Real Estate Market Intelligence June 2024

Real Estate Market Intelligence

June 2024

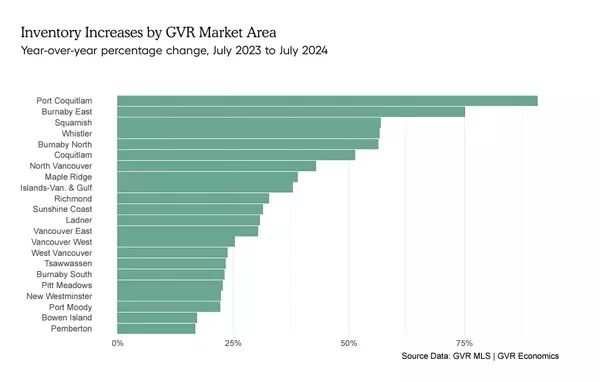

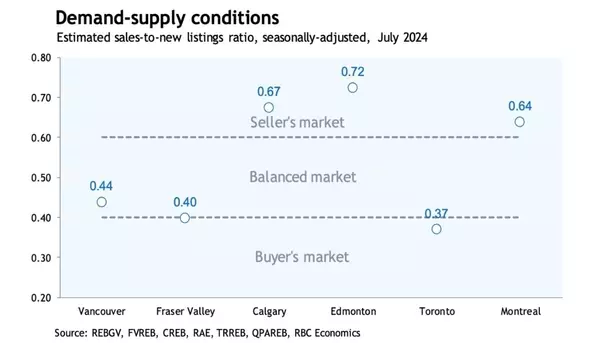

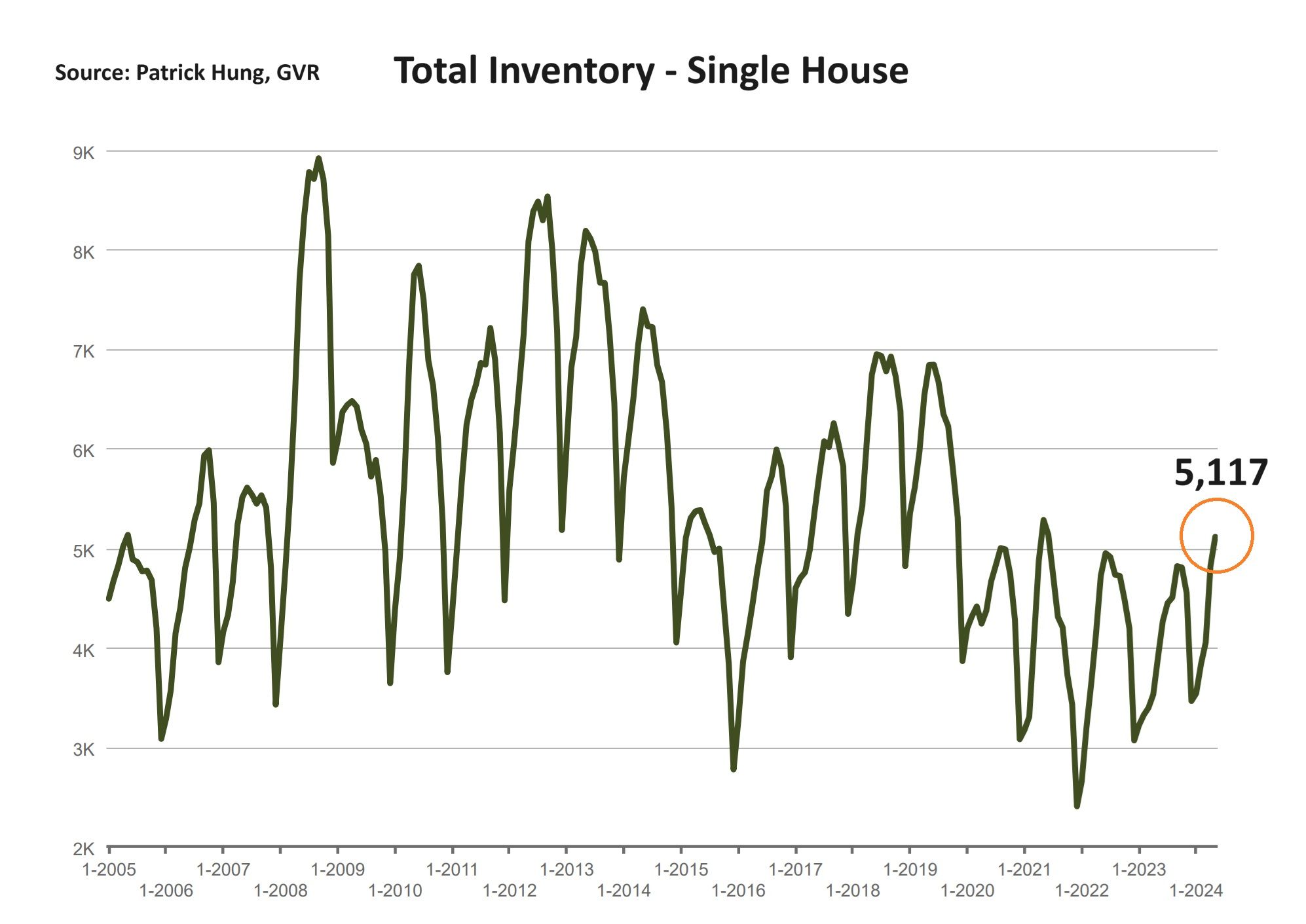

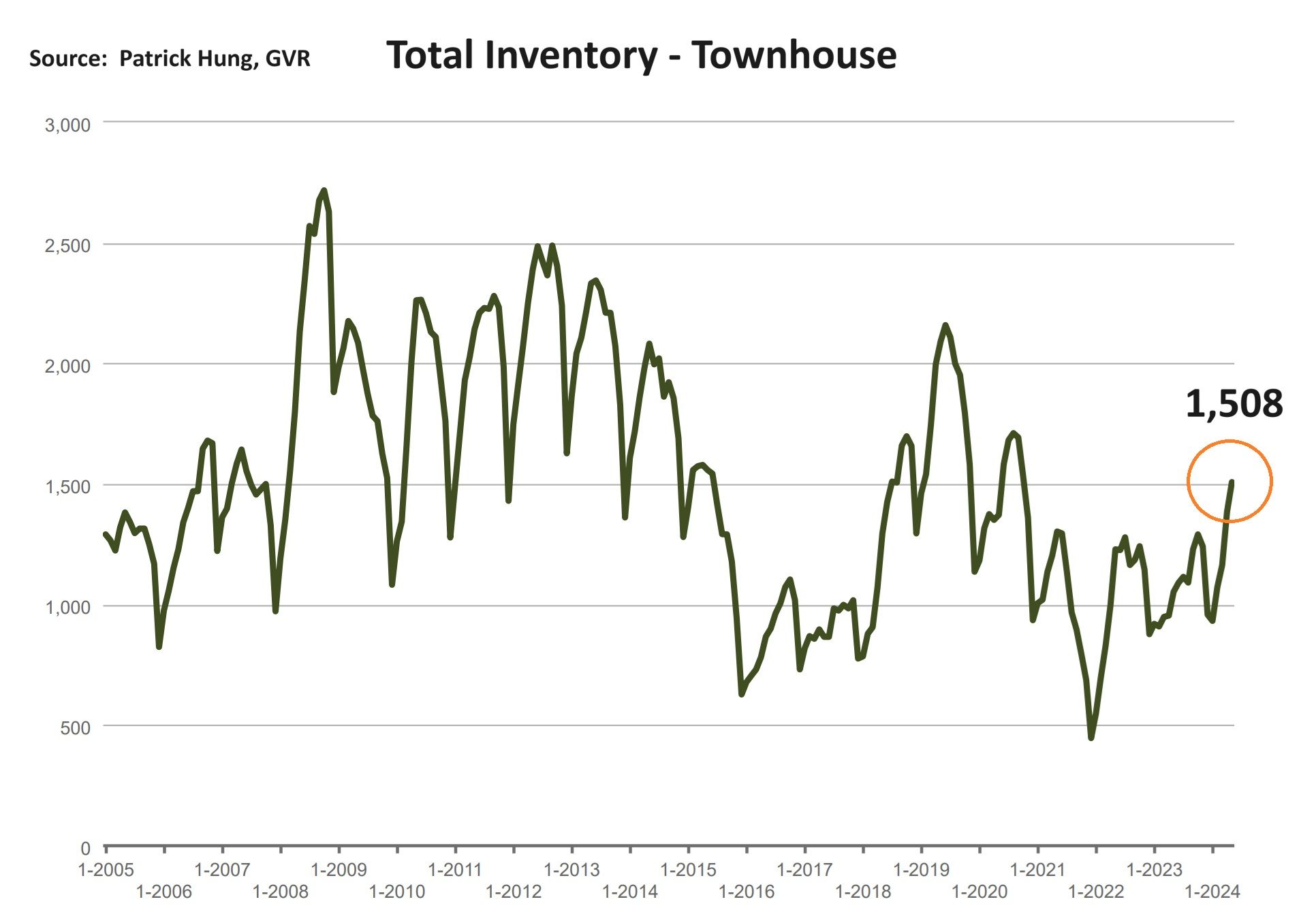

It may be spring weather in Vancouver, but the real estate market has definitely entered into the early Summer dull-drum and suddenly facing the double whammy of increased inventory and less sales. To put it into perspective, this past May's total inventory is 13,026 units, which is the third highest inventory for the month in the past decade, coming only behind May 2014 (17,737 units) and May 2019 (15,553 units). For so long, the Vancouver real estate has been facing an under supply issue (and still is), but the sudden surge of inventory has caught nearly everyone by surprise, from Sellers to Buyers and realtors. On top of that, everyone is interpreting this in their own ways, and that just shows how polarized the current market is. Some Sellers are stuck in the the market 3 months ago, when tit was roaring, while Buyers are already in 3 months ahead, where summer is ending and most people are on vacation. Demand and sales continue to go in the opposite direction, and last month's sales were the lowest for the month (except for May 2020, during the pandemic shutdown) in over 20 years! Many questions were raised, such as "Where are there suddenly more lookers than Buyers?" and "What should I do when I sell now with so much competition?" The market is still trying to figure itself out, and Buyers, Sellers, and realtors need time. For Sellers, the two groups are evident; those with no urgency (money & time constraints) continue to wait out the market, while cash strapped Sellers are willing to take a hit and cut loose. For Buyers, many continue to wait on the sidelines as mortgage rates remain relatively unchanged, even with the recent rate cut of 0.25% (more on this later). As for realtors, the productivity is slowing too as the increase in inventory and decreased in sales mean they are spending more time on each sale, and thus is spreading themselves thin with each Buyer and Seller taking longer to transact.

