Real Estate Market Intelligence October 2024

Real Estate Market Intelligence

October 2024

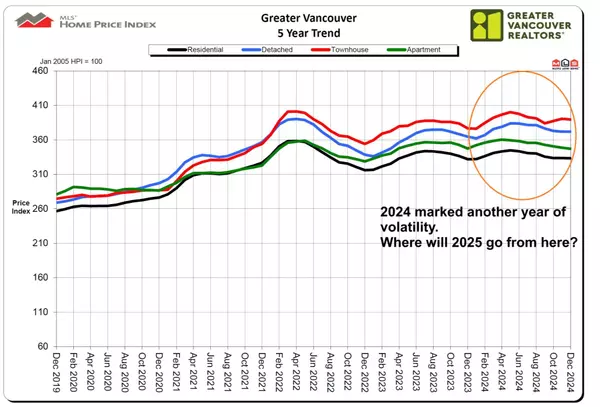

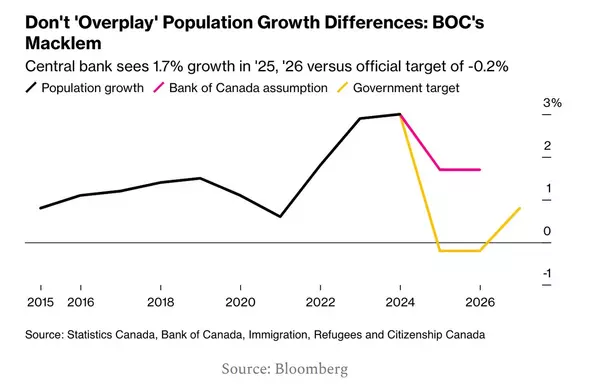

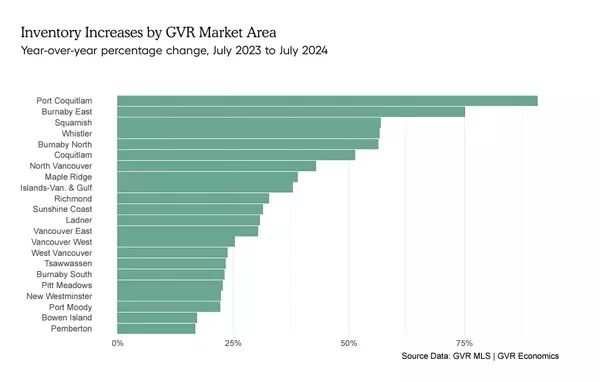

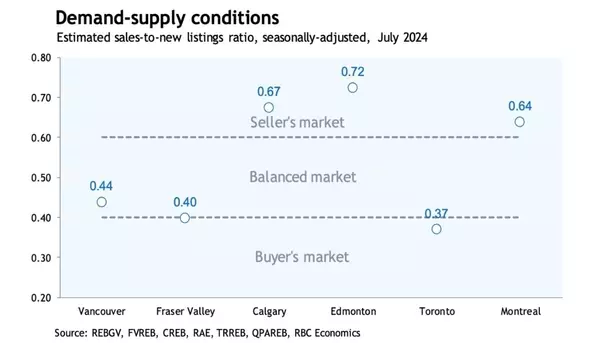

Fall has fallen and the wreath of foliage has adorned the streets. As the weather turns much cooler, the Vancouver real estate experienced a phenomenon of the decade: last September had the highest inventory (14,496 units) for the month since 2014. It was also +16.7% above the 10 year average. At the same time, despite the Bank of Canada continual rate cuts and the US Feds jumping onboard with a jumbo 0.50% cut, it has still failed to reel Buyers off the sidelines, with the September sales coming in at -26% below the 10 year average. As the opposing forces continue to pull harder, so the market continue to stretch with Buyers and Sellers views polarizing further. This may seem puzzling but when we look back only a year ago, in 2023, the Vancouver real estate market was in a under-supplied market, and at one point the inventory was the lowest in 20 years. Rate were elevated back then, but Sellers weren't selling. Fast forward to now, we have a healthy housing supply and highest inventory in a decade, yet Buyers aren't buying. Confusing? Indeed, and I think the answer is multi-fold.

