Real Estate Market Intelligence July 2024

Real Estate Market Intelligence

July 2024

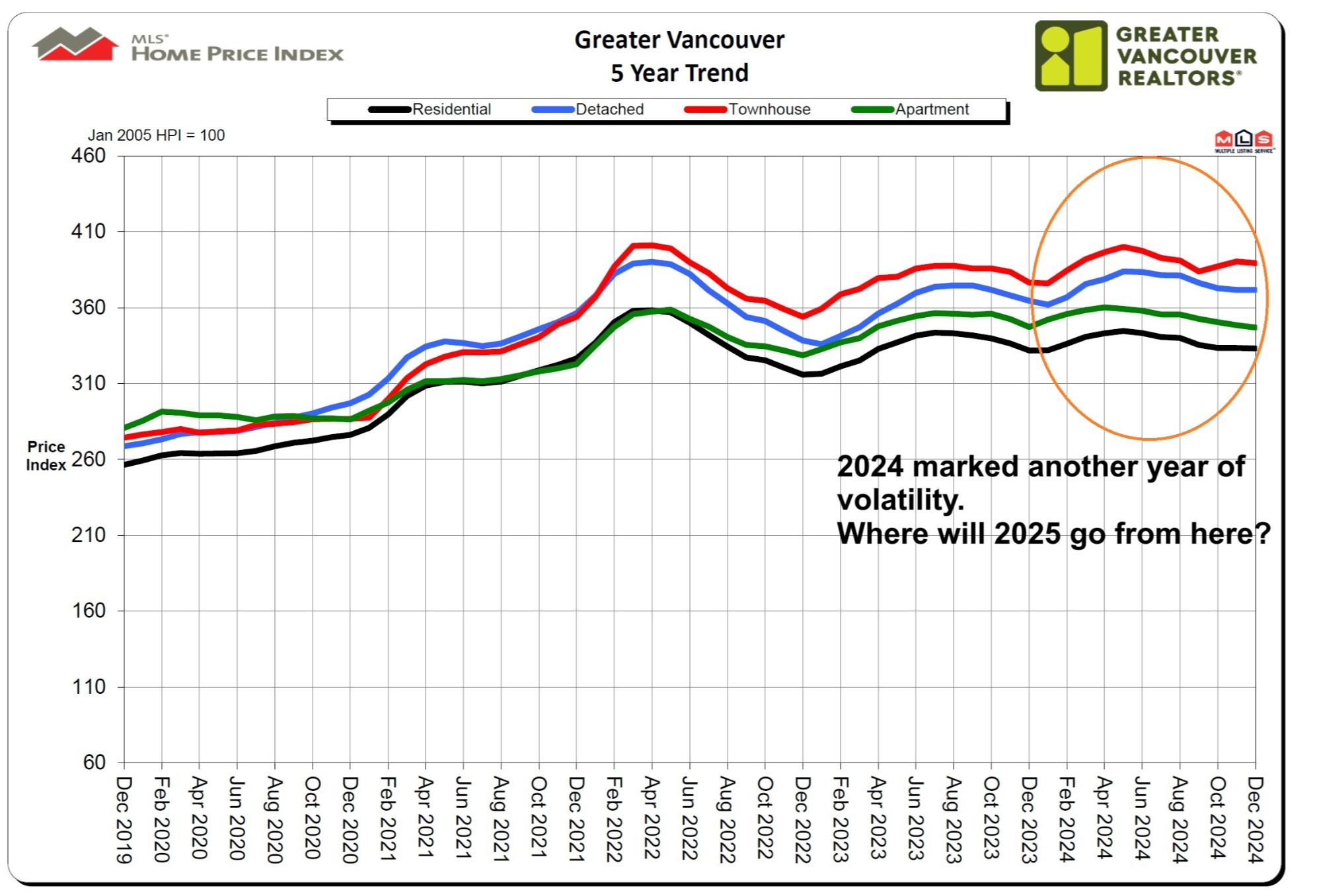

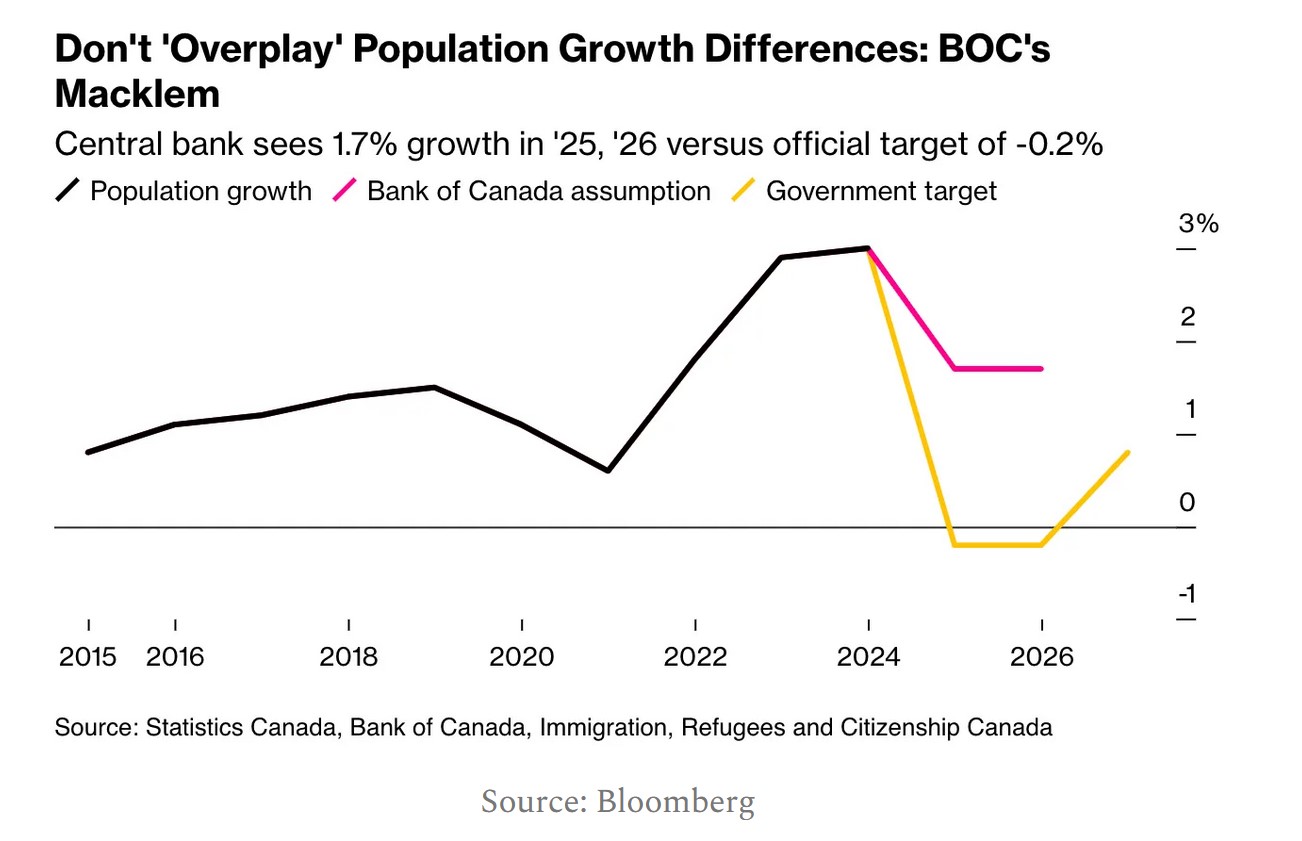

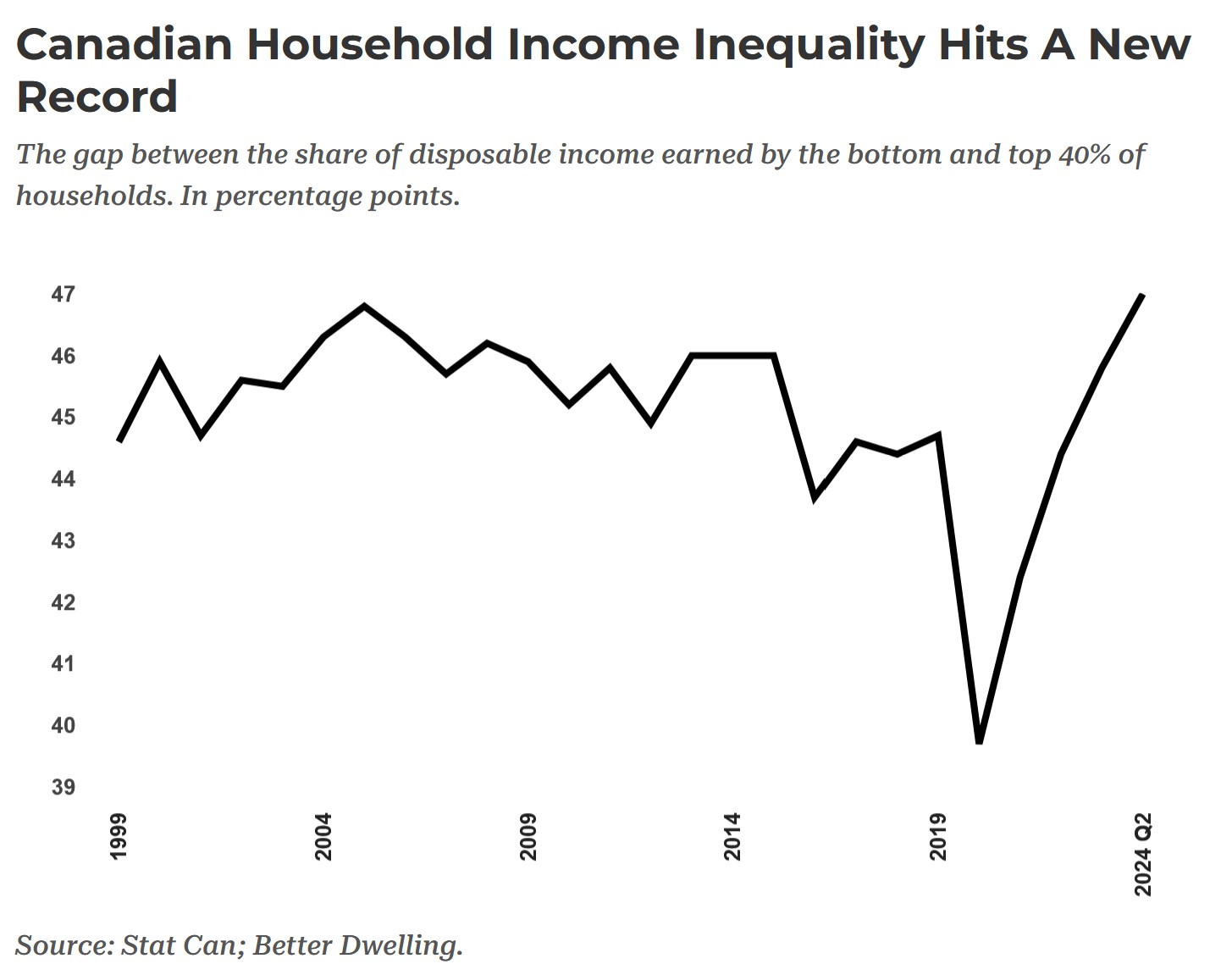

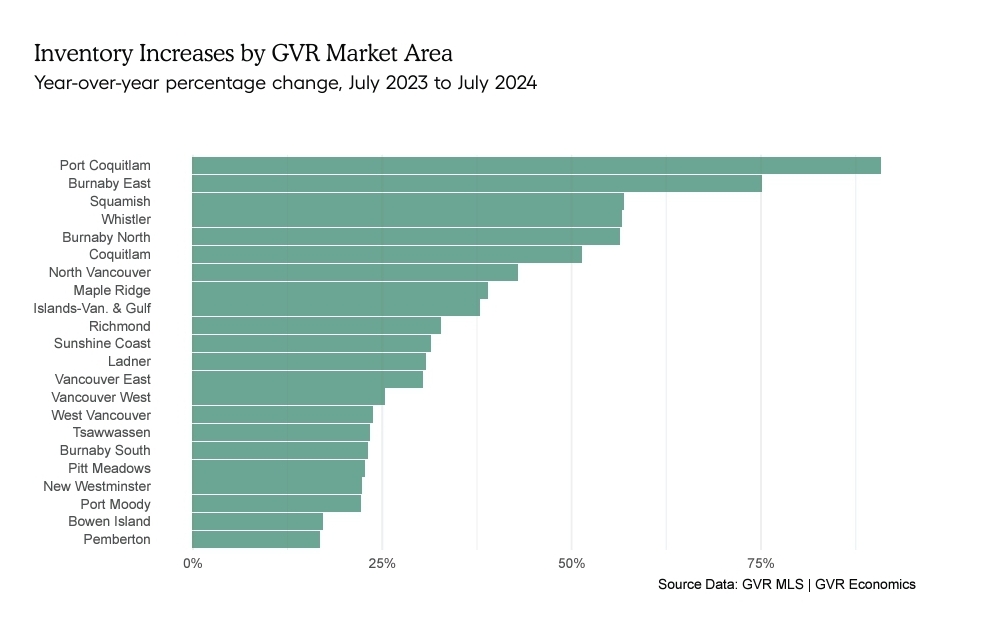

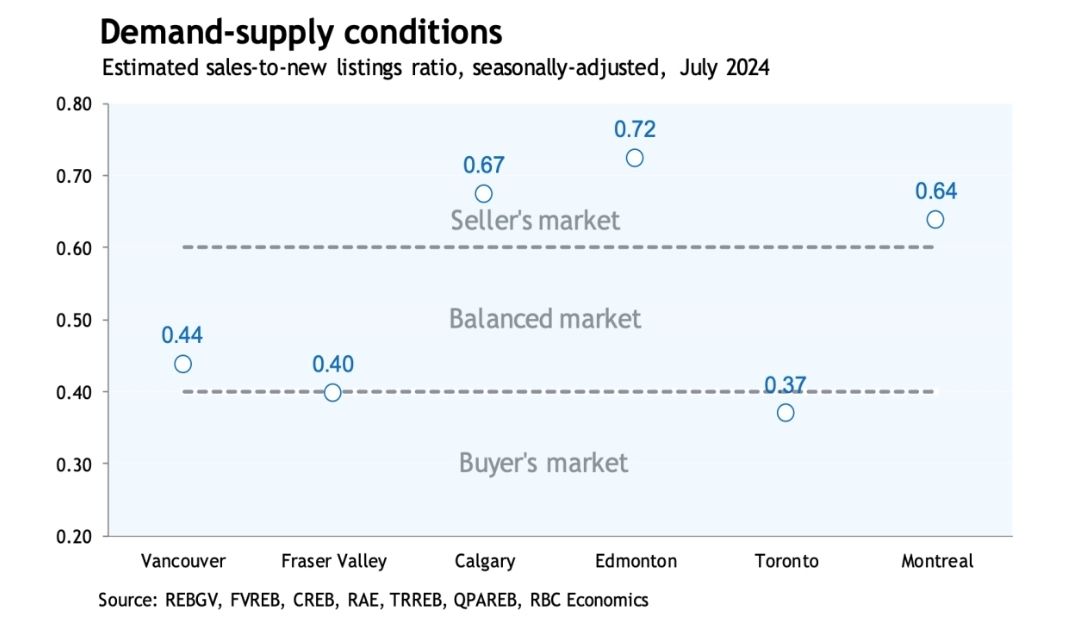

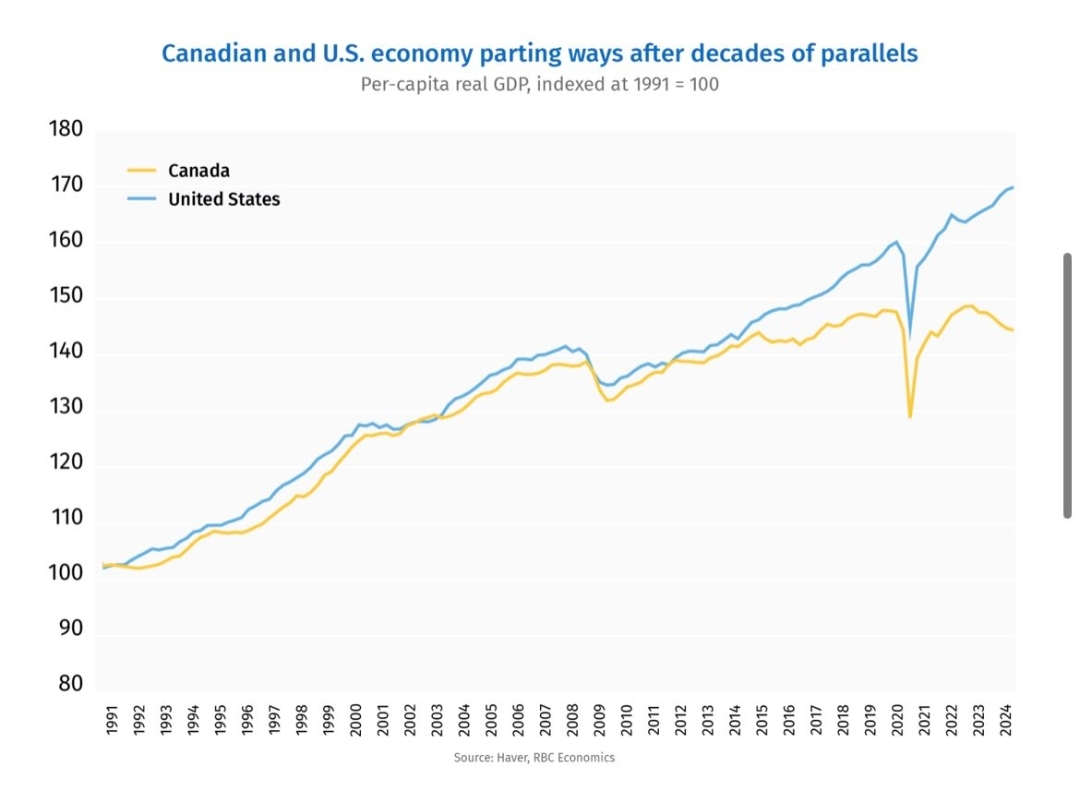

The Vancouver real estate has always been surprising, whether on the upside or the downside. Summer months are typically slower with less sales, and what the month of June brought was an upside news (rate cut) along with downside results (lower sales, higher inventory). Buyers did not come off the sidelines as market had widely expected. Keep in mind that any monetary policy