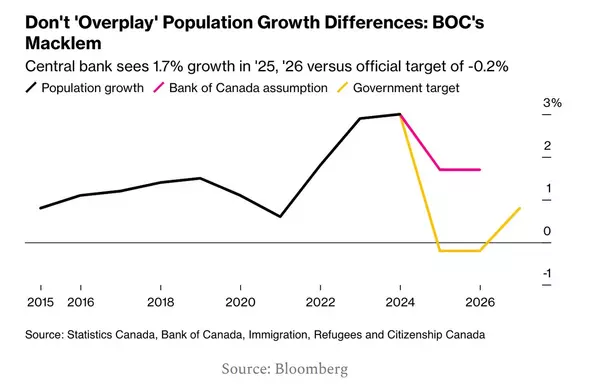

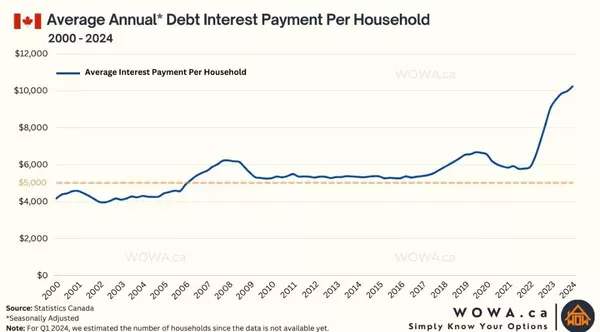

On the economic front, the Bank of Canada has finally announced its first rate cut of -0.25% in the last four years. There was quiet celebration in the market, especially this is the signal of the beginning of a rate cut cycle. I personally believe the rate cut is more psychological than practical. Fundamentally, not much has changed, and a -0.25% perhaps only shifted the Buyers sentiments by a little bit. Keep in mind that Canada's fixed mortgage rates is is dependent on the bond rate, not the overnight rate. Also, the variable rate is still too high to many Buyer's liking. So, the mortgage scene has not been affected yet. In my opinion, it will take at least another -0.75% rate cut in order to see a clear shift in demand and Buyer sentiment. The key question is, how long will we take to get there? Maybe 6-9 months, or more? Also, the Canada market is also highly dependent on the US, so if we continue to cut rates and the US does not, the divergence would kill the Canadian dollar, and a weak exchange rate means higher inflation for Canadians. The general consensus now is that the Bank of Canada has about 0.75% of rate cut wiggle room before the US cuts, so be prepared and brace yourselves for a weaker exchange rate in the near future.