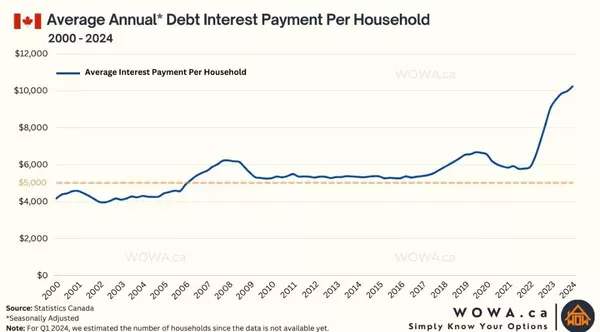

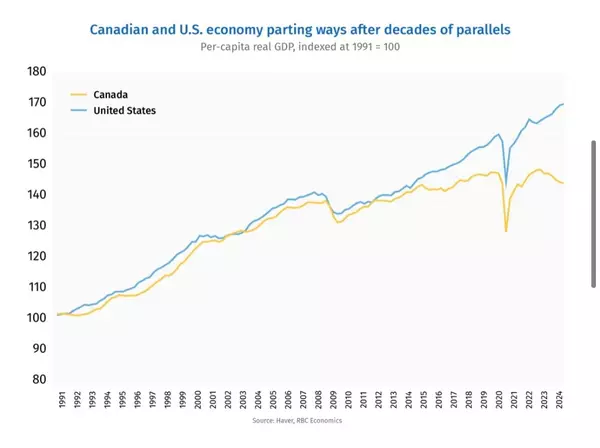

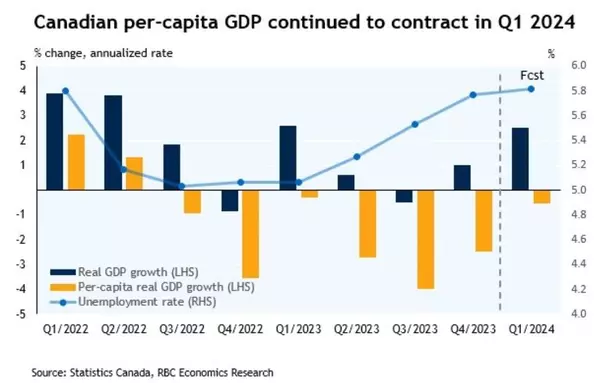

Firstly, the typical Canadian real estate prices has had a long history "going up fast, coming down slow." This mainly has to do with Sellers motivation, whom have purchased 5, 10, or 15 years ago, and they have built enough equity into their home that they can weather any short term downfalls. I've reiterated before that these Sellers sell when they want to, not because they have to. As for Sellers (or investors) who have to sell, they may be an estate sale (inheritance) who are looking to cash out, or over-leveraged investors who can no longer hold on. Thus, the prices on the way down is usually sticky. Secondly, the lagging effect of interest rate cuts / hikes are taking much longer to filter through the economy. Back in 2022-2023, most economist predicted that higher interest rates would cause inventory to rise. That didn't happen. Sellers were patient as some of them had locked in their rates. Again, fast forward to now with rates coming down, and most economist predicted that second half of 2024 real estate market would pick up as lower rates would spur activity. Now that didn't happen either. In fact, we saw the exact opposite. Ever since the pandemic, many traditional prediction methods are off, and more contrarian theories arise. Thus, it is possible that the prices may be flat for the next 12 months due to the healthy supply, and Buyers may still not come off the sidelines as prices remains elevated and affordability remains weak, despite rates dropping further. Thirdly, the Canadian economy is still weak, with unemployment rate at 6.6% (and rising), and 1 in 20 Canadian business have shut down (worst since pandemic). If the average household is concerned about keeping their jobs and putting food on the table, then real estate is really just an afterthought.

As we edge towards the end of the year, and with two more rate cuts on the horizon, just how much these cuts will move the needle in real estate? I believe it won't have too much of an effect based on recent statistics and trends showing sales trending around -26% below 10 year average. For Sellers, most were optimistic about next Spring, but again what if the prices remain flat till then? For Buyers, perhaps the true question remains around affordability, and unless a huge price correction occurs, some will remain on the sidelines no matter how deep the rate cuts are. With the latest September inflation rate coming in at 1.6% (mainly driven by lower gasoline prices), all indicators now point to the Bank of Canada's anticipated rate cut of 0.5%. Let's see.

Some of the unique trends I've been observing:

1. Canadian business are shutting down at a frightening speed, with seasonally adjusted data showing 46,354 business closed in June. This is the largest scale of business closure since the pandemic in 2020. What is more worrisome is that business closure and unemployment rate tend to have a downward spiral effect. For example, when businesses close, unemployment rate goes up. People spend less as they lost their jobs, and causing more businesses to close. Are rate cuts the answer to help Canadians climb out of this hole?

2. The US Fed's jumbo rate cut of 0.5% in mid September has surprised many (myself included). Structurally, the US is in a much better condition than Canada, and for them to cut 0.5% most likely mean they already see financial cracks (possibly global) that is deteriorating at a faster pace than expected. Having said that, the currency devaluation (increasing money supply and lower value of cash) is spurring the NASDAQ to hit all time high recently. It would be interesting to see if real estate be the next investment option.

3. In another political move, the Canadian government has increased the uninsured mortgage limit from $1m to $1.5m, and also expanding the 30 year amortization period to first time home Buyers. Just when the government is saying they are helping young families with affordability, keep in mind that this "uninsured" mortgage limit increase will most likely get the Buyers' parents to co-sign on it, and not the mention the high monthly mortgage payment that will sure cripple the family's spending. The government is encouraging those to risk it all to own a home, while having a hard time putting food on the table. Binge on debt, they recommend. Simply put, the true solution to providing affordability is providing more new housing supply and not further stoking demand.

4. Much in line with the trend in the past few months, the September Vancouver real estate market continue to face more supply (+16.7% above 10 year average) and substantially less sales (-26% below 10 year average.) Last month's sales count was the lowest of the year since January 2024, and is the fifth consecutive monthly decline. Detached homes sales were performing the worst, with condos and townhouses following. In general, the Greater Vancouver market fell into a Buyer's market for the first time since April 2020 (pandemic shutdown), with 8.1 months of inventory. Detached homes make up most of that scale, with 11.4 months of inventory. Apartment and townhouses segments are considering in a balanced market.