usually take 18 months to have a full effect on an economy, and that is what we are seeing in Canada now. Small business insolvency remains high, and the economy remains weak with low productivity. Historically, an economy is at the weakest point before the first rate cut, just like the night is darkest before dawn. On the real estate front, we have not seen inventory this high (13,000+ listings), nor sales this low (less than 2,400 units) for a month of June since 2019. Even June 2020 (3 months after the shutdown of the pandemic) there were more sales than this past month. This may be startling for many, and rightfully so. I still remember vividly, back in 2022, when the Bank of Canada hiked rates, and the market nearly froze that summer. Two year later, we are now here feeling the "real" effects of that aftermath. On the supply side, the real estate Sellers are really coming onto the scene, and even in July now we are still seeing a continuation of that above-normal inventory surge. The healthy supply of inventory will definitely take some time for the Buyers to digest. Even with the rate cut of 0.25%, Buyers felt nothing has changed, similar to room temperature adjusted by 1'C, which is barely noticeable. With boots on the ground, I do feel that Buyers are either holding out for a better price or just wanting a better timing (i.e. after summer). It is important to note that, even with less foot traffic and showings, it does not feel like Buyers have left the market: they are just much more observant and careful. The Vancouver real estate median price saw a slight drop last month of -0.4% after it peaked in May. With inventory still on the rise, we will most likely continue to see negative price growth in at least the next 3-4 months. Note that the last cycle of peak to valley (price drop) happened in Aug 2023 to Jan 2024. If history tells us anything, the Vancouver real estate price drop cycle usually last anywhere between 5-9 months. Million dollar question is, where is the next bottom? With more rate cuts upcoming, there is certain a bit more optimism in the air, even though that cannot be felt at the moment.

