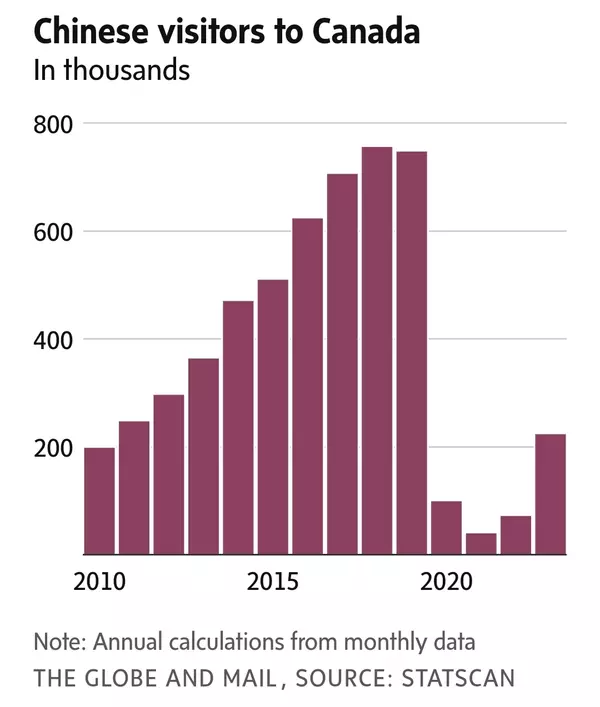

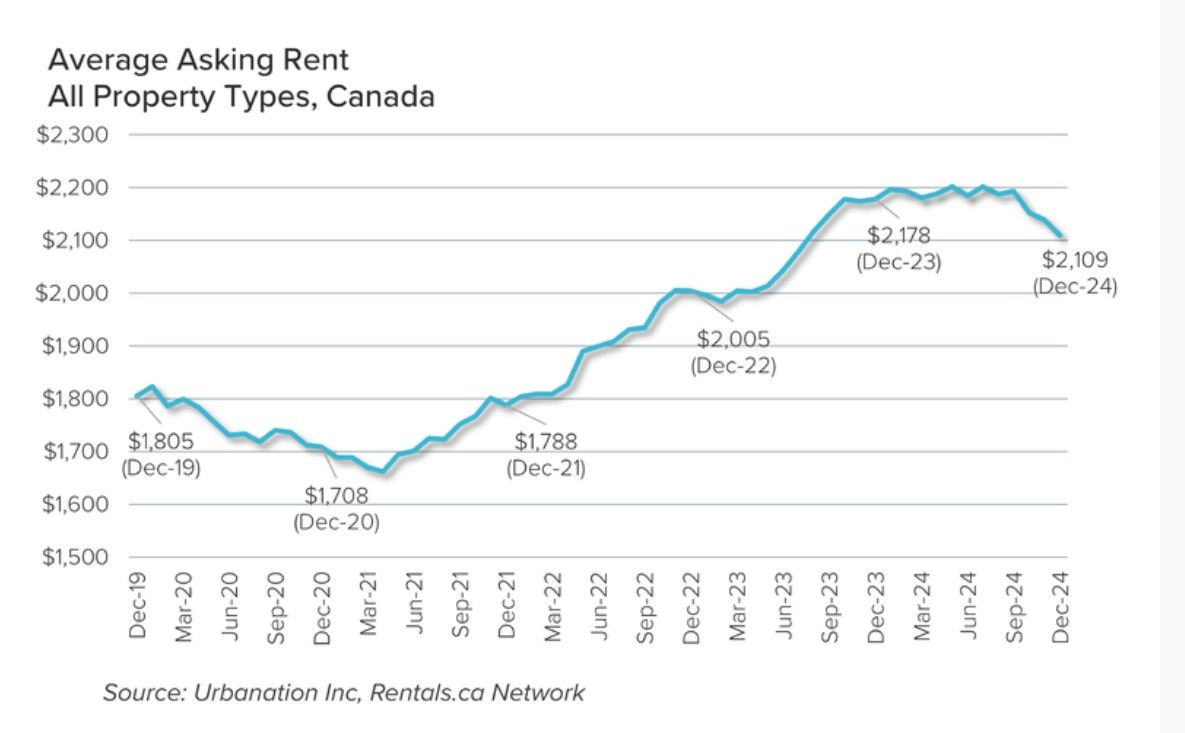

6. Rental rates drops further as immigration head to net-zero next two years

7. Projected annual price growth at 1.6%

Observation 1: More Affordability with Lower Rates and Increased Amortization (for first time buyers)