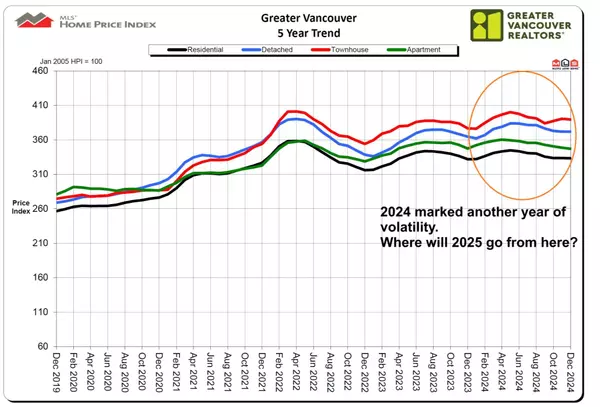

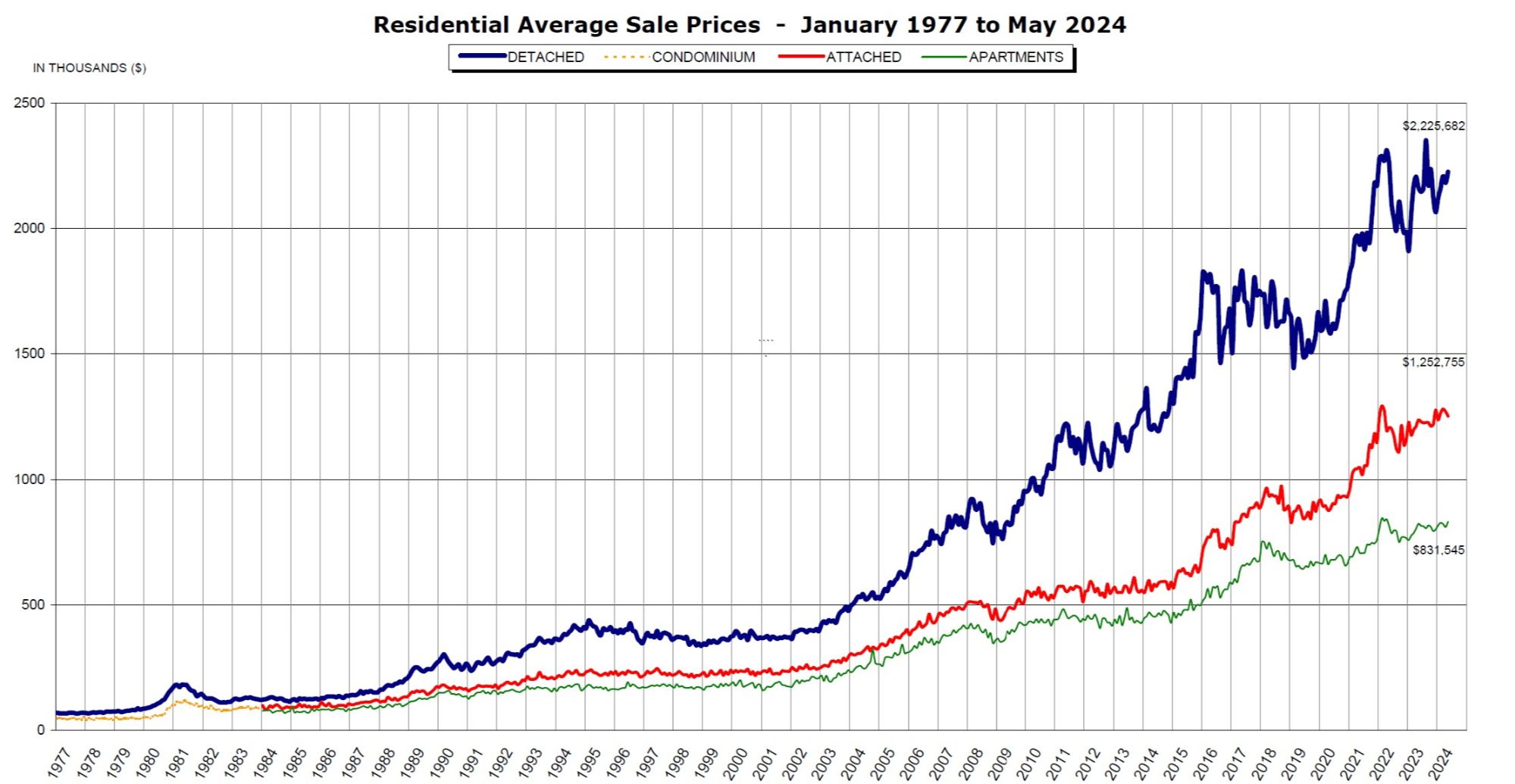

The current Vancouver real estate market reminds me of the summer 2022, when the Bank of Canada began the rate hike cycle of +1% in one go, and that sent the market into the sudden freeze. Just now we are on the other side of the spectrum, the beginning of the rate cut cycle, and we are still seeing the same effect. The difference is that that last cycle had Sellers holding for the past two years, and the current cycle is seeing Sellers coming onto the market. An important fact to consider is that the current Vancouver real estate price is drawing closer to its all time high set in March 2022. With inventory on the rise (and if it continues to rise), we should see the price growth slowing very soon, with the possibility of a minor downward correction in the upcoming months. Buyers still consider prices are too high, and that is valid point. It certainly will take a few more rate cuts to get the Buyers comfortably to return. When that happens, there should be plenty of inventory for them to digest. For now, the shift back to a balanced market may be painful for some (mostly Sellers), but I do believe it's a welcoming change. This summer's real estate market should be a slow one, but will continue to be volatile with the rate cut in the back drop. Keep an eye out for the July rate announcement, and enjoy the early summer weather.

Some of the unique trends I've been observing:

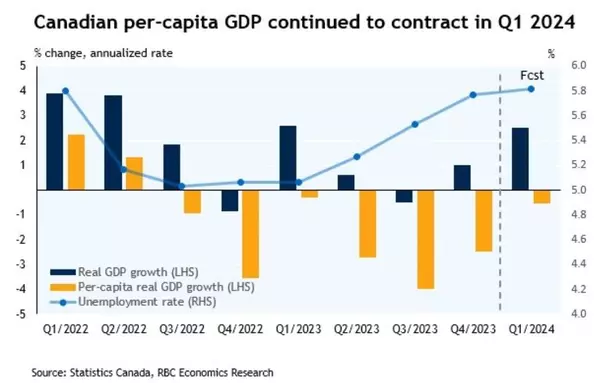

1. Canada's May unemployment rate went up to 6.2% (+0.1% from April), while the US's unemployment rate increased to 4% (also +0.1% from April). If we dig deeper into Canada's report, there are actually more part-time jobs because job seekers couldn't find better options. Sectors such as health care and finances see a rise in employment, while the construction sector is getting hit hard.

2. The double whammy for Vancouver real estate has finally happened. For the month of May, supply is +19.9% above the 10 year average, while demand is -19.6% below the 10 year average. When we combine the two, we have a realized 39.5% difference. Market is shifting, anyone?

