Real Estate Market Intelligence February 2025

Real Estate Market Intelligence

February 2025

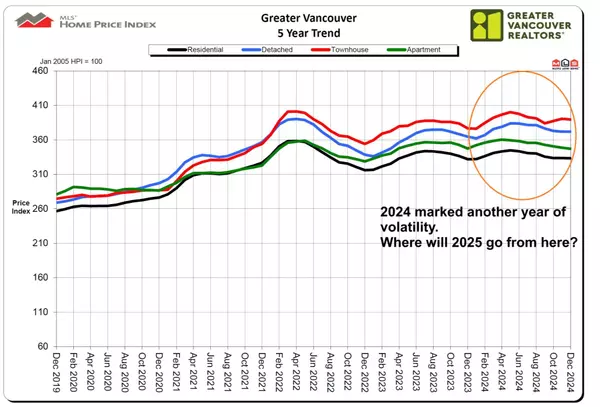

With only one month into 2025 and we're already off to a turbulent start. A lot to unpack here as we saw Bank of Canada dropped their rates by 0.25%, while the US Feds decided to hold rate. Prime Minister Justin Trudeau resigned, leaving Canada without a leader to deal with the on again off again US Tariff trade war. In the midst of all the chaos, the Canadian dollar briefly drop to its lowest value in over 20 years before recovering. Meanwhile, mortgage rates has been just as volatile, with some fixed rates (mirror that of the bond rates) continue to drop to levels not seen in 3.5 years. Last but not least, we have the release of the first month of Vancouver real estate stats, with January's supply increasing at a whooping 31% over the 10 year average, which is the highest for the month of January in 20 years. Let's dive deeper.

For the first month of 2025, the Vancouver real estate started off to a busier one as the momentum carried over from last year. Report had shown that for the first 3 weeks of January, open house traffic, showing requests, and sales activities were way up. However, when Trump took office on Jan 19th until the second week of February, the market started to cool. Understandably, as the fog of tariff war persisted, Buyers were spooked and retrieved back to the sidelines. Historically, it would normally take 2-3 months for any major global uncertainty to clear before the Buyers become more comfortable to make a move. However, Spring market is right around the corner and it is usually the busiest time of the year for real estate. Thus, the timing of the tariff talk has, for now, dampened the recent market upswing. Should the scale of the tariff be minimized, I expect sales activity to return quickly.