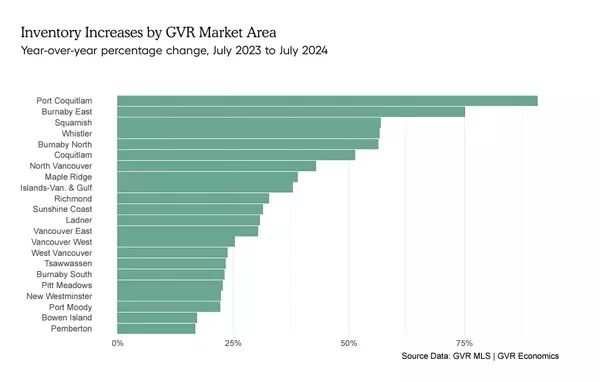

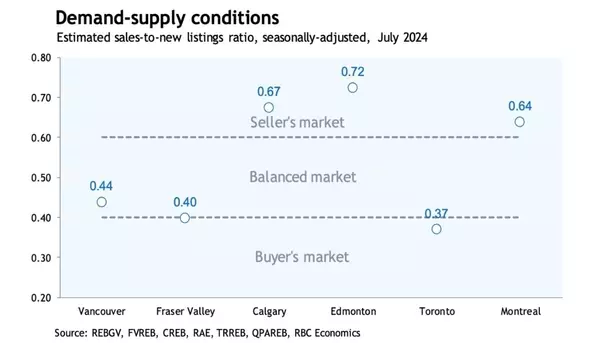

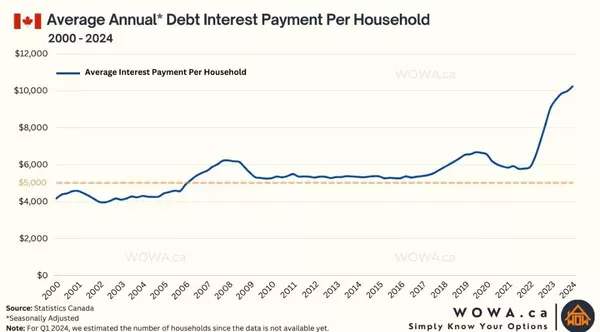

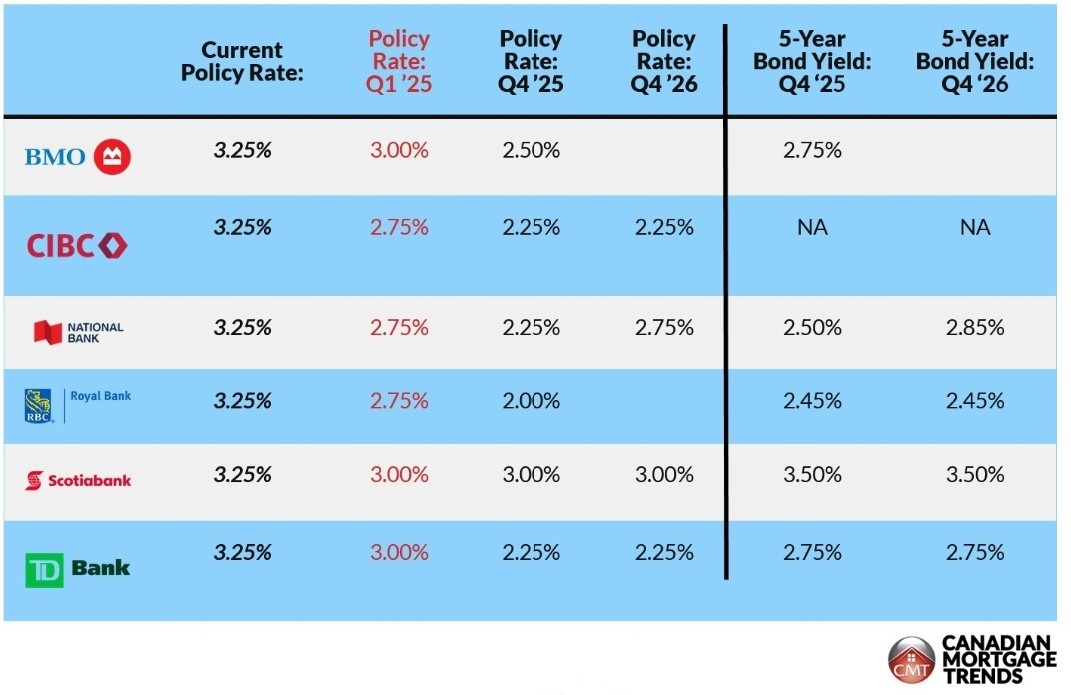

Canadian major banks are predicting that the Bank of Canada will slash rates in the range of 0.25% to 1.25%, effectively making the policy rate ranging between 2% to 3%. While that is a huge gap for experts to predict, the core belief is that more affordability is on its way. However, keep in mind that policy rate does NOT equate bank rates, as we have been seeing in the past 2 weeks that the 5 year bond rate is slowly creeping up, causing some mortgage rates to rise. This has caused further confusion among Buyers. Overall, lower rates compounded with federal policy of increased amortization (for first time buyers), more buyers more likely to come out of the woodwork. Key is, would there be abundant supply (like that of 2024) to keep the market balanced.