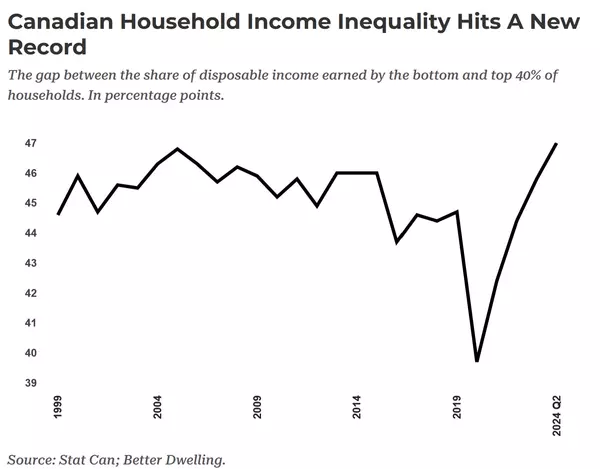

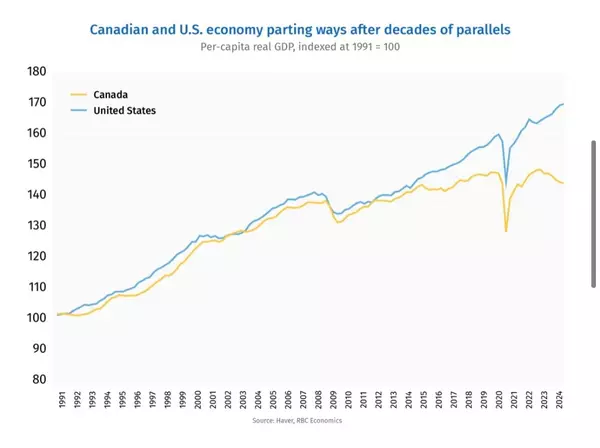

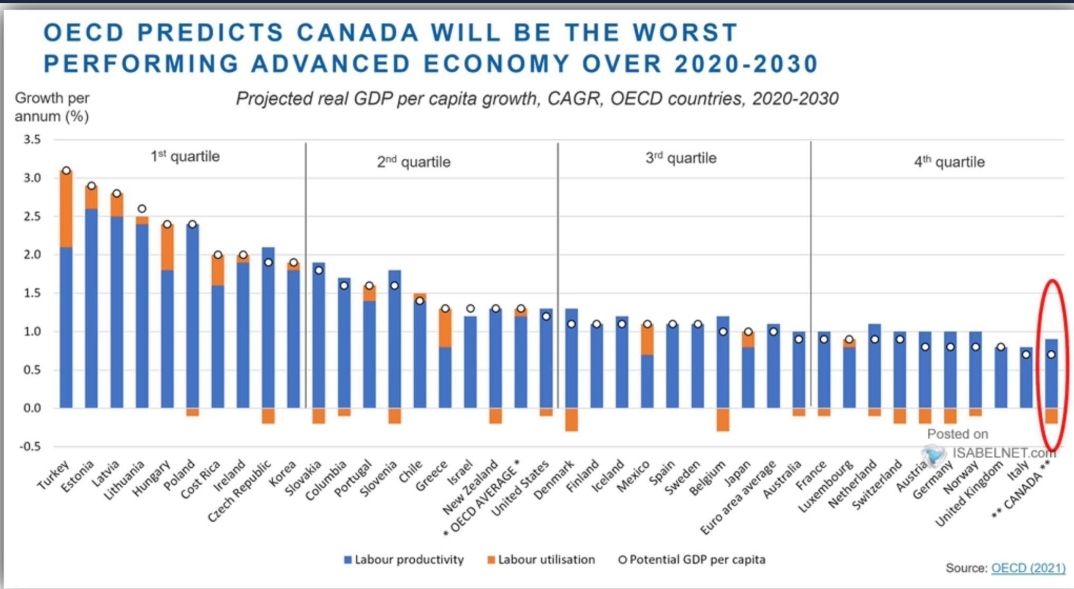

3. Canadian productivity has been low and stagnant for the past 10 years (aka "The Lost Decade".) Combine that with the newly introduced capital gains tax increase to 66.7%, and it's not difficult to see why foreign investments are leaving Canada to the US. Unless there are any drastic changes from the federal government, we should expect talents and investment to continue outflow from Canada in the years ahead. Sadly, OECD (Economic for Cooperation and Development) states that, among 37 developed countries, Canada is expected to be the worst performing advanced economy between 2020-2030. Canada's economy seem to be only driven by housing and energy (gas), and simply does not have a competitive edge on the global stage.

4. Average asking rent in Canada has reached a record of $2,022 in May, which is up +9.3% from a year ago and +0.9% from a month ago. looking deeper into the report, we see the rent growth happen mainly outside of major cities, such as Vancouver and Toronto (where rent has actually dropped by -3.3% and -1.2% respectively over the past year). Either it's buying or renting, the Gen Z (age 12-27) and Millennials (age 28-43) continue to move away from big cities and into the other more affordable provinces or suburbs.