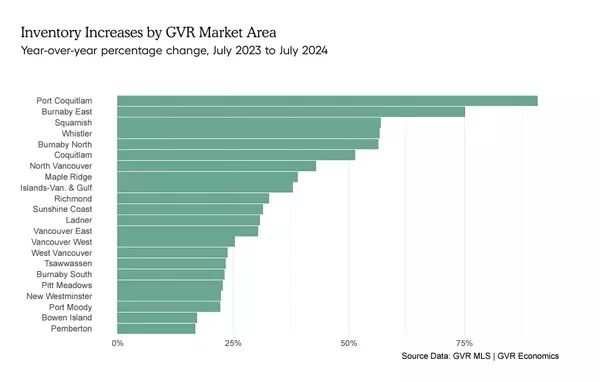

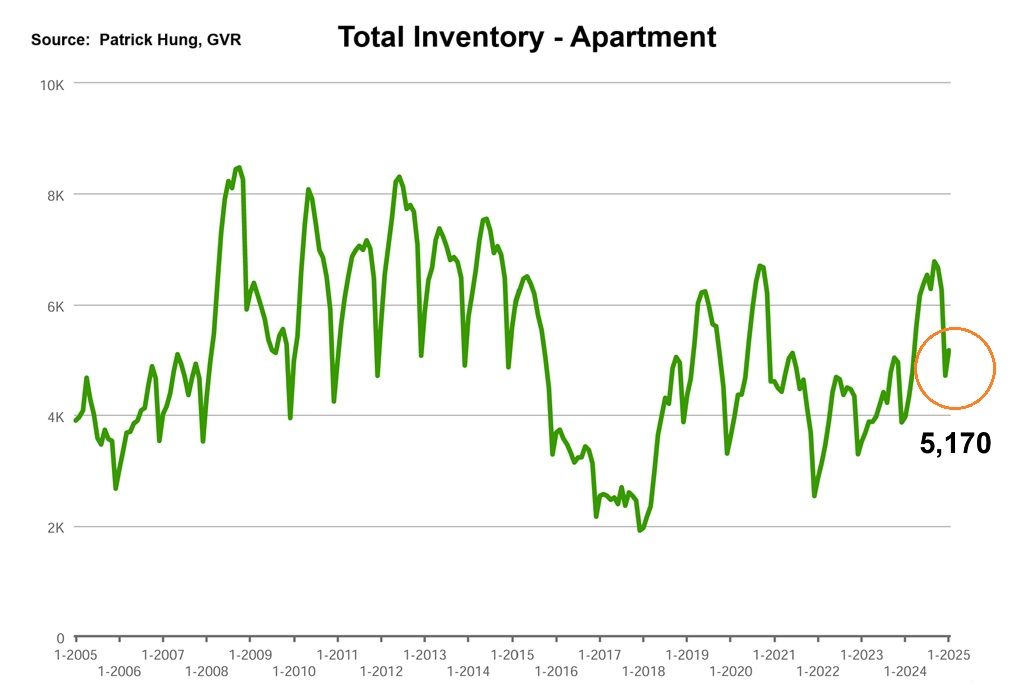

Meanwhile, prices continue to remain flat at +0.1% last month, but what's most important of all is the housing supply, which we have seen a +31% increasing over the 10 year average, and it's the highest number of new listings in the month of January ever recorded (since 2005, when the real estate board started to release stats). This supply surge was mainly driven up by the condo segment, as more newly-constructed condos will come onto the market. Having said that, we are seeing more Sellers willing to come off the sidelines than Buyers. Unlike last Spring when there was a major supply constraint, this year the Buyers are faced with more options and can afford more time to choose and negotiate. Noteworthy is that good homes still sell very quickly and usually within the first two weeks. That tells me although Buyers may be more selective now, are just waiting for the right product to come on.