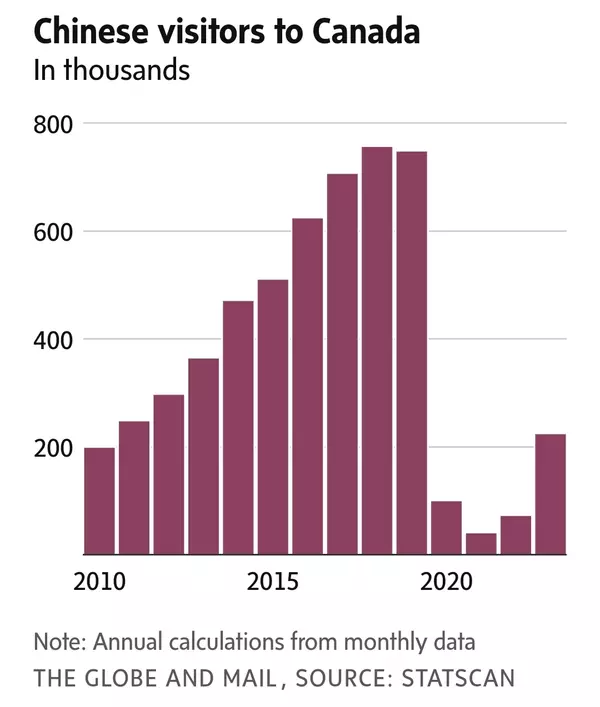

5. The Canadian rental market saw the slowest growth since October 2021, at +2.1% year over year. This was mainly attributed to less foreign students now (half from record high) and the stoppage of temporarily working permit program. Ontario and B.C had the most significant annual rental decline, at -9.5% and -8.1% respectively. Contrarily, the annual asking rent in Saskatchewan surged +23.5%, making it the fastest growing province in Canada.

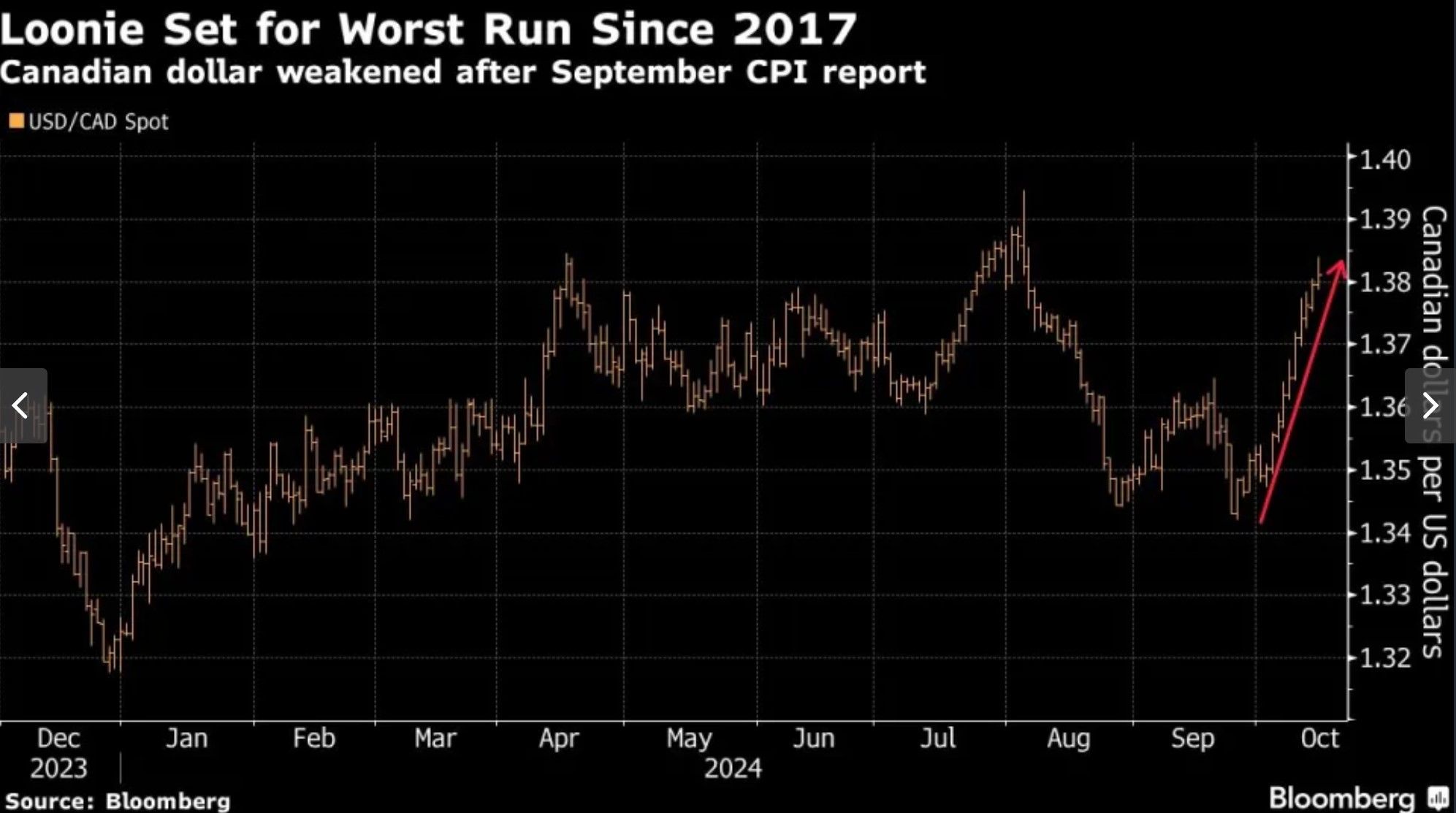

6. The latest September inflation came in at 1.6% and was mainly driven by lower gasoline prices. While this downside surprise was welcoming to many, keep in mind that other indicators of underlying price pressure were held steady. Also, the Canadian dollar took a hard hit (steepest drop in 7 years) from the weak economic data. Tread carefully.

Here are the 3 highlights for September:

- Total inventory has spiked to 14,496 units, which was the highest for the month of September since 2014.

- September sales of 1,838 units was another dismal month, and is the worst for the moth of September since 2018.

- The surge in inventory combined with weak sales has been a steady trend since the summer. This seems poised to continue into the fall and possibly winter.

- September home price saw the most significant annual monthly price drop, at -1.4% (August's price drop was -0.1%). If September was an indicator of what the remaining of the year has in store, then we will most likely see further price drop, and possibly accelerating at a faster pace.