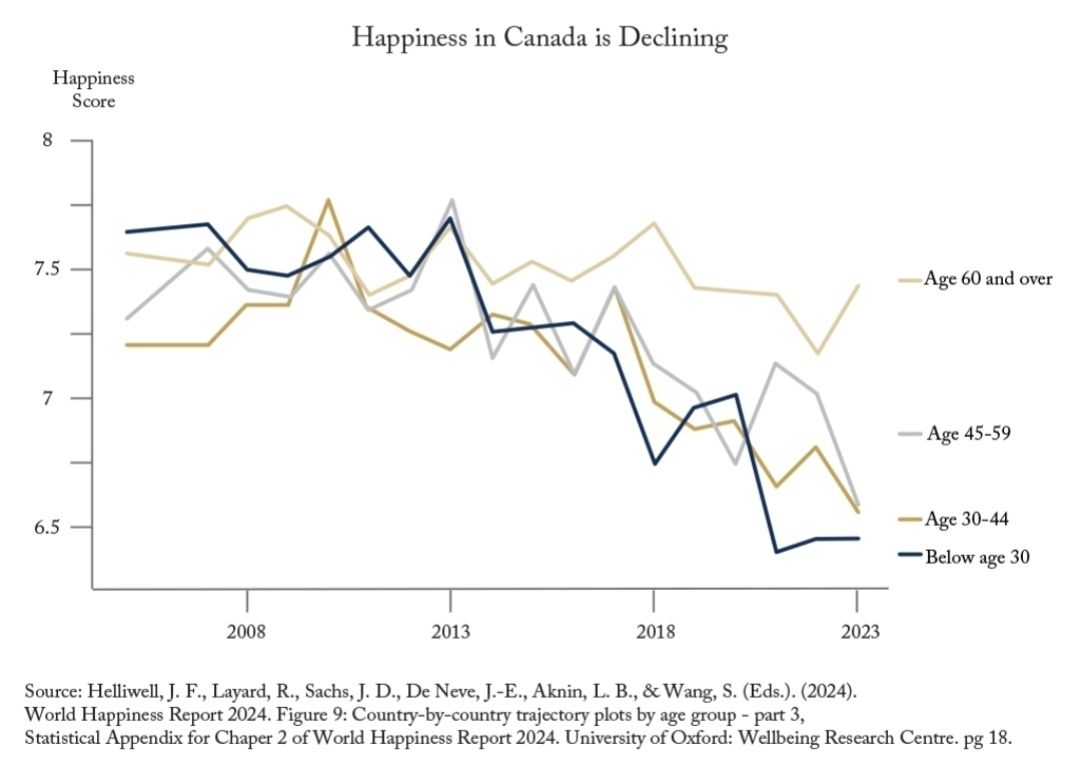

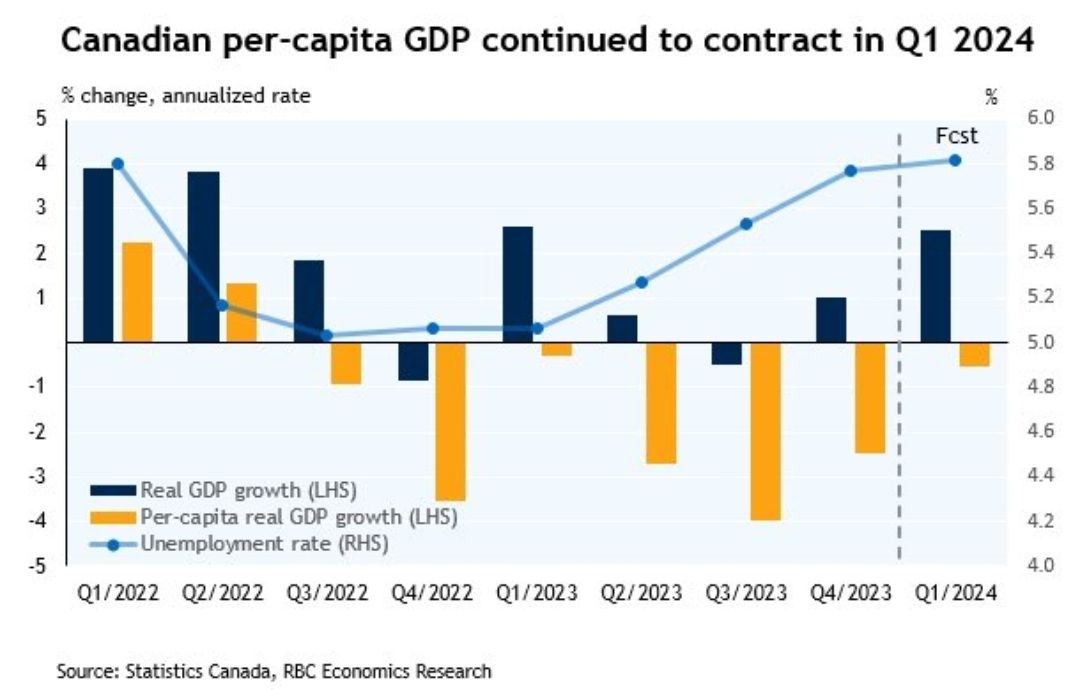

Speaking of optimism, the latest Canadian inflation in June came in at 2.7% (compared to 2.9% the month before). This was a pleasant surprise as it should give the Bank of Canada more reason to further cut rates by end of July. On the other hand, the Canadian unemployment has gone up to 6.4% (up from 6.2%). When we dive deeper into the report, those who are mostly affected were the younger generation (age 18-25) and also the new immigrants. What this means is employers continue to elected and hire more experienced workers, leaving the younger workers (with less experience and expertise) struggling. New immigrants are also having a hard time as their expertise gained overseas is not recognized in Canada. This lack of placement has long been plaguing Canada's labour market, just that the recent surge of 1 million immigrants has made matter much worse. Overall, the norm for employment between 6% - 6.5% may be consider acceptable by the Bank of Canada in the near future.