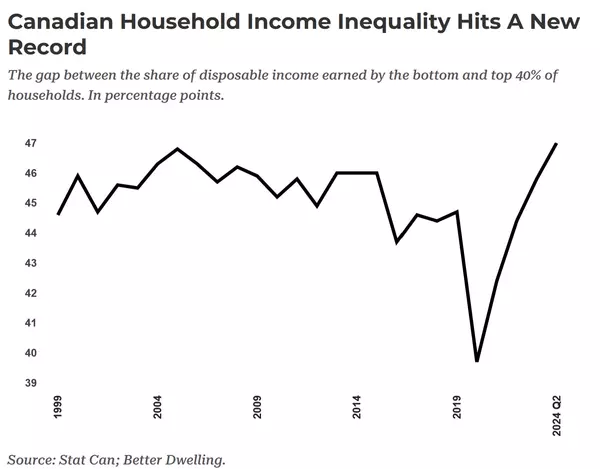

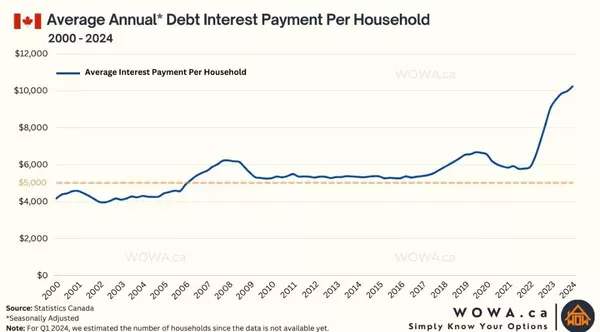

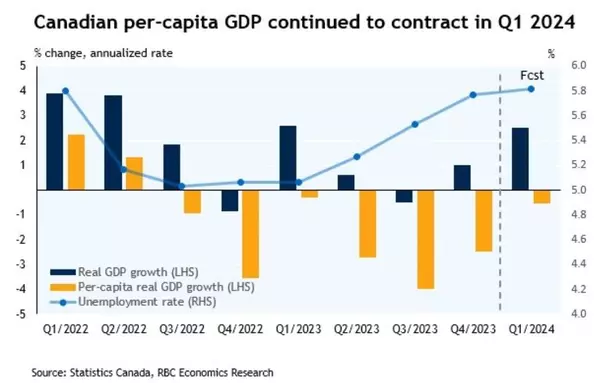

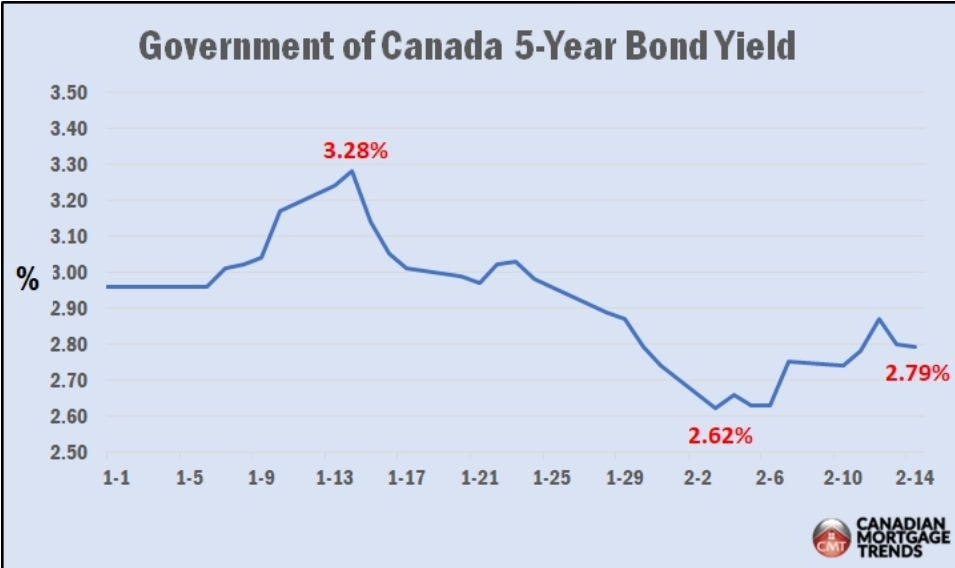

On the economic front, the Bank of Canada has lowered the interest rate by 0.25%. By the same token, Canada's 5 year bond rate (where the bank's 5 year mortgage rate mirrors) had seen it's biggest drop of -0.50% in a matter of 4 weeks (between Jan 14-Feb 14) after tariff announcements. This has given Buyer's more purchasing power, albeit only by a little. Having said that, major banks and economists suggest Bank of Canada will continue cutting in the next meeting, so I expect increased Buyer activity on the horizon. As that same sword cuts the other way, the Canadian dollar had briefly plunged to new lows (on Feb 2) not seen in 20 years, before recovering quickly. A weaker Canadian dollar translate into elevated import inflation risk, and that just spells more trouble in the already troubled Canadian economy. Whether there's a tariff war or a softening Canadian dollar, there seem to be no escape for more inflation incoming this year. Looking ahead, the real estate market, just like everything else, is poised to be even more volatile in the coming months. Stay agile, and position yourself accordingly: the ride has just begun.

Some of the unique trends I've been observing:

1. Surprisingly, Canada's unemployment rate has dropped slightly to 6.6% in January (compared to 6.7% in December), even though it certainly doesn't feel like it. Of all the provinces, Alberta had the most jobs added (+1.4%), which Ontario has +0.3%, and BC was mid-pack at +0.5%.

2. The US tariff and talks of trade war has sent jitters through the Vancouver real estate market. The first three weeks of January carried the momentum from last year, with increased open house traffic and showing requests. As soon as the tariff was announced, Buyers confidence were shaken, and rightfully so. Imagine who wants to buy one of their life's most valuable assets in the midst of all the uncertainty?