Here are the in-depth statistics of the September:

- Last month's sales were -26% below the 10 year September's sales average.

- Month by month residential home sales remain nearly flat at +1.1% from August 2024.

- Month by month new home listings surged by a whooping +33.3% compared to August 2024.

- Last month's price dropped of -1.4% was the most significant monthly drop for the year. (compared to -0.1% from August)

- Sales-to-listing (or % of homes sold) ratio is dipped further to 12.8%. (compared 14.3%% in August). By property type, the ratio is 9.1% for single houses, 16.9% for townhouses, and 14.6% for apartments/condos.

Download September 2024 Vancouver Real Estate Market Report

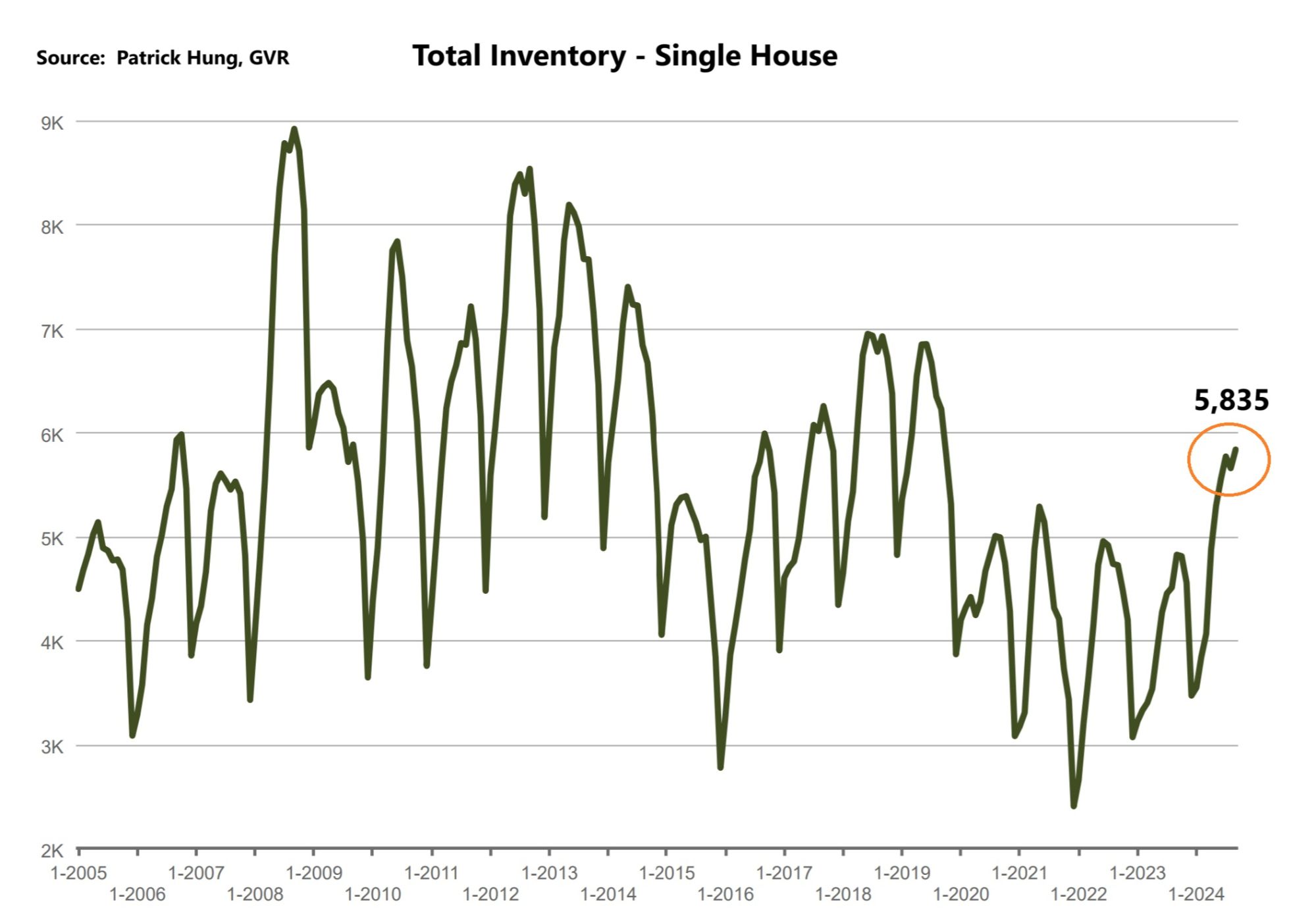

Single House Market

Last month, the single house market feels like it's at a standstill, with sales ratio (% of homes sold) dipping further to 9.1% (compared to 9.6% in August). Monthly price took the biggest plunge of the year at -1.3% (from -0.1% in August). Typically, September is the month where Buyers return to the route and may resume their buying/selling plans. Contrarily to the traditional trend of increased sales in September, we saw sales nearly flat at 518 units (compared to 512 units in August). If summer was dull market, then the fall market for single house looked like a continuation of that. More importantly, the Buyers and the Sellers are moving further apart on price evaluation. For example, even when the Seller's (and their agents) are proactive in pricing their home BELOW their previous similar sold price (for example, a month ago), offers are still coming even lower. This has created this new reality for the Sellers, where they have to continually chase the downward market to make a sale happen, and they feel like they are losing as the months go on. As mentioned, most single house Sellers whom have bought 5, 10, 15 years ago have accumulated enough equity in their home that they do no need to fire sale. Some may choose to hold off till next Spring, where activities may pick up. However, it is also very possible that price may just stay flat till next Spring, albeit there would be more traffic. In other words, the difference is the same. If the fall-winter trend of over-supply continues for single house, I would expect the negative price growth to pick up.