5. The BC province wide single house zoning to multi-plex policy cutoff date is right around the corner, with each municipality required to submit by end of June. Cities such as Burnaby has been embracing the plans with huge changes in favour for multiple family, while North Vancouver has decided to opt-out of the program. And then there's Richmond, where the municipal government is opposing partial of the change and may be willing to go to court with the provincial government. As these stories continues to unfold, the city of Burnaby has thrown a curve ball into the development game, implementing a developmental for high density by nearly $50k per unit this year. That's nearly 10% of the price of a 1 bedroom condo! I couldn't help but notice the lies from politicians promises about affordability and housing. On one hand, they approve laws to build more homes and try to solve the problem. On the other hand, they continue to implement more taxes to drive up both the construction costs and home prices.

Here are the 3 highlights for May:

- Total inventory has surpassed 13,000 units, marking the third highest inventory May since 2014 and 2019.

- The weak demand continues to drag on, and Buyers remain on the sidelines for much longer. The waiting game continues while inventory piles up.

- May continue another month of home prices growth of +0.5% (April price growth was +0.8%). Price continue to level off as inventory rises, and again this was most evident in the apartment segment.

Here are the in-depth statistics of the May:

- Last month's sales were -19.6% below the 10 year May's sales average.

- Month by month residential home sales increased by -3.8% from April 2024.

- Month by month new home listings decreased by -10.8% compared to April 2024.

- Last month's price growth was +0.5% compared to April 2024.

- Sales-to-listing (or % of homes sold) ratio is 20.8% (compared to 23.5% in April 2024). By property type, the ratio is 16.8% for single houses, 25.1% for townhouses, and 22.5% for apartments/condos.

Download Real Estate Market Report May 2024

Single House Market

The single house market is in a mixed bag right now, combining opposing forces of rising inventory (+5.8% last month) and strongest price growth (+1.3% last month) among all segments. So what do these two forces feel like with boots on the ground? For reasonably priced single houses, open house traffic are still plentiful, especially for those that's under $1.8m in Vancouver, Burnaby, Richmond and Coquitlam. Buyers are aware that land remain scarce in central locations, and is willing to move only (and only) when Sellers are within reason. Multiple offers occurring mainly for homes under that range of $1.8m, but the number of offers dropped to only 1-2 offers, to some even having none. There are still Buyers out there, but there are certainly more lookers than takers. As for homes that are not sharply priced, they are sitting on the market for much longer, and Sellers may either elect to price cut, or hold firm to expire and wait till the next upturn cycle. Keep in mind that 50% of homeowners in Vancouver has no mortgage, so time (and money) is not or urgent concern to them. I personally believe that is the exact problem with Vancouver housing market, that there is just too much equity rolled into the home (tax free) that shelters the homeowners, with little or no mortgage, from selling. These house-rich owners will continue to sell when they want to, not when they need to. Noteworthy is that the premium market for homes over $4m has seen 242 sales since for the past 6 months. From the top down, that shows me the confidence in the Vancouver market is still there, just that we are going through a transition at the moment.

For the month of May, the areas with the most price gains are in West Vancouver, Burnaby South and Buranby East at +3.1%, +2.8% and +2.7% respectively. Conversely, the neighborhoods registered the most significant price drops are in Pitt Meadows, Tsawwassen and Ladner, with -1.2%, -0.6% and -0.1% respectively. The detached home market remains in a balanced market for the 3 months in a row, with average days on market dropping slight to 26 days (compared to 32 days last month), and month-to-month average price continue to climb by +1.3% (compared to +1.6%% last month). Sales-to-listing ratio (% of homes sold) remains relatively unchanged at 16.8%. (compared to 17.6% last month).

Townhouse Market

For the first time in a long time, the townhouse market sees an increase in inventory with less sales. Traditionally, townhouse has always been the "next best thing" besides owning a single house, but perhaps this segment is losing steam too due to to the fact that townhouse prices has elevated to a point where it's out of reach of the average family. Last month's townhouse price growth of +0.9% was coincidentally wedged between apartments (-0.3%) and houses (+1.3%). Sales of townhouse in core Vancouver is drifting behind that of the Fraser Valley, and this is evidently due to the affordability among younger Canadian families looking to upsize. It is not difficult to see why; a brand new townhouse in Langley is approx $950k, where such product in core Vancouver is $1.7m. The most obvious difference is that Fraser Valley (especially Langley) has am abundance of townhouse supplies, whereas Vancouver remains historically low. The golden rule of location plays a key role here, and so does prestigious Vancouver school catchment for those parents who care. Due to the widening price gap, more families will continue to choose Fraser Valley townhouses over Vancouver, and not because they want to, but that's what they can afford.

In May, the areas with the most townhouse price growths were mainly in the outskirts in Whistler, Sunshine Coast, and North Vancouver at a +3%, +2.9% and +2.8% respectively. Conversely, the neighborhoods with the a least price growth are in Burnaby East, East Vancouver, and Burnaby South, at -0.9%, -0.8%, and -0.7% respectively. The townhouse market has remains in the Seller's market, with average days on market edging up slightly to 24 days (compared to 20 days last month). Month-to-month sale price climbed marginally by +0.9% (compared to +1.3% last month). Sale-to-listing (% homes sold) ratio remain the best among all segments but dropped to 25.1% (compared to 31% last month).