3. The Bank of Canada has slashed the rate by 0.25%, effectively bringing the overnight rate to 3%. What's more important is Canada's 5 year bond rate, which mirrors the major bank's 5 year fixed rate, has dropped by -0.50% in the last three weeks. We are starting to see some of 5 year fixed rates between 3.89% to 4.19%. For buyers, now poses a good opportunity to lock in their rates, whether fixed or variable, just to be safe.

4. In January, the Vancouver real estate market saw the highest monthly listing increase (+31%) in the past 20 years. As this was driven mainly by the condo segment, such Seller should be cautious as this year will have even more new-construction done. This will add further inventory and downward price pressure into the already over-supplied market. And the falling rent is not helping either.

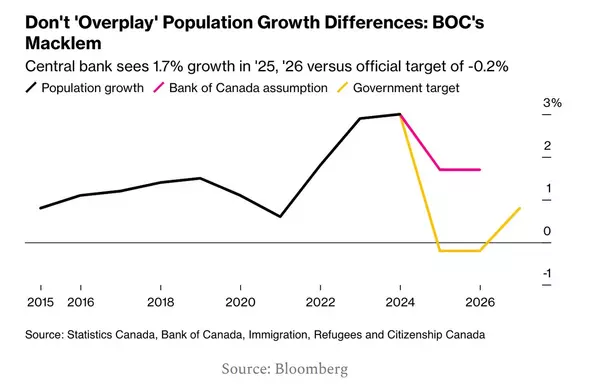

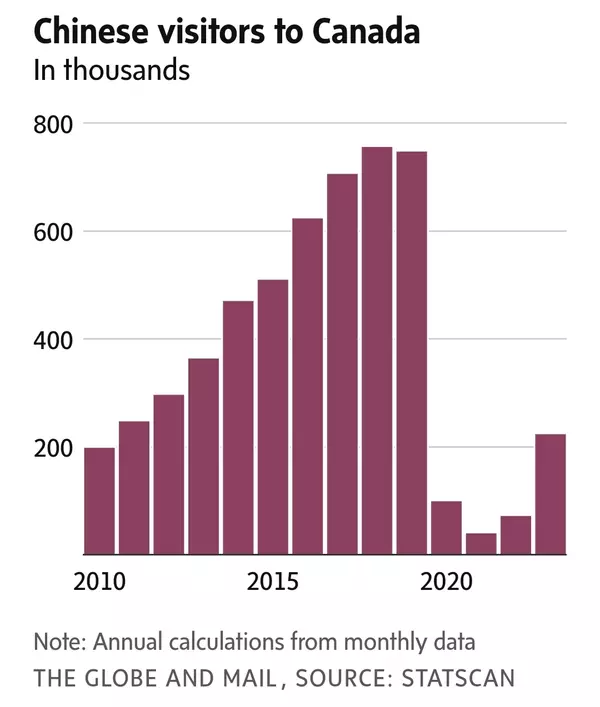

5. Speaking of falling rent, January saw the Canadian residential asking rent fall to a 18 month low, at $2,100. As immigration target is expected to reach net-zero by 2026, it does feel like the immigrants are leaving faster on their own accord. Who would blame them? They were sold a Canadian dream of better job and livelihood, only to find out suffocating high standard of living, limited job opportunities, and nearly no way of ever owning their own home due to elevated prices. If immigrant don't see a viable future in Canada, they will leave sooner or later.

6. According to a report, 60% of all goods in the fridge of a Canadian household is imported. Be prepared for the imported inflation and is poised to further cripple the Canadian economy.

7. Canada's inflation shifted slightly back up to 1.9% in January (up from 1.8% in December). This was supposedly to be lower due to the GST break, but it was offset by higher fuel prices. Now that the GST break is over, and it seems the word "inflation" is starting make a come back after being off the headline for over a year. Bank of Canada's next rate announcement is March 12, and whether they cut or not, they will have a hard job to do. But before then, there may be more (tariff) news to shift the market either way.