The Canadian's government latest program of increasing the uninsured mortgage to $1.5m may spur activities for single houses priced under that. However, keep in mind that in the Greater Vancouver area, there is very slim pickings for these homes priced under $1.5m, but the Fraser Valley such as Surrey and Langley has much more selection. This program may drive up the demand and price of entry level single houses in affordable neighbourhoods in the Fraser Valley, while the affluent neigborhoods like Vancouver Westside will see little change.

For the month of September, the neighorhoods that registered most price growth are Ladner, Bowen Island, and Port Moody, at +3.1%, +2.8% and +1.8% respectively. Conversely, the neighborhoods registered the most significant price drops are Burnaby South, West Vancouver and Pitt Meadows, with -4.3%, -3.3% and -3.2% respectively. The detached home market continue to dip into the Buyer's market, with average days on market further slight improved to 39 days (compared to 41 days last month), and month-to-month average price took the biggest hit of the year at -1.3% (compared to -0.1% in August). Sales-to-listing ratio (% of homes sold) slipped further to 9.1%. (compared to 9.6% last month).

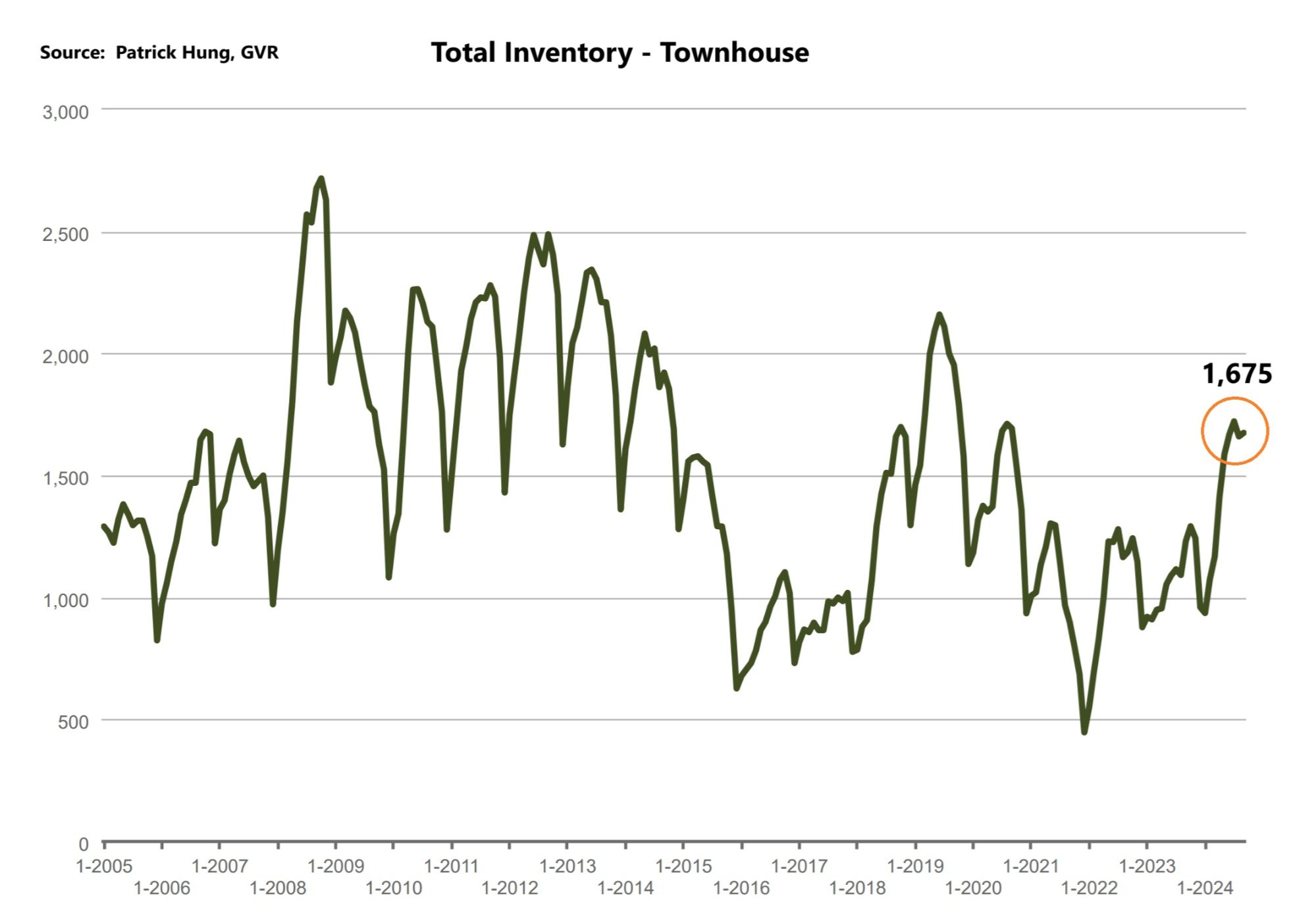

Townhouse Market

For the past few months, the townhouse market has continue to lead the charge in negative price growth, and in September it was no different as it took a -1.8% hit (again the most significant monthly drop for the year.) The ironic thing is, even though September's month-over-month townhouse inventory was nearly flat at +0.9%, the prices came down the most. Underneath the surface, the townhouse has the lowest days on market (29 days), compared to single house and apartment (39 days and 31 days respectively), and the least number of active listings (2,241 units). The townhouse stats do look like the strongest segment of all, but deep down, I believe that its prices are already out of the reach for most Buyers. This is especially true for the Greater Vancouver area, with average townhouse price at $1,099,200. For the same reason, many Buyers are choosing to scoot over to Fraser Valley, where average townhouse price is much more affordable at $834,400. For young families (such as those who just had a baby), the decision to move out to the Fraser Valley is much more financially logical. They can make a lateral movement from selling their Vancouver condo and adding less than $100k to upsize to a Fraser Valley townhouse. I still believe that Greater Vancouver townhouse, which once was dubbed the "next best thing" besides a single house, is simply facing a short term phenomenon. I am a believer that the pent-up demand for townhouse is there, just that once the market activities pick up (whenever that would be), this segment would likely be the first to take off.