With summer in full swing, my feeling is the Vancouver real estate market will continue to get hit by the double whammy of lower sales and high inventory. Price will come down a bit and some Sellers, now this time around with more competitors, may elect to take a cut and leave the scene, especially apartment investor Sellers who have decided to leave the scene for good. As for Buyers, the current market is actually offering a rare chance (since 2019) that they can take their time and negotiate. But somehow, many are still waiting. Perhaps they are still trying to figure out the market as they wait for more rate cuts on the horizon. Note that with many housing and government policies continue to evolve, and my bets are that the market will become even more polarized. Ensure to position accordingly as the market will not uniformed, and it would become increasingly difficult to navigate and compare between neighbourhoods and products. Next rate announcement is end of July, and my bets would be on another cut. Let's see.

Some of the unique trends I've been observing:

1. BC government's mandated single house zoning policy (Bill 44) has finally launched in July 1, and each municipality's policies has created more confusion than assertion. For example, the City of Burnaby has welcomed four-plex zoning, but also quietly increased the developmental fees, making it financially hard for developers to crunch the numbers. In Richmond, the Bill has allowed for a heritage site, such as Steveston, to build 8 storey building, and legitimately change the character of the entire neighborhood. The Richmond mayor, Malcolm Brodie, has asked for a 5 year extension for Steveston redevelopment. For Coquitlam, the council has asked for a 1 year extension for similar reasons. Overall, it's a mess and there remains more questions than answers.

2. The Vancouver real estate market in June continues its polarity, with sales recording -23.6% below 10 year average, while total inventory has risen to +20.3% above the 10 year average. The demand and supply continue to stretch further on both ends: the double whammy continues.

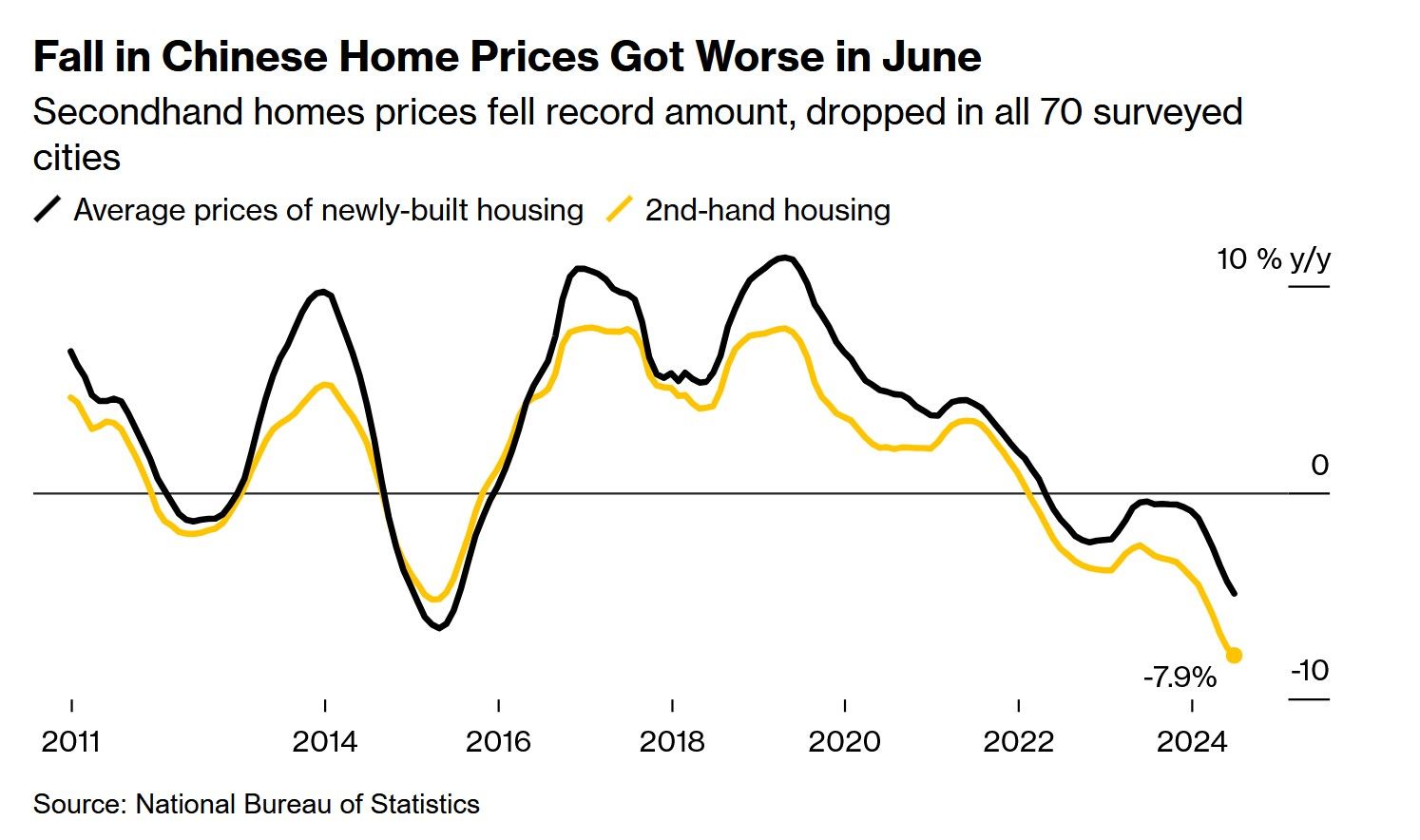

3. China's economy is still reeling, with most notably the real estate sector of second hand home prices dropping -7.9% this year. Would this have a spillover effect and causing a drag on highly Chinese-concentrated cities like Vancouver and Toronto?