Here are the 4 highlights for January:

- Total inventory of 11,494 units was the sharpest rise in January inventory for the past 20 years.

- Beginning of January continued the welcoming trend of heightened activities, even though is still -11.3% below the 10 years average.

- January is seasonally a slower month compared to what's to come in Spring, which is typically the busiest time. However, this year has seen an unconventional start.

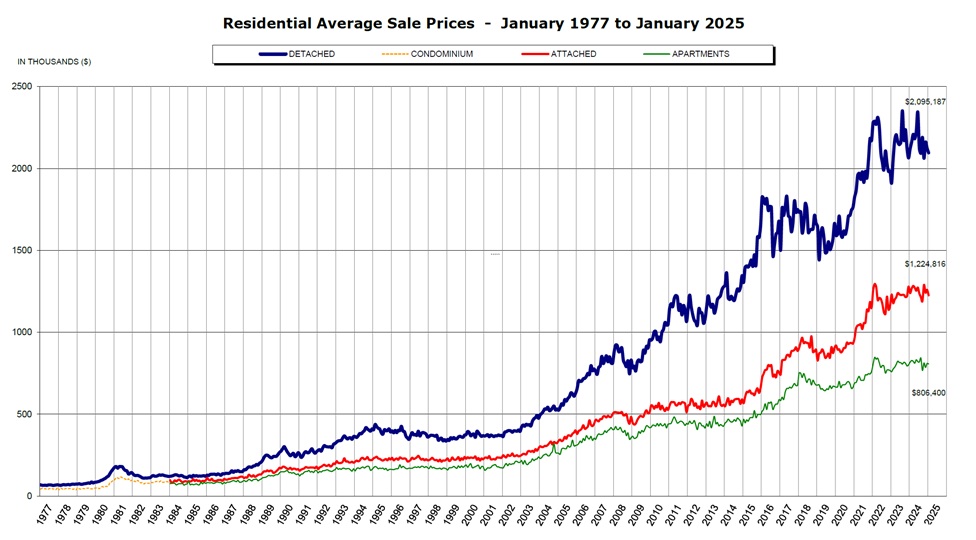

- Prices continue to chop sideways for the past three months, with average prices barely moving at +0.1% since November.

Here are the in-depth statistics of the January:

- Last month's sales were -11.3% below the 10 year January's sales average.

- Due to seasonality, month by month residential home sales dropped -12.9% from December 2024.

- Month by month new home listings exploded to 230.8% compared to December 2024. Partial of this was due to some of the listings expired at the end of the year, and was being re-listed in January.

- Last month's price remain unchanged at +0.1%.

- Sales-to-listing (or % of homes sold) ratio is dropped slightly to 14.1% (compared 17.1% in December). By property type, the ratio is 9.2% for single houses, 18.5% for townhouses, and 16.5% for apartments/condos.