In September, the areas with the most townhouse price growths were Maple Ridge, Burnaby North and Richmond, and registering +0.8% & +0.5% (tied for 2nd and 3rd) respectively. Conversely, the neighborhoods with the negative price growth are Port Coquitlam, Vancouver East, and North Vancouver, at -5.5% and -5% and -4.3% respectively. The townhouse market stays in a balanced market, with average days on market remaining flat at 29 days (same as last month). Month-to-month sale price dipped further by -1.8% (compared to -1.2% last month). Sale-to-listing (% homes sold) ratio remain the best among all segments but dropped slightly to 16.9% (compared to 181% last month).

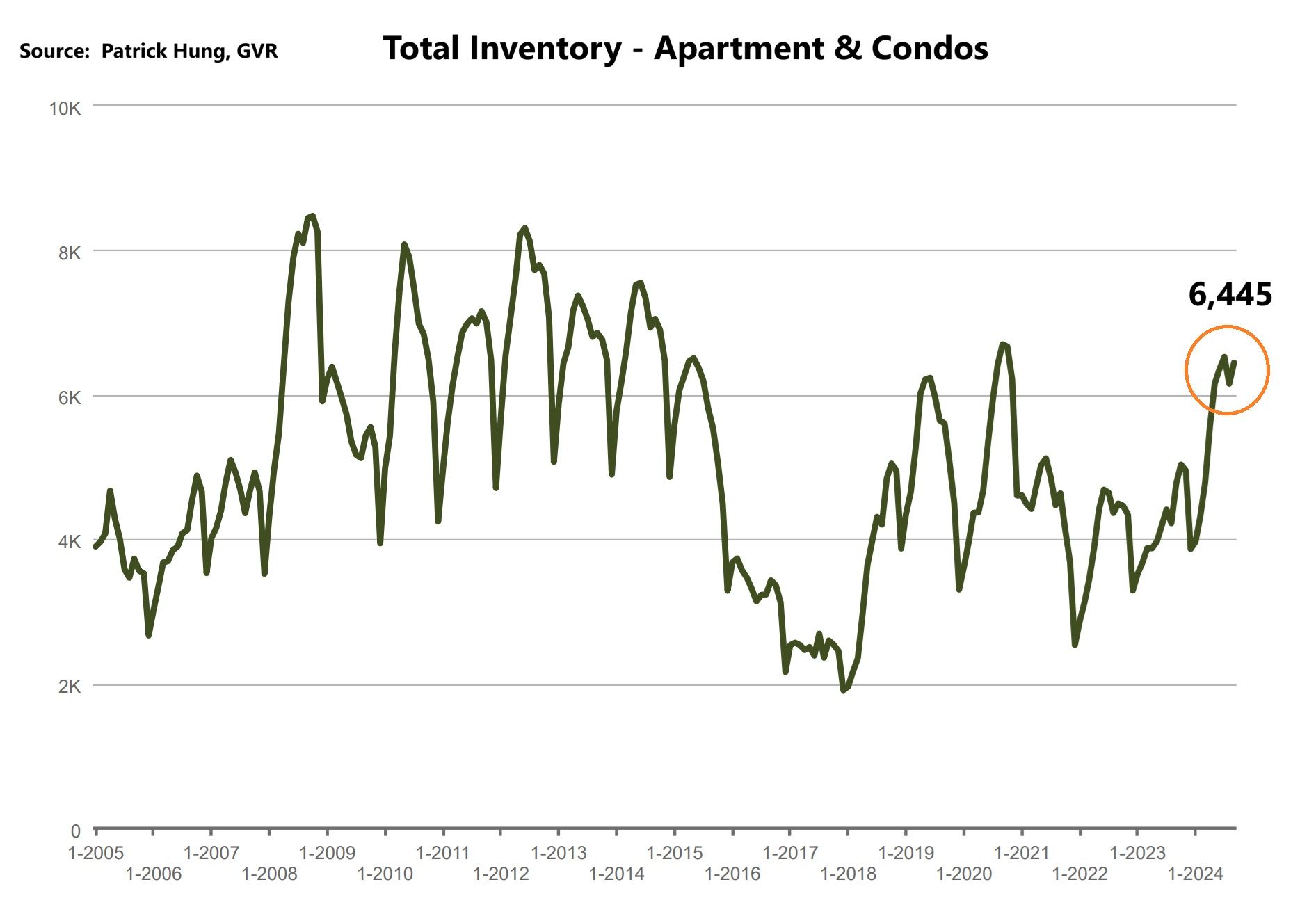

Apartment and Condo Market

The apartment market is easily the stickiest market now, despite its had the least monthly price drop (-0.8%) compared with other segments. This past month's stats are partly skewed due to the fact that highest monthly price growths were all in the outskirts (Squamish, Sunshine Coast, and Whislter at +13%, +12.3% and +11.7% respectively. If we strip out the outskirts, the Greater Vancouver area apartment market does feel much weaker. In nature, the apartment market is where end users and investors come together. However, in the current environment where investors are far and few between, and end users are still staying put, the accumulation of medium to luxury condos have driven to a Buyer's market and have further downward pressure on the prices above $800k. However, the entry level apartments between $500-$600k are still popular and stays in a Sellers market. As the Canadian economy trails down the weaker path, the Vancouver condo market will continue to be polarized. Have a look at Toronto, where it's currently the epicentre of the condo storm. In 2022, a report by Statistic Canada stated that 2 out of 5 (38.9%) are investments, and in Vancouver it is estimated 1 out of 3 (34.2%). Based on that, the investors who bought a pre-sale back in 2022 