4. Canada's unemployment rate hits 6.4% (up +0.2% from the month before) as there is simply not enough jobs to go around. Young workers (age 18-25) and new immigrants are bearing the brunt. The glaring difference was seeing the widening gap between annual population change (+8.4%) and the employment (+6.7%).

5. The new BC tenancy policy is now in full effect, with the most obvious and head-scratching change being that owners (Sellers) will need to provide 4 months (previously 2 months) of notice for the new Buyer to occupy the home. This will surely have a negative impact on tenanted properties for sale. Why? Firstly, most Canadian bank mortgages have a maximum of 3 months of pre-approval period. That means within that 3 months, the deal has to close. Now that if it takes more than 4 months for the Buyer to close and move in, the pre-approval would have lapsed and had to be resubmitted, causing delay and confusion. Secondly, 4 months is a long time to close a real estate transaction, especially when the market can really turn. I have recently been hearing many of my colleagues say their Buyers are now staying away from tenanted properties.

6. The Vancouver real estate market sales-to-Listing ratio (% of homes sold) is at 17.6% (balanced market), but is dropping at an alarmingly pace. Most evidently would be the single houses segment, where is hoovering close to a Buyer's market. At the same time, the townhouse and apartment apartment are still in a Seller's market but edging close to a balanced market. The summer should bring this ratio further down and tipping the favour further to the Buyer's side.

Here are the 3 highlights for June:

- Total inventory has remain elevated above 13,000 units, marking the highest June inventory since 2019.- The rate cut of 0.25% did not motivate the buyers back to the market, with sales plummeting to similar ranges back in 2019.

- After 6 months of price gains, June saw the first month of price drop at -0.4% (May's price growth was +0.8%). Expect the negative price growth to continue in the near future as inventory piles on.

Here are the in-depth statistics of the June:

- Last month's sales were -23.6% below the 10 year June's sales average.

- Month by month residential home sales dropped by -13.1% from May 2024.

- Month by month new home listings decreased by -11.2% compared to May 2024.

- Last month's price dropped -0.4% compared to May 2024.

- Sales-to-listing (or % of homes sold) ratio is 17.6% (compared 20.8% in May 2024). By property type, the ratio is 13.1% for single houses, 21.1% for townhouses, and 20.3% for apartments/condos.

Download June 2024 Vancouver Real Estate Report

Single House Market

For the month of June, the areas with the most price gains are in mainly in the outskirts such as Bowen Island, Sunshine Coast and Whistler, at +7.1%, +2.2% and +1.9% respectively. Conversely, the neighborhoods registered the most significant price drops are Tsawwassen, New Westminster and Ladner, with -4.6%, -2.7% and -2.2% respectively. The detached home market remains in a balanced market but is near the borderline of a Buyer's market, with average days on market increasing to 31 days (compared to 26 days last month), and month-to-month average price remained nearly flat at -0.1% (compared to +1.6%% last month). Sales-to-listing ratio (% of homes sold) dropped to 13.1%. (compared to 16.8% last month).

Townhouse Market

For the first time in a long time, the townhouse market saw the most significant price drop (-0.6%) among all property types last month. This definitely came as a surprise as the townhouse market, similar the single house segment, has strong holding value with relatively high demand. However, we saw that changed in June as townhouse inventory accumulate to a point where it's edging close to a balanced market. Note that multiple offers are still happening on good townhouses, no matter where the location is. The ironic thing is, some of these multiple offers were not even intended: it just happened that more than one buyer jumped on the good townhouse at the same time. This tells me that the townhouse Buyers are ready and willing, and is just waiting for the right home to come on. It's been a while since the townhouse Buyers were afford the time to choose, and if you are one of them, I would recommend to act in the next 3-4 months. This segment has a tendency to pick up the heat quickly once the market roars back. With more interest rate cut on the horizon (next 3 months), I would suspect the townhouse market will be the first to bounce back, and may do so with the most ferocity.

In June, the areas with the most townhouse price growths were all in Burnaby, with Burnaby East, North, and South registering +3.5%, +2.9% and +1.1% respectively. Conversely, the neighborhoods with the least price growth are all in the outskirts (ironically the exact reverse of the single house trend) with Whistler, Sunshine Coast and Pitt Meadows, at -3.7%, -3.2%, and -3% respectively. The townhouse market has remains in the Seller's market but is shifting very close to a balanced market, with average days on market dropping to 21 days (compared to 24 days last month). Month-to-month sale price dipped slipghtly by -0.6% (compared to +0.9% last month). Sale-to-listing (% homes sold) ratio remain the best among all segments but dropped to 21.1% (compared to 25.1% last month).