Download January 2025 Greater Vancouver Real Estate Report

|

Townhouse Market

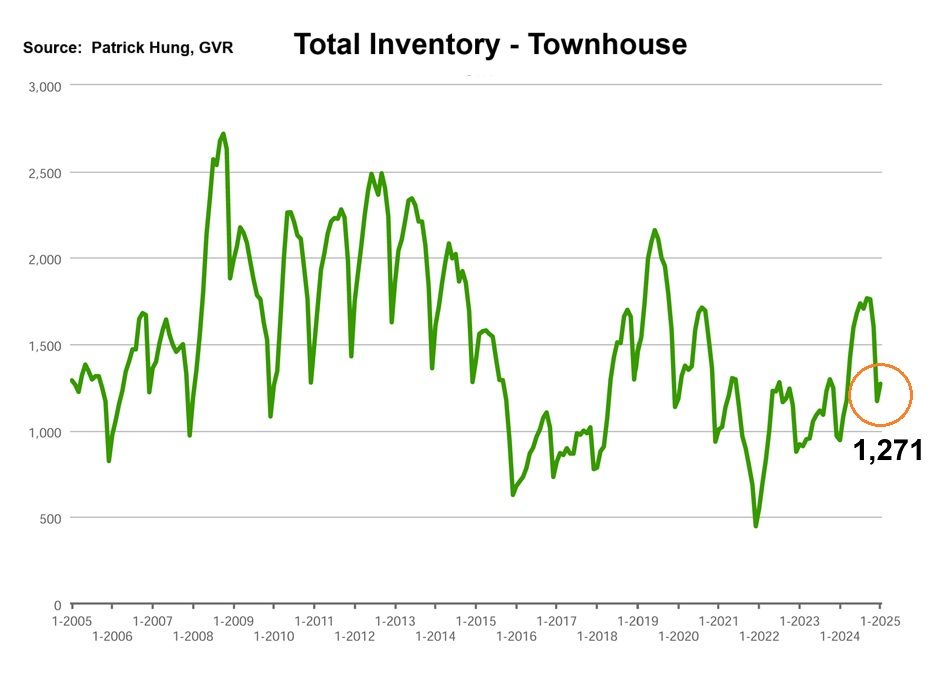

The January townhouse price took a surprising hit, albeit only a minor one, with a -0.8% drop. As townhouse remains the most popular choice for the growing family, this minor price drop may have been caused by the Canadian growing economic woes; families who were looking to up-size are either taking a pause, or just started throwing low ball offers because, let's face it, that's all they can afford. As townhouse buyers composed mainly of end-users, they are more affect by job security (unemployment rate), household income, and economic outlook. So now when there are so much uncertainties, they are even more cautious than before. Another way to look at it is that, Buyers who want to upsize to townhouse simply are having a hard time selling their own home, namely apartments, which has seen a surge in supply recently. This ripple effect has caused a slowdown in the townhouse sales and price growth, even though the sale-to-listing ratio of 18.5% remain the highest amongst all segments. Having said that, entry level townhouses less than $1m in Greater Vancouver and $800k in Fraser Valley are still popular, just that Buyers are now more selective. The good ones will fly off the shelves, while townhouses in worse condition or priced higher are poised to sit much longer on the market due to rising competition.

In January, the areas with the most townhouse price growths were led by North Vancouver, Pitt Meadows and Maple Ridge, registering +4.4%, +1.4% and +1.1% respectively. Conversely, the neighborhoods with the negative price growth are Vancouver West, Richmodn and Squamish, at -3.3%, -2.1% and -2% respectively. The townhouse market shifted from a Sellers market to a Buyer's market, with date on market increasing to 44 days (compared to 35 days in December). Month-to-month sale price continue to trend down for the second month at -0.8% (compared to -0.3% in December). Sale-to-listing (% homes sold) ratio remain the strongest among all segments and but has dipped to 18.5%. (compared to 23.6% December).

|

Apartment and Condo Market A perfect storm is brewing for the apartment market, with a surge in inventory compounded by a drop in rent. Rental managers are reporting a 3-4 month turnaround for rental units, even as they continue to lower asking rent. Thus, mom-and-pop investors are liquidating as they wonder just how much longer can they bleed cash every month. But wait, wouldn't lower interest rate increase purchasing power and elevate the sales, especially amongst first time home buyers? Indeed, we are seeing entry level condos remain active, but there are just a lot of competition out there. Also, 2025-2026 will have the most pre-sale units ready to be complete, and that means towers and towers of new supply will come onboard. We are talking about thousands of units pending. It's not hard to see that with Canada's net-zero immigration policy, rents are dropping, investors are hurting, and buyers remain cautious. In the coming months, I would expect inventory continue to rise in the apartment market, and homes will take much longer to sell. This is the segment where the downward price pressure is the most prominent, and Seller would now have to price their homes competitively in order to attract any offers. For the month of January, the best performing neighbourhoods for apartments are all in the outskirts (due to seasonality) at Whistler, Squamish and Sunshine Coast, at +7% +6.9% and +4.5% respectively. Conversely, the areas with the most significant price drops were all in the outskirts in West Vancouver, Port Moody and North Vancouver with -3%, -2.2% and -1.4% respectively. The apartment and condo segment has remained in a balanced market for the second month, with average days increasing to 45 days (compared to 36 days in December). Month-to-month sale price remain nearly flat at -0.2% (compared to -0.4% in December). Sale-to-listing (% homes sold) ratio dropped slightly to 16.5% (compared to 18.7% in December).  |