are now getting 15-20% less in market value. Their cash flow is now negative, and if they sell, they may have to take a $100-$150k loss. Even when the interest rate start to come down, these inventors are emotionally damaged, and it may take some time for them to return. It is also equally possibly that they may never return. Either way, the apartment market is now highly driven by end users, and as the investors are "cleansed" from this market, it awaits to be seen how the inventory will play out in the next few months. I believe there will still be more negative price growth in store, especially in the medium to higher priced segment.

For the month of September, the best performing neighbourhoods for apartments are all in the outskirts, in Squamish, Sunshine Coast and Whistler, at a whooping +13%, +12.3%, and +11.7% respectively. Conversely, the areas with the most significant price drops were Tsawwassen, Ladner, and Coquitlam, with -11.4%, -11% and -2.3% respectively. The apartment and condo segment has slipped further down but remain in a balanced market, with average days dropping slight to 31 days (compared to 35 days last month). Month-to-month sale price growth remained flat at -0.8% (compared to a flat 0% last month). Sale-to-listing (% homes sold) ratio remained dipped slightly to 14.6% (compared to 17.2% last month).

Here are the Three Trends I'm Observing:

1. Cold Summer

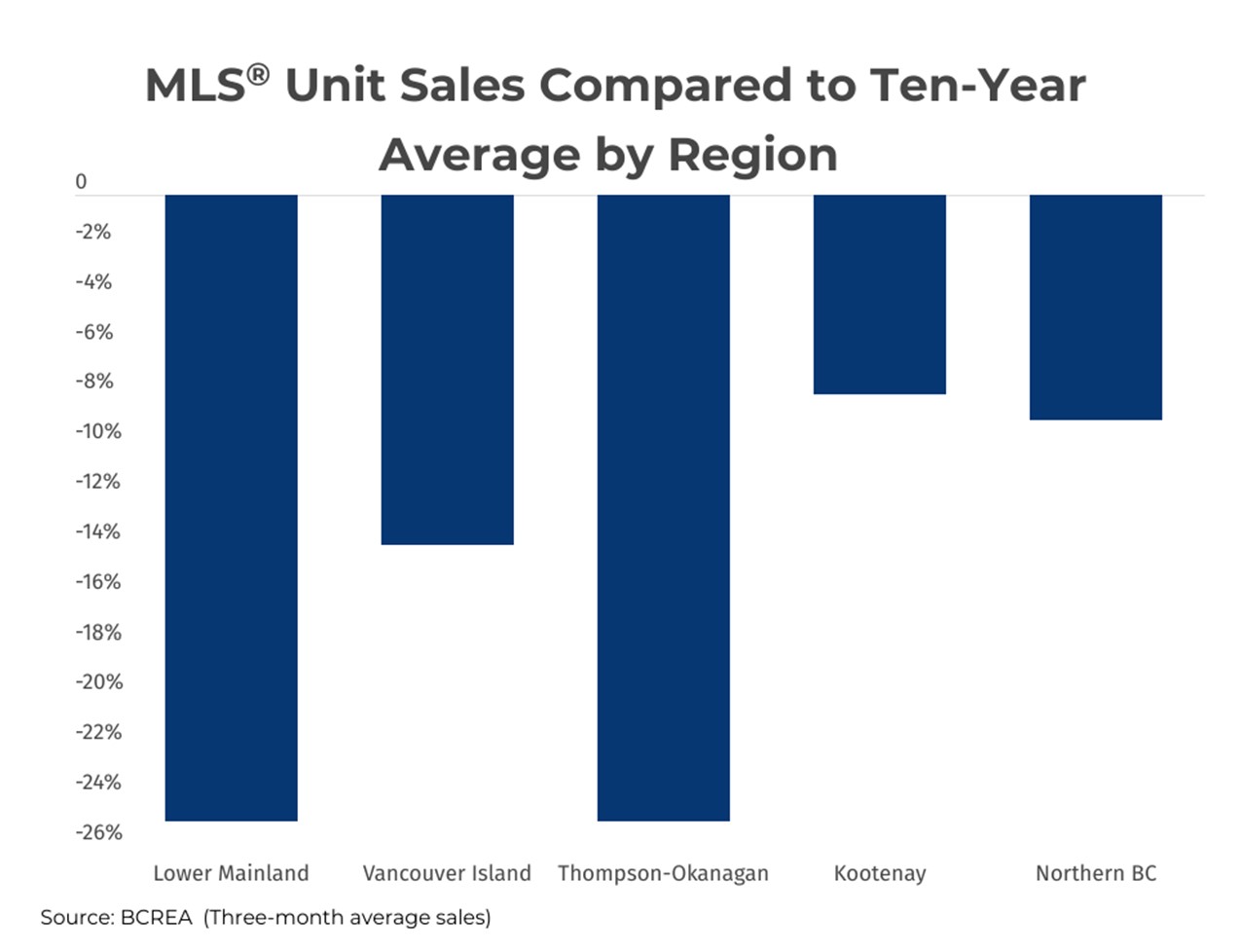

For the summer and the past three months, the Greater Vancouver market saw sales trend that were nearly -26% below average. Coincidentally, inventory is at its highest level since 2019. Many had predicted that lower rates should rekindle demand. However, that has yet to show in the current market. As we know that it takes time for any monetary policy (i.e rate cut) to filter through the economy, just what if lower rates continue to fail to entice Buyers to come off the sidelines? Would lower sales persist for the another 4-6 months? (Source: BCREA)