Apartment and Condo Market

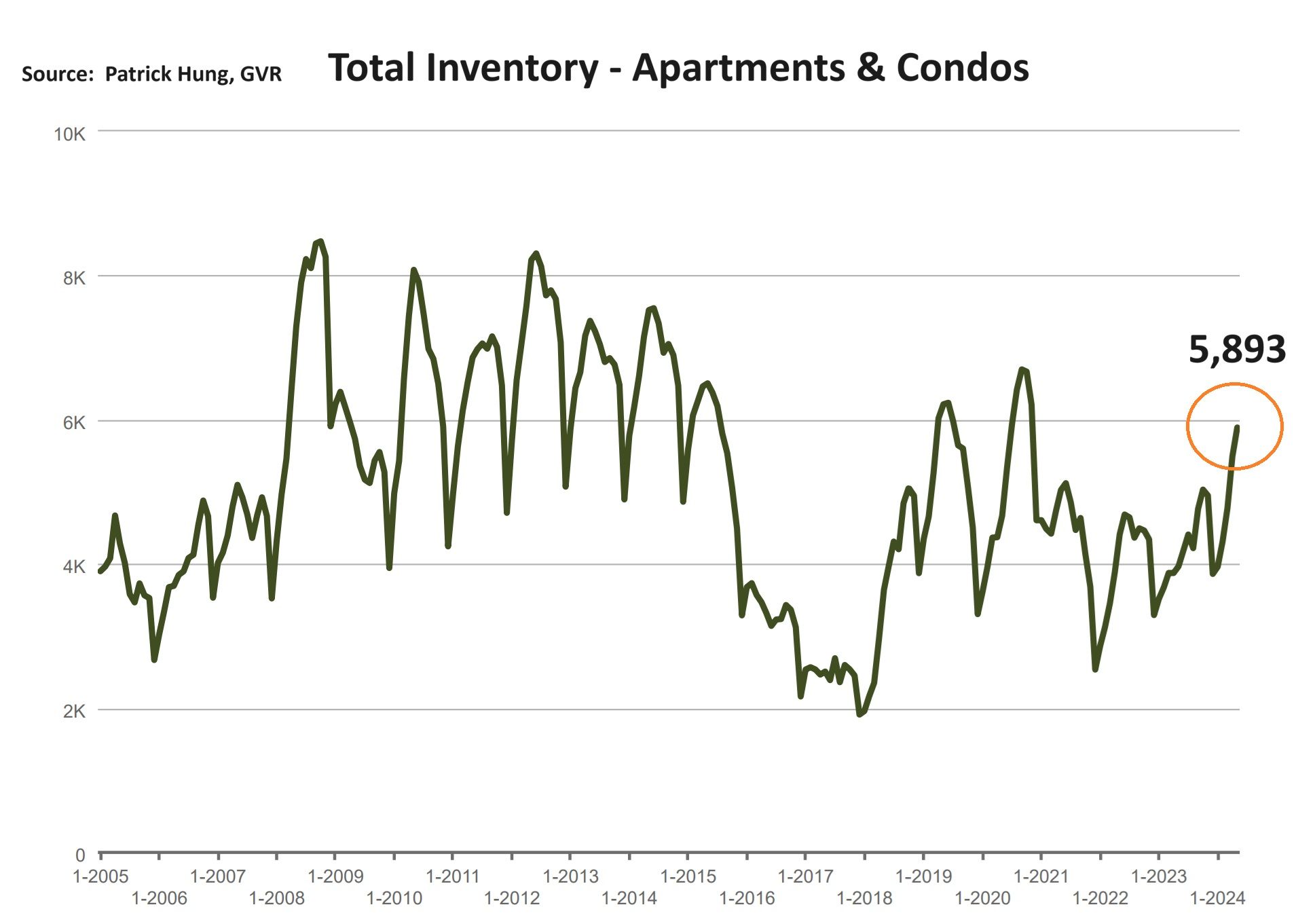

The apartment market has been hardest hit segment this Spring, with the sharpest rise in inventory and very sluggish sales. May continues to see more new apartments flooding the market, thanks in part to either retail mom-pop investors liquidating, former Air BnB units jumping ship, or mortgage renewal stress sales. This has caused another month of negative price growth (-0.3%) for apartments, and this trend look to continue into the early summer months. With the recent rate cut, the first time home buyers remained firmly on the sidelines basically due to their pre-approved mortgage rates (fixed rates) also remained the same. In other words, the rate cut has not made things more affordable yet. As for Sellers, some are still living in a market 3 months ago, where there were much more bids and less inventory. I suggest apartment Sellers to assess their situation and the market closely. If they are serious about selling, either price their home sharply so it becomes the benchmark of the building, or else another Seller will set the benchmark for you. This change in scenery is definitely a hard pill for for apartment Sellers to swallow, so there seem to be more listings sitting than selling. Either way, if the rates come down to the certain level, the apartment market should return as first time home buyers and investors would come back roaring, and by then, there should be more plenty of inventory to digest. Noteworthy is that entry level apartments under $600k in Greater Vancouver remain active, while 2 bedrooms over $850k are taking longer and longer to sell.