Apartment and Condo Market

After months of policies (ie. AirBnb ban, capital gains tax increase) that disrupted that apartment market which consists of many mom-and-pop investors, we are starting to see the dust settle a bit last month. Of all the property types, apartments were the only segment that had a slight drop in total inventory. Recent policies launched in July are likely to be the most disruptive to apartments, namely the new "extended" BC tenancy occupancy time frame. In short, this policy now requires owners (Sellers) to give the tenant 4 months notice (previously 2 months) for the new Buyer to occupy the home. Note that the apartment market, with many retail investors, have tenants in place. Thus, extending the tenants to 4 months to move out is simply wrecking more havoc and uncertainly. For example, major Canadian banks have a 3 month closing time for mortgage pre-approvals. That means the transaction need to close in 3 months from approval, while the 4 month tenancy stay would stretch beyond that. I feel that this was another policy change that the government had drawn up on the back of a napkin, without consulting the real estate profession. The market is already reacting, with more Buyers staying far far away from tenanted property. I expect the apartment scene to the most chaotic and polarized segment going into the second half of the year.

For the month of June, the best performing neighbourhoods for apartments are Ladner, Tsawwassen, and Port Coquitlam, posting +4.1%%, +3.4% and 1.2% respectively. Conversely, the areas with the most significant price drops were all n the outskirts in Squamish, Sunshine Coast, and Whistler, with -4%, -3.6% and -2.7% respectively. The apartment and condo segment have remained in the Sellers market but again hoovering around the balanced market, with average days flat at 24 days (same as last month). Month-to-month sale price growth continue to dip into the negative territory at -0.4% (compared to -0.3% last month). Sale-to-listing (% homes sold) ratio remained dipped to 20.3% (compared to 22.5% last month).

Here are the Three Trends I'm Observing:

1. Interest-ing

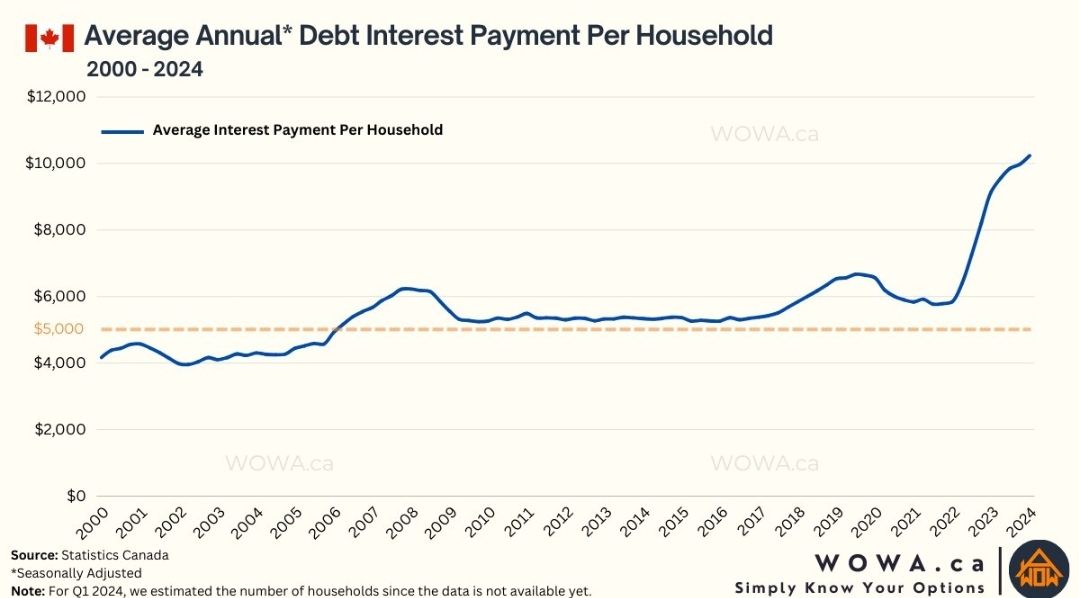

For many years, the Canadian debt interest payments bounced between $4000-$6000, and then BOOM in 2022. Now we sit at $10,000. With more Canadian mortgage renewals coming up soon, expect this number to keep rising. If anything, this has got to be the most alarming graph to the Canadian government. (Source: Statistic Canada, Wowa.ca)

2. Chinese Woes

China's economic woes continues, with the real estate sector facing the most head wind as usual. So far in 2024, the second hand resale home prices fell 7.9% and was widespread in 70 cities. Would this have knock-on effect on some Canadian cities, like Vancouver and Toronto, where there are higher concentration of Chinese population? My guess is that the premium homes may take a hit, but the average home would be spared. (Source: National Bureau of Statistics, Bloomberg)

3. Mommy and Daddy Bank

It's no surprise that when the real estate prices have skyrocketed since the pandemic, parents would step in and help their kids with generous gifted downpayments for their kids' home. According to the Financial Post news report, the size of that gift has ballooned up to $204k in BC, and approximately 31% of those Buyers got family's help. However, I do feel that number is way higher, perhaps over 75%. Don't worry, Mommy and Daddy bank are coming to the rescue. (Source: Financial Post)

Recent Posts