1. Locked In

Canada's major banks fixed rates are mirrored to that of the government's 5-year bond yield. With that said, the recent trade war has created a window for prospective Buyers to lock in their rates. It's been 3 years since Canadians had seen fixed rates between 3.89-4.19%. The market is extremely volatile now, so things can go either way. In my opinion, it never hurts to just lock in your rates. (Source: Canadian Mortgage Trends)

2. Supply, Supply

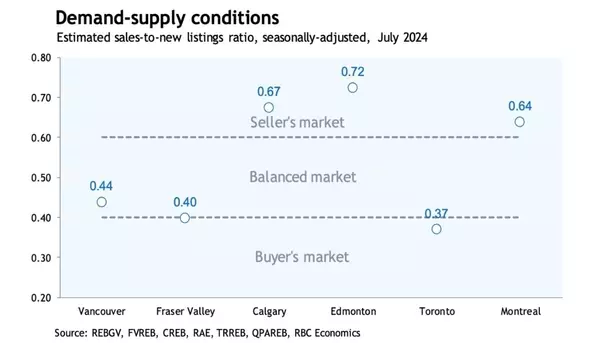

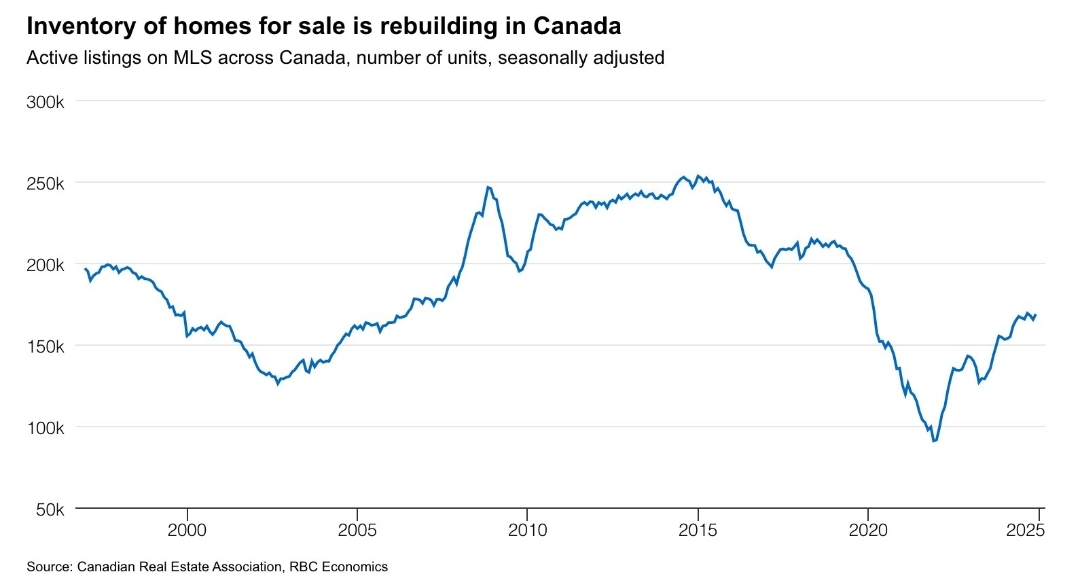

Housing supply across Canada is rising, with year-over-year home for sale inventory climbing in Montreal at +10%, Calgary +18%, Vancouver +27%, and Toronto at a whooping 49%. Even in the face of rising inventory, Canada still faces a housing shortage and an affordability crisis: home prices are still out of reach for many. But for now, the supply is at least normalizing. (Source: Canadian Real Estate Association, RBC Economics)