For the month of May, the best performing neighbourhoods for apartments are , Port Moody, Richmond and West Vancouver, posting +1.6%% and +0.5% (tied for 2nd and 3rd) respectively. Conversely, the areas with the most significant price drops were Tsawwassen, Whistler, and Ladner, with -2.1% & -1.9% and -1.5% respectively. The apartment and condo segment have remained in the Sellers market, with average days on nearly flat at 2 days (compared to 25 days last month). Month-to-month sale price growth continue to dip lipped into the negative territory at -0.3% (compared to -0.3% last month). Sale-to-listing (% homes sold) ratio remained dipped to 22.5% (compared to 26% last month).

Here are the Three Trends I'm Observing:

1. See You Later

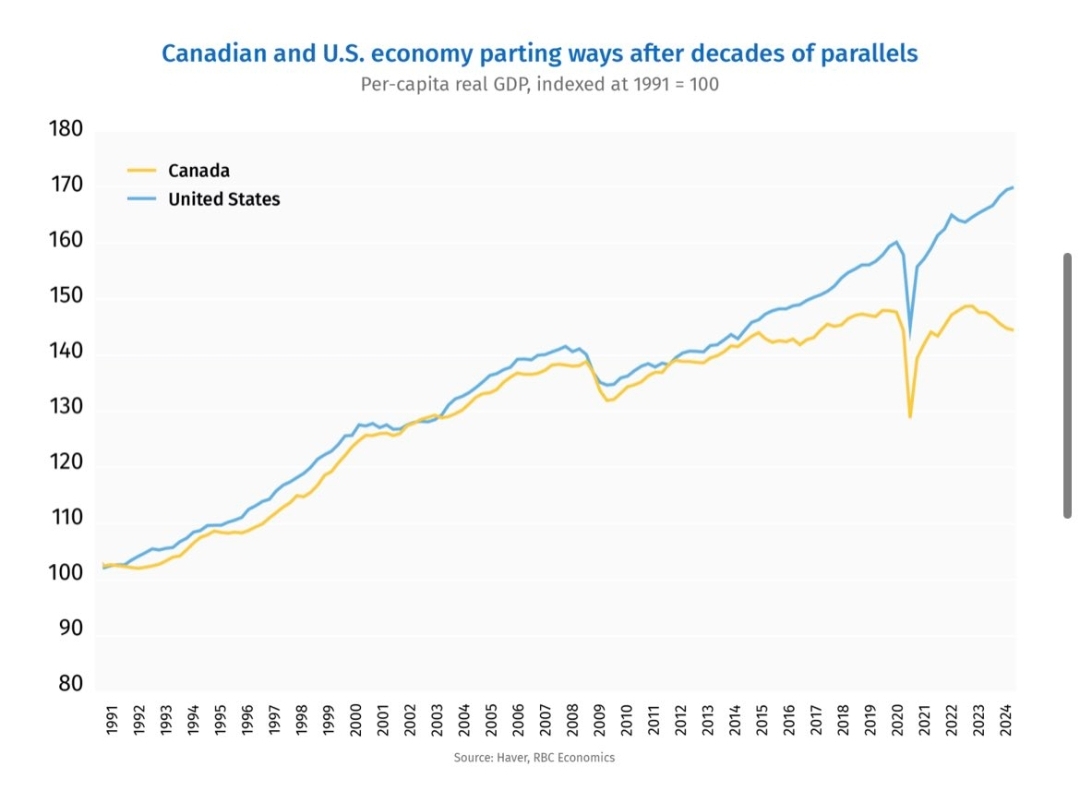

For decades, Canada and the US has been in lock-step for per-capita real GDP growth. But something changed 9 years ago, and the Canadian economy and the US parted way since then. The gap widened the most after coming off the pandemic in 2022-2023. Note that the divergence started back in 2015, which somehow coincided with Justin Trudeau's government taking over the reigns in November of 2015. (Source: Haver, RBC Economics)

2. Thanks for Trying

Back in 2021, the OECD (Organization of Economic Cooperation and Development, a unique forum among 37 developed countries to collaborate on economic policies) predicted that Canada is dead last on performance in advanced countries. Perhaps they saw something that we missed? Recent reports of Canada's low productivity and self-crippling rise in capital gains tax confirmed the OECD theory that Canada is definitely losing its competitive edge on the global stage. Even when we take on over 1 million immigrants last year, I have been hearing stories that living standards are too tough for these new immigrants and they're either heading back to their home country or to the US soon. Talent and investments are out flowing from Canada at a pace we've never seen before. (Source: OECD)

3. Rent of Two Tales

The average asking rent in Canada has reached a record of $2,022 in May. Major cities such as Vancouver and Toronto remain in the top 3, but their rent has dropped (Vancouver by -3.3% and Toronto by -1.2%) compared to last year. Meanwhile, the Prairies region such as Edmonton, Regina and Saskatoon has seen a spike in rent (+14.5%, +15.5%, and +13.9% respectively). When one rent goes down, the other rent goes up. (Source: Rentals.ca)

Recent Posts