Observation 2: End-User Remain the Market's Main Driving Force

Observation 3: Single House and Townhouse Market Will Outperform Condos

Observation 4: Distress Sales Will Grow As Insolvency Rises

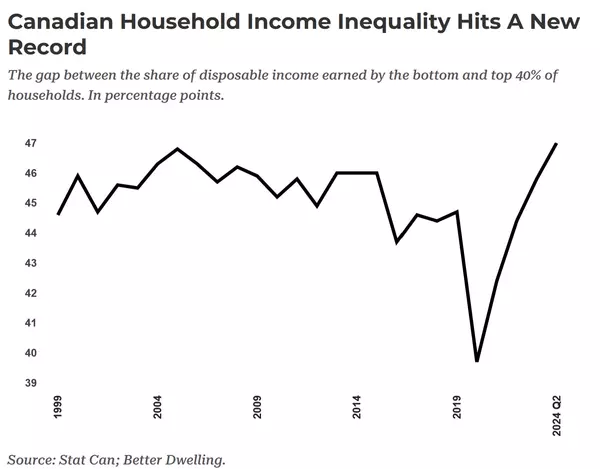

"Mom and Pop' investors will be looking away from investing in real estate due to the BC government's increasingly over-controlled tenancy laws. As these regulations continue to strip away the landlords rights, it has become an uphill battle for any landlords to sell (i.e 4 month notice to end tenancy). Rising costs (strata fees, repairs), market uncertainty along with all the headache and sleepless nights just isn't worth it anymore for mom and pop anymore; they'll explore easier alternative such as stocks, mutual funds or REIT.

The rise and fall of rental rates have historically coincided with immigration and unemployment rate for decades. Since April 2022 to Dec 2023, Canada has absorbed over 1.5 million immigrants, composed of temporarily workers, international students and permanent residents. As the federal government slammed the brakes on immigration on Oct 2024, compounded with unemployment rate near 7%, one can argue that residential rental vacancy will rise as the rental rates will fall. For 2025, the best case scenario for rental rate would be remaining flat. However, it would be more likely to see further rent rates drop as more condo inventory (i.e pre-construction completed) come onto the market later this year.

Observation 7: Projected Annual Price Growth at 1.6%

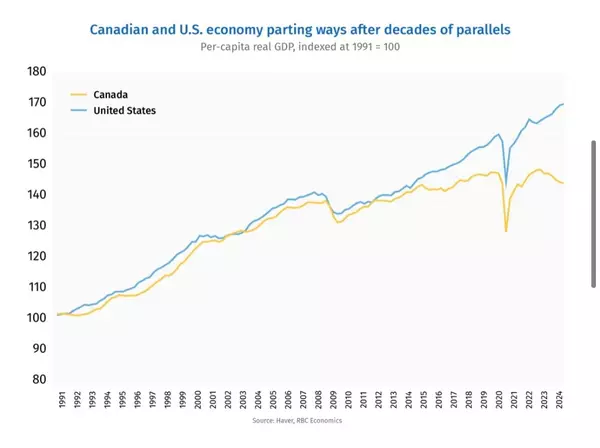

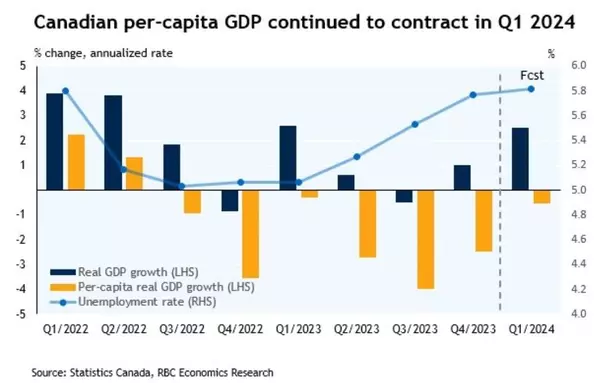

2025 is poised to be a another year of volatility, so it is that much harder to do any projection. In my opinion, real estate, stripped away the investors and dominated mainly by end-users, will have a nearly flat price growth of 1.6%. Key factors to consider are the Canadian economy, which remains weak despite more incoming rate slashes. Higher unemployment rate may around 7% will cause most people to be more concerned about their job security, staying afloat and putting food on the table, rather than getting a new home.

Downsize Risk:

Sales slow further and dip between 25-30% below 10 year average if the Canadian economy deteriorates further due to tariff war. Double whammy of high unemployment rate with rising inflation. Canadian dollar tanks further.

Upside Risk:

Sales pick up drastically as Buyers respond to lower rates. First time home Buyers and other end-users finally come of the woodwork having waited for over two years of elevated interested rate. Demand eclipses supply, and minor price gain follows. While on the backdrop of the Canadian dollar tanking, some retail investors may consider returning and crowding the real estate investment market, in an attempt to hedge the falling loonie.

Download December 2024 Real Estate Market Report

Here are the in-depth statistics for the year 2024

- Total sales for the year was 26,561 units, almost nearly flat as well at +1.2% from 2023.

- Last year's sale total was 20.9% below the 10 year annual sales average.

- Total number of properties listed was 60,388 units, which was 5.7% above the 10 year annual average.

Recent Posts