2. Loonie Tunes

After reports of weaker economic data and consumer spending, the Canadian dollar is set for its worst run of losses in 7 years vs. the US dollar. No matter it's gas, stocks, or real estate, there seems to be barely anywhere to hide from the heightened volatility on a global level. (Source: Bloomberg)

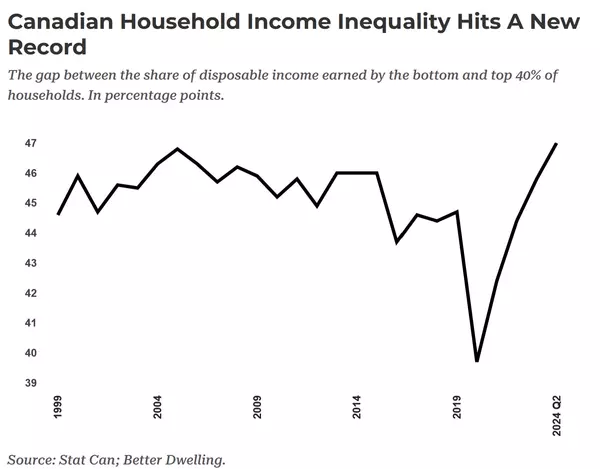

3. Shrinking Middle

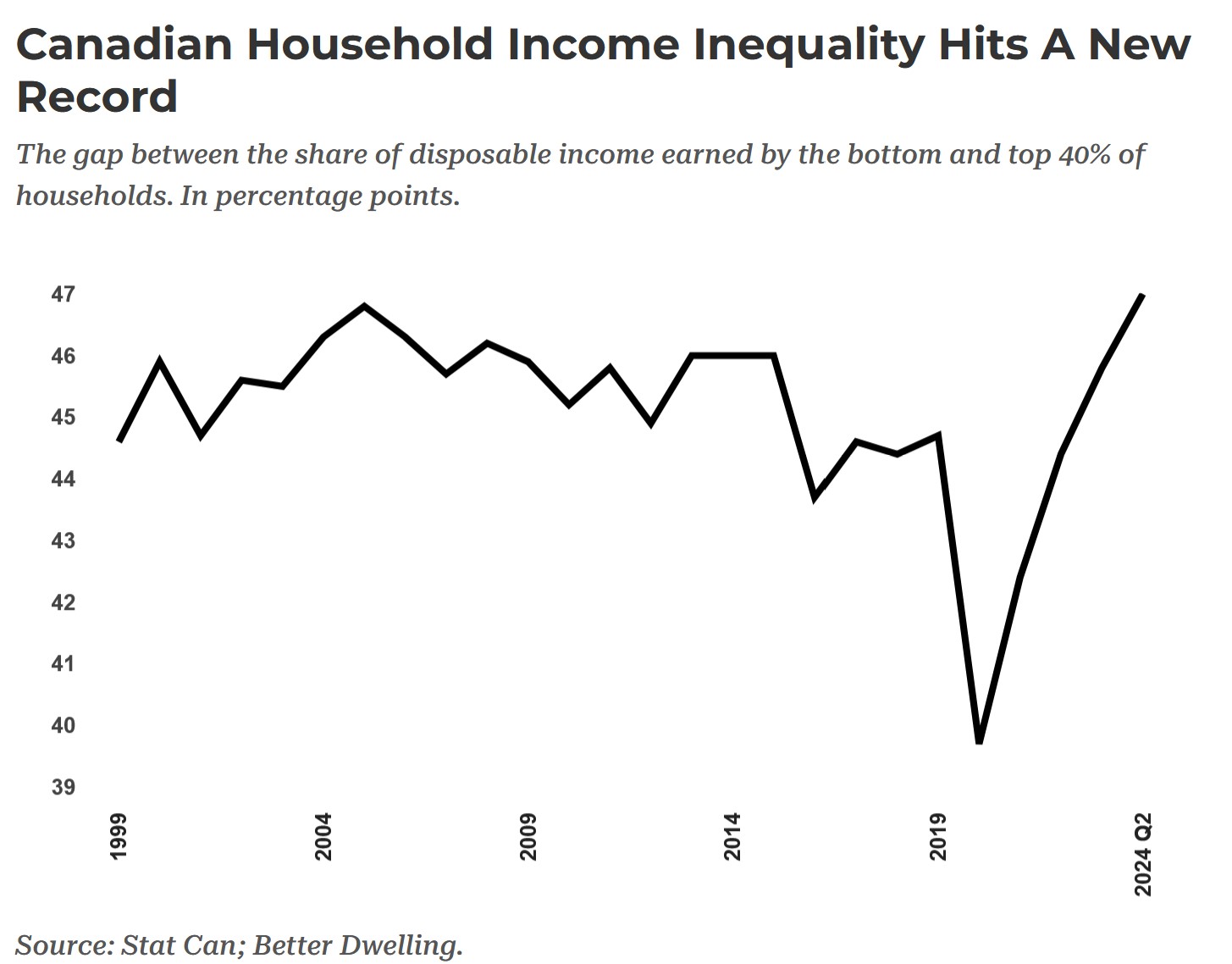

Both globally and in Canada, the gap between the rich and the poor is widening at an alarming rate, with Canada at its highest in 25 years. Ever since the pandemic, Canada's middle class is shrinking and we are heading towards a polarized society with the extreme rich and the extreme poor. No wonder many Canadians are upset with the government. (Source: Statistic Canada, Better Dwelling)

Recent Posts