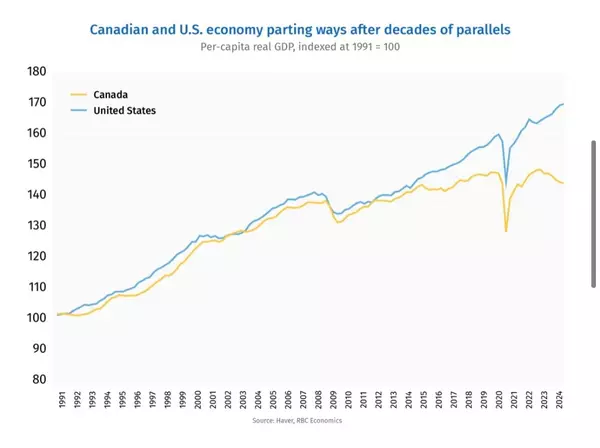

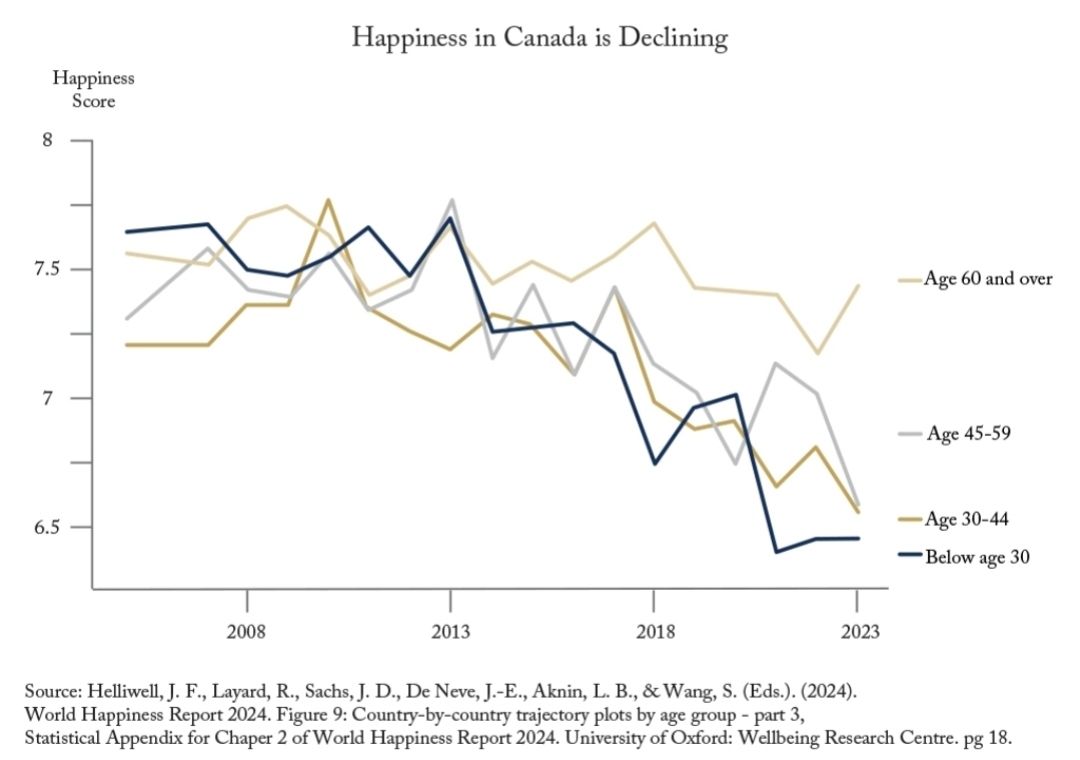

3. Smiles to Frowns

Canada ranks 15th in the 2024 world happiness index, down from 5th in 2015. For those under 30, Canada ranks 58th, which is one of the worst declines globally. Once the happiest group, they are now the least happy in Canada. Coincide this with the Canadian real GDP per capita that has been stagnant for the past decade, it's not hard to understand why. (Source: World Happiness Report 2024)

